The Ethereum network, a pivotal component of the contemporary blockchain ecosystem, has seen its financial fortunes wane dramatically in a startling downturn. Spanning merely six months, the layer-1 network has experienced a catastrophic 99% drop in revenue, a descent from the zenith of profitability to the nadirs of fiscal intake since March 2024.

Insights derived from Token Terminal paint a distressing picture: a once-thriving network with daily revenue surpassing $35 million on March 5, nosedived to a paltry $200,000 by September 2. This decline marked a new annual low, setting off alarm bells across the crypto financial landscape.

The narrative behind this downturn is multifaceted. Observers attribute the financial hemorrhage to the burgeoning popularity of layer-2 (L2) networks, alongside a pivotal network upgrade in March—dubbed the Dencun upgrade—which notably diminished fees for transactions processed on these L2 solutions. This technological pivot reshaped Ethereum’s revenue topology significantly. Statements from Token Terminal elucidate the phenomenon: transaction fees on L2s have dwindled, propelling usage rates while concurrently eviscerating layer-1 revenue streams.

The aftermath of the Dencun upgrade witnessed a migratory trend, with transactional activities transitioning from Ethereum’s foundational mainnet to the more economically viable L2 networks. This shift heralded a surge in daily transactions and active user engagement on the L2 platforms, casting shadows on Ethereum’s monetization model, especially concerning fee revenue.

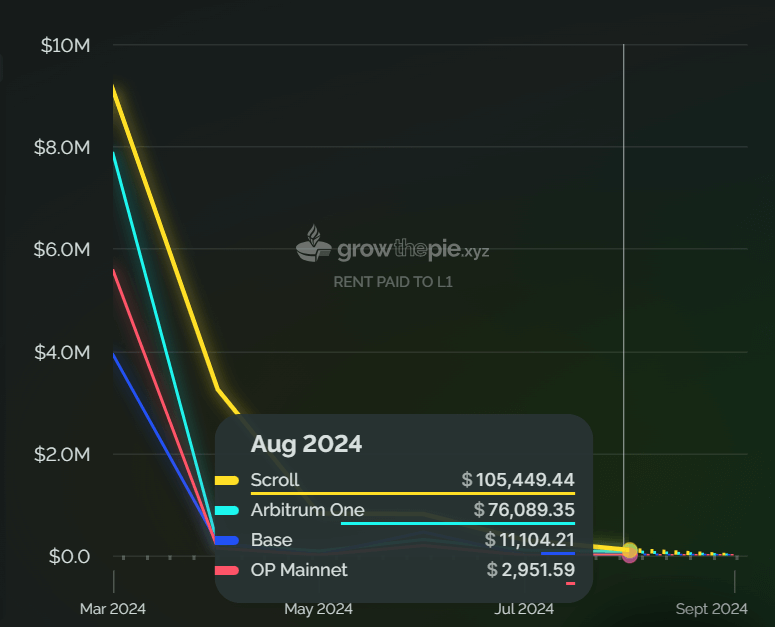

The impact of this migration paints a stark financial portrait: Coinbase’s L2 network, Base, for example, raked in $2.5 million in revenue during August. Yet, it contributed a mere $11,000 towards settlements on the mainnet, starkly illustrating the value shift away from Ethereum’s primary layer.

Analyst Kun, deeply enmeshed in the cryptosphere, issued a dire warning: should this trend persist, L2 networks might overshadow and eventually abandon the Ethereum mainnet, particularly for consumer-centric applications. He underlined the pressing necessity for Ethereum to cultivate invaluable, irreplaceable use cases on its mainnet to circumvent a potentially severe depreciation in value.

Kun lucidly articulated the conundrum facing Ethereum:

“ETH L1 needs valuable use cases on mainnet that cannot be seized, or you have to hope that L2 usage is so extensive that it compensates for the reduced value generation on the mainnet, which is challenging and creates a valley of valuation issues.”

The ‘Death Spiral’

The concept of a ‘death spiral’ has been floated by notable Bitcoin investor Fred Krueger, echoing Kun’s concerns but adding a more catastrophic financial prognosis for Ethereum. He dissected the current fee revenue scenario—$200,000 daily, translating to an annual sum of $73 million. In Krueger’s analysis, this revenue is pathetically inadequate to buoy Ethereum’s $300 billion market cap.

He provocatively speculated that a more truthful valuation of Ethereum, given its current fiscal performance, would languish around $3 billion, starkly underscoring the chasm between Ethereum’s projected market value and its tangible fee income. He stated:

“[Ethereum is] not akin to a corporation amassing $73 million annually in profit, nor revenue. That $73 million is insufficient to counterbalance the inflation inherently affecting ETH validators.”

As we navigate the tumultuous seas of Ethereum’s revenue narrative—a saga of technological evolution, market dynamics, and financial speculation—one cannot help but ponder the future of this blockchain behemoth. Will it adapt and thrive, or is it destined for a revaluation that could redefine its standing in the cryptocurrency pantheon? Regardless of the outcome, Ethereum’s journey is a captivating study in the resilience and adaptability of blockchain networks.

To delve deeper into the evolving world of decentralized finance, stay updated with DeFi Daily News for more trending news articles like this, keeping your finger on the pulse of change within this dynamic sector.

![rewrite this title with good SEO [LIVE] Crypto News Today, October 6 – Bitcoin USD Price $124K, Is XRP Finally Ready To Hit $4? BNB Sets New ATH: Best Crypto To Buy? – 99Bitcoins rewrite this title with good SEO [LIVE] Crypto News Today, October 6 – Bitcoin USD Price $124K, Is XRP Finally Ready To Hit $4? BNB Sets New ATH: Best Crypto To Buy? – 99Bitcoins](https://i2.wp.com/99bitcoins.com/wp-content/uploads/2025/09/BTC-USD-FOMC.jpg?w=120&resize=120,86&ssl=1)

![rewrite this title Crypto News Today [ LIVE] Updates, October 6th rewrite this title Crypto News Today [ LIVE] Updates, October 6th](https://i3.wp.com/image.coinpedia.org/wp-content/uploads/2025/05/17173854/Coinpedia-Digest-Top-Crypto-News-This-Week-Hacks-Regulations-and-Institutional-Adoption-1.webp?w=120&resize=120,86&ssl=1)