In the ever-dynamic world of cryptocurrencies, Ethereum whales have been stirring the waters, showcasing a bullish stance in the midst of fluctuating market conditions. On-chain indicators have painted a vivid picture of these prominent investors’ behavior, showing a substantial accumulation of Ethereum. This intriguing strategy unfolds as Ethereum, the second-largest cryptocurrency by market capitalization, experiences a downtrend in its value. Such movements hint at the possibility of more short-term price dips, but the underlying confidence displayed by these whales might suggest a brighter horizon for the Ethereum market.

Whales Accumulate More ETH

Recent market analysis has revealed quite the spectacle, as data from IntoTheBlock, a noted market intelligence platform, highlights a substantial uptick in Ethereum purchases by whales. On a noteworthy date, July 24, these whales amassed an astounding 297,670 ETH, valued at approximately $1 billion. The preceding day was no less remarkable, with nearly 400,000 ETH being swept up by these large investors. Over the span of a week, inflows to whale addresses surged by over 28%, a testament to their growing appetite for Ethereum.

Related Reading

The dwindling outflows from these whale addresses echo an optimistic sentiment towards Ethereum, despite its recent lackluster performance. The outflows have seen a downturn of over 14% in the past week and a decline exceeding 16% over the past month.

The narrative of Ethereum whale accumulation further gains momentum when considering the large holders’ netflow metric presented by IntoTheBlock. This metric has seen a staggering 313% increase, showcasing a clear inclination towards hoarding ETH rather than selling it off.

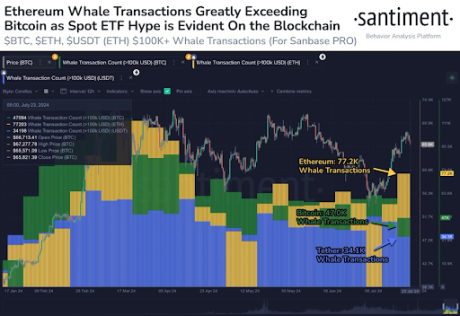

A noteworthy contributor to this surge in Ethereum whale activity has been identified as the initiation of trading for Spot Ethereum ETFs on July 23. The on-chain analytics platform Santiment underscored this development, noting an exceptional uplift in ETH transfers exceeding $100,000 in value since July 17. This figure outstrips the volume of BTC transfers by over 64% and USDT transfers on the Ethereum network by an impressive 126%.

The introduction of Spot Ethereum ETFs was not merely a new asset class for investors to dabble in; it represented a potent catalyst anticipated to propel Ethereum’s value to new heights. Crypto analysts, including the likes of RLinda, had forecasted Ethereum’s rise to $4,000, buoyed by the optimistic outlook surrounding these ETFs. Such predictions underscore the eagerness with which Ethereum whales have been accumulating the digital currency, in anticipation of lucrative returns.

The Spot Ethereum ETFs Launch Might Be A Headwind At First

While the launch of Spot Ethereum ETFs has been widely projected to spark a significant price rally for Ethereum, historical patterns suggest that initial headwinds could temper this enthusiasm. This phenomenon was observed with Bitcoin shortly after the launch of Spot Bitcoin ETFs earlier in the year. Ethereum now finds itself in a similar pivotal moment, as Grayscale’s Ethereum Trust (ETHE) encounters notable outflows, drawing parallels to the earlier discussed Bitcoin scenario.

Related Reading

The advent of Spot Ethereum ETFs and the associated high expectations did not shield Ethereum from the immediate market realities. Grayscale’s ETHE witnessed $484.1 million in net outflows on its first day of trading—an amount surpassing the initial outflows from the larger GBTC fund. Farside Investors data reveals that the second day saw a continuation of this trend, with net outflows amounting to $326.9 million. These developments suggest that the early days of the Spot Ethereum ETFs could see a significant shake-up in market dynamics, potentially leading to increased volatility and selling pressure for Ethereum.

Featured image created with Dall.E, chart from Tradingview.com

Conclusion

In the fascinating ecosystem of cryptocurrencies, the actions of Ethereum whales provide a narrative rich with strategic accumulation, bullish undertones, and a careful navigation of market volatility. As we watch the unfolding of events surrounding the Spot Ethereum ETF launches, it’s clear that these significant market players are not just participants but are shaping the future trajectory of Ethereum’s value. Whether these accumulations lead to the expected bull run or face immediate headwinds, the activities of these whales are a testament to the unwavering belief in the potential of Ethereum. For the keen observer, these developments offer not just insight but a story of faith, strategy, and the relentless pursuit of value in the dynamic world of DeFi. For more trending news articles like this, visit DeFi Daily News.