Exploring the intricate mechanics of perpetual futures contracts in the vibrant world of cryptocurrency can unveil a myriad of insights about trader sentiment and market dynamics. At the heart of these financial instruments is the concept of a funding rate – a mechanism designed to ensure the perpetual contract’s price closely follows the underlying spot price over time. Let’s delve deeper into this concept, particularly focusing on the Ethereum perpetual futures market, to discern what recent fluctuations tell us about the broader market sentiment.

Onchain Highlights

At its core, the average funding rate represents a percentage periodically exchanged between long and short positions in the perpetual futures market. This rate can be either positive or negative, depending on market conditions. When the funding rate is positive, it means that those holding long positions are paying those holding short positions, indicating that investors are generally bullish on the asset. Conversely, a negative funding rate requires holders of short positions to pay those in long positions, reflecting a bearish market sentiment.

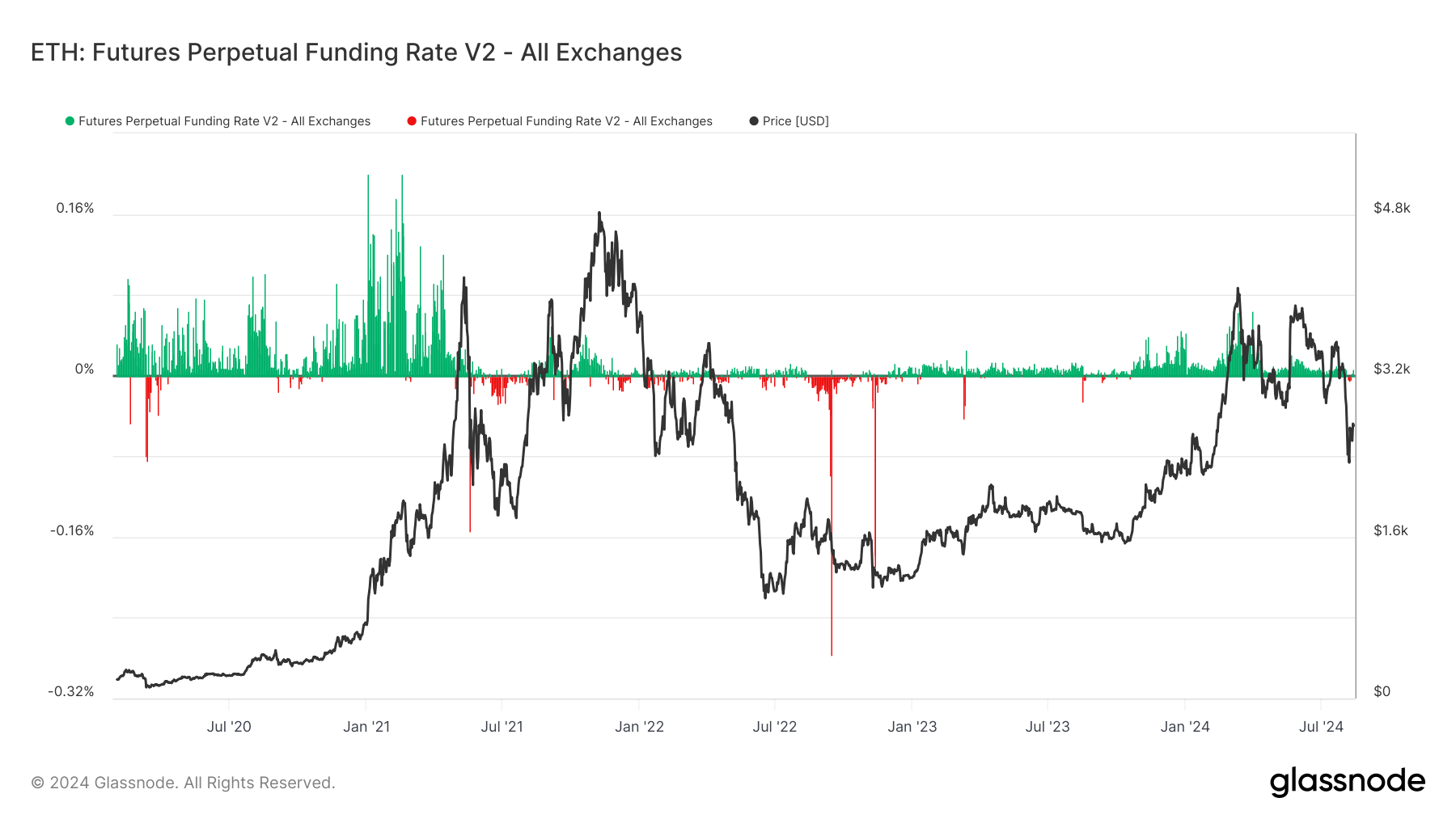

Ethereum’s perpetual futures funding rate serves as a fascinating focal point for understanding market sentiment towards this leading cryptocurrency. Recently, there has been a noticeable downtrend in Ethereum’s funding rates, stripping away its bullish lustre. This decrease in the funding rate, observable across both short-term and long-term horizons, hints at a burgeoning bearish sentiment among traders and investors alike.

Historically speaking, a negative dip in funding rates is often emblematic of short positions compensating long positions – a clear sign that bearish bets are dominating the market. This phenomenon has been especially pronounced in light of Ethereum’s price actions since the onset of the 2024 trading year. Despite the typical volatility associated with Ethereum prices, there have been significant stretches where funding rates remained solidly positive, signaling a strong bullish conviction among participants. However, the recent downturn, coupled with a slip in Ethereum’s price beneath the $2,700 threshold, unmistakably signals a shift towards bearish inclinations in the market psyche.

The past few epochs of Ethereum’s perpetual futures funding rate have been a rollercoaster of highs and lows, effectively mirroring the broader cryptocurrency market’s sentiment. During periods of heightened optimism, such as the meteoric 2021 bull run, the funding rates ascended into positive terrain, thereby indicating a predominance of long positions as traders wagered on continuing ascensions in price. Conversely, during times of market apprehension and downturns – notably throughout mid-2022 and various intervals in 2023 – funding rates veered into the negative, painting a vivid picture of the market’s shift towards bearish sentiment.

