rewrite this content using a minimum of 1200 words and keep HTML tags

Amid a flood of headlines from the new US administration, investors are sifting through key policy moves to understand what will truly impact markets. So, what have we learned so far? Below, we highlight the recent significant developments that we think will affect markets going forward.

Tariffs: The US’s tariff approach to China vs other countries is diverging, so far. Trump imposed a 25% tariff on Mexico and Canada to gain concessions but delayed implementation once they complied. In contrast, a 10% tariff on China was enforced without concessions. Most recently, Trump said a 25% tariff on all steel and aluminum imports would be announced. Recent price action and volatility suggests that the equity market anticipates prolonged tariff retaliations. The tariffs could have significant impacts on US energy businesses, steel and aluminum buyers and sellers, and the overall economy. Stocks in the automotive, technology, consumer goods, industrial, and luxury sectors may remain under pressure due to ongoing uncertainty. Companies like Ford, GM, Stellantis, Volkswagen, Apple, Walmart, Caterpillar, LVMH in particular, face supply chain disruptions, margin pressures, and overall trade uncertainty pausing capex intentions. Lastly, there is a growing sense that Trump may move toward a universal tariff on all imports later this year which weighs on investor sentiment. We remain cautious as trade tensions will continue to impact corporate earnings and market sentiment.

Sovereign Wealth Fund: Most sovereign wealth funds (SWFs) are designed from current account surpluses, but the US lacks one. Instead, Treasury Secretary Bessent plans to monetize US balance sheet assets to fund the SWF (pending Congressional approval). This could be a major capital market event, enabling the US to buy commodities, expand globally, and potentially invest in companies.

Monetary Policy: The resilient US labour market supports the Fed’s decision to hold rates steady, while the ECB and BoE continue cutting key rates. This policy divergence is expected to drive markets through H1 2025. All central banks, however, remain data-dependent and focused on monitoring trade policy uncertainties for resolution.

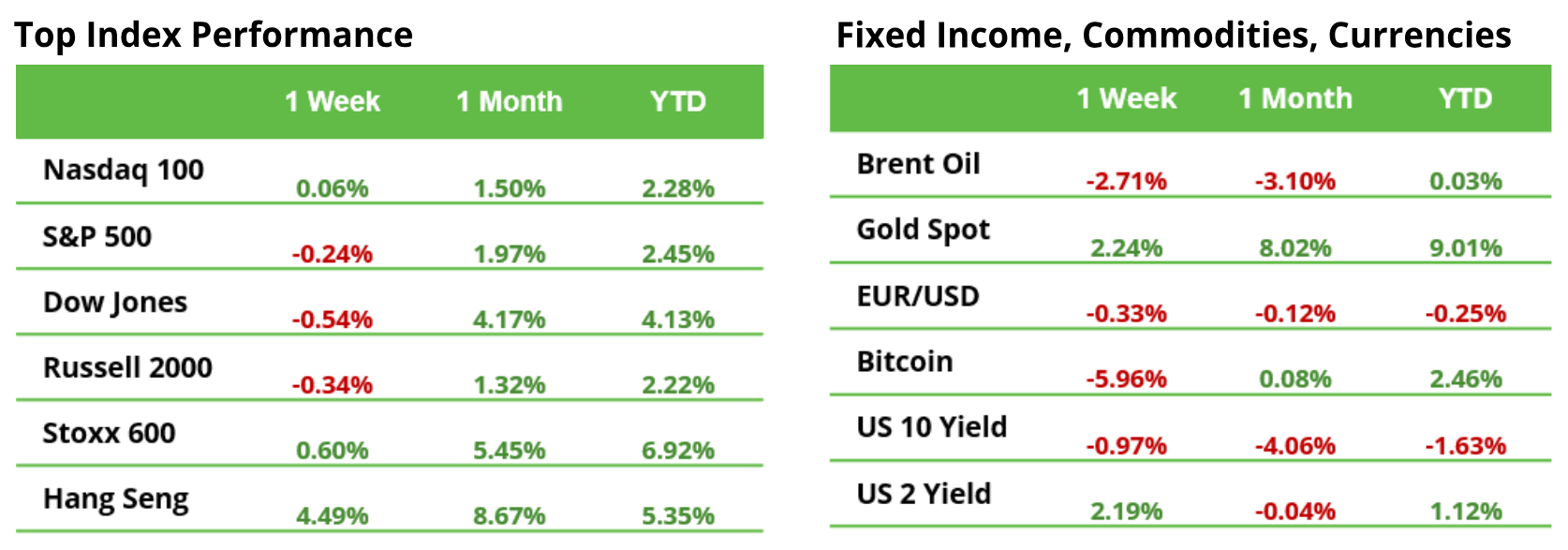

Earnings Season: After reporting last week, S&P 500 earnings growth for the fourth quarter is expected to be 12.3% with Communications and Financials the two strongest sectors. Revenue growth is also better than initially expected, at 5.1%. Technology is the leader from a sales perspective, but Health Care is finally showing some signs of life with revenues expected to be up 8.6%. This would be a welcome change for the index overall.

Trump, trade war and markets: a calculated risk with uncertain dynamics

The U.S. trade deficit has widened significantly in recent months, reaching a staggering $98.4 billion in December 2024. A red flag for Donald Trump, who sees it as proof of the unfair treatment of the U.S. in global trade. At the same time, it highlights the immense importance of the U.S. as a key market for other countries.

This development is likely to further strengthen Trump’s stance. His goal: tougher measures to enforce what he considers “fair” conditions. Although he has ignited the trade war, he has not yet escalated it. Tariffs against China are in place—but at a moderate 10%. Planned 25% tariffs on imports from Canada and Mexico were postponed at the last minute by one month. Whether they will actually be implemented or if Trump will increase the pressure even further remains uncertain.

However, higher tariffs are not the answer to his “America First” policy—the economic situation is far too complex for that. Trump uses tariff threats as a tactical bargaining tool to push through his interests. The markets seem to recognize this. After initial nervousness, the situation has calmed down. The feared escalation has not occurred, and the “buy-the-dip” mentality, familiar from the past two years, remains intact.

Still, this offers a glimpse of what investors can expect in the coming weeks—and possibly in the next four years. Markets will continue to be driven by headlines, and uncertainty will remain a constant factor. While tensions have increased, panic has not yet set in. The S&P 500 closed last week less than 1% below its record high.

Investors are torn. No one wants to take on significant risk, but at the same time, no one wants to sell stocks and miss the next breakout to the upside. The sentiment? A cautious “wait and see.”

Earnings and events

Macro

12 Feb. US CPI; Fed Chair Powell testimony to Congress

13 Feb. UK GDP; Eurozone Industrial Production

14 Feb. Eurozone GDP; US Retail Sales

Earnings

10 Feb. McDonald’s

11 Feb. CocaCola, Shopify

13 Feb. Applied Materials, Siemens, Relx

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link