rewrite this content using a minimum of 1000 words and keep HTML tags

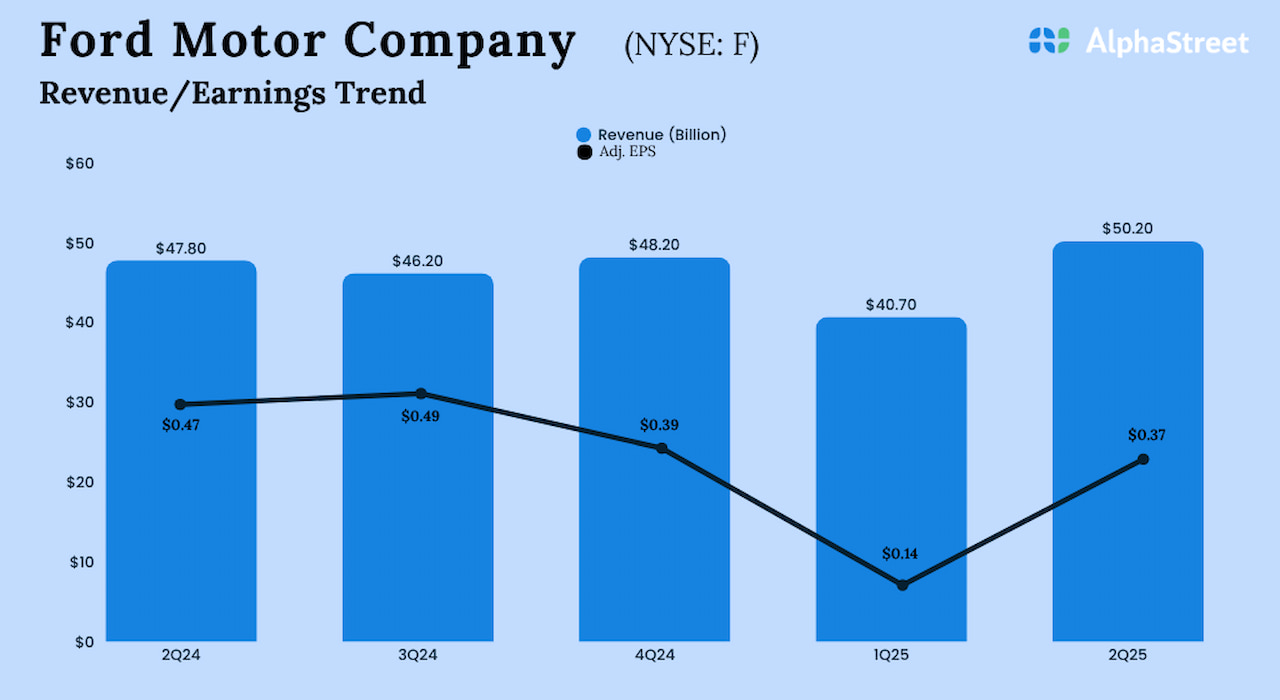

Ford Motor Company (NYSE: F) reported a decline in adjusted earnings for the second quarter of fiscal 2025. Revenues increased 5% during the three months.

Second-quarter earnings, excluding special items, declined to $0.37 per share from $0.47 per share in the comparable quarter of fiscal 2024 but surpassed estimates. On an unadjusted basis, the company reported a modest loss for Q2, vs. net income of $1.8 billion or $0.46 per share in Q2 2024.

The bottom line was negatively impacted by special charges related to a field service action and expenses related to a previously announced cancellation of an electric vehicle program. At $50.2 billion, second-quarter revenue was up 5% year-over-year.

Jim Farley, Ford’s CEO, said, “Ford Pro is a unique competitive advantage driving both top and bottom-line growth while creating new high-margin revenue streams from software and physical services. Ford Blue delivered profitable market share gains, and we continue to improve the efficiency of our Ford Model e business.”

The management reinstated its full-year 2025 adjusted EBIT guidance at $6.5-7.5 billion, adjusted free cash flow at $3.5-4.5 billion, and capital spending at about $9 billion. It expects a net tariff-related headwind of about $2 billion in FY25.

Prior Performance

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link