Such fluctuations in funding rates underscore their value as a barometer for gauging trader sentiment, often acting as precursors to significant price movements in the underlying asset. It’s this dynamism and interplay between funding rates and market sentiment that highlights the nuanced complexity of the cryptocurrency markets.

Ethereum’s funding rates and the associated decline in its price not only point towards a prevailing bearish mood but also invite a deeper examination of market dynamics and trader psychology. As these elements continue to evolve, they paint a detailed picture of the cryptocurrency landscape at any given moment.

Now, reflecting on these intricate market dynamics and the subtle cues they provide about the collective mindset of traders brings us to appreciate the complexity and excitement enveloping the world of cryptocurrency trading.

Conversely, as we embark on this analysis, it’s essential to recognize the evolving nature of such markets. Today, Ethereum’s funding rates might hint at bearish sentiments, but the unpredictable essence of cryptocurrencies means a reversal could be just around the corner. For enthusiasts and traders alike, this volatility is not just a challenge but also a source of excitement, presenting opportunities to decipher market signals and make informed decisions.

For those keen on staying abreast of these fascinating shifts and twists in the DeFi space, including the rollercoaster of funding rates and market sentiments, a wealth of information and insights can be found by visiting “DeFi Daily News”.

In conclusion, while the recent downward trend in Ethereum’s perpetual futures funding rate and its price reduction below a significant threshold may seem disheartening to some, it is merely a chapter in the ever-unfolding story of the cryptocurrency markets. The fluctuations in funding rates, a reflection of changing market sentiments, are a testament to the market’s vibrant dynamism. Whether these trends herald a prolonged bear market or merely a temporary phase before the next surge remains to be seen. However, one thing remains certain: for those who navigate these waters with insight and agility, the world of cryptocurrency trading remains an endlessly fascinating frontier, ripe with opportunities for the bold and the informed.

Source link

![The America that Almost Was Still May Be [I Endorse RFK For President] The America that Almost Was Still May Be [I Endorse RFK For President]](https://wp.fifu.app/defi-daily.com/aHR0cHM6Ly9pLnl0aW1nLmNvbS92aS9HS3o3YmtLZXBlZy9tYXhyZXNkZWZhdWx0LmpwZw/b8671ae05f32/the-america-that-almost-was-still-may-be-i-endorse-rfk-for-president.webp?w=75&h=75&c=1&p=10669)