rewrite this content using a minimum of 1000 words and keep HTML tags

Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Este artículo también está disponible en español.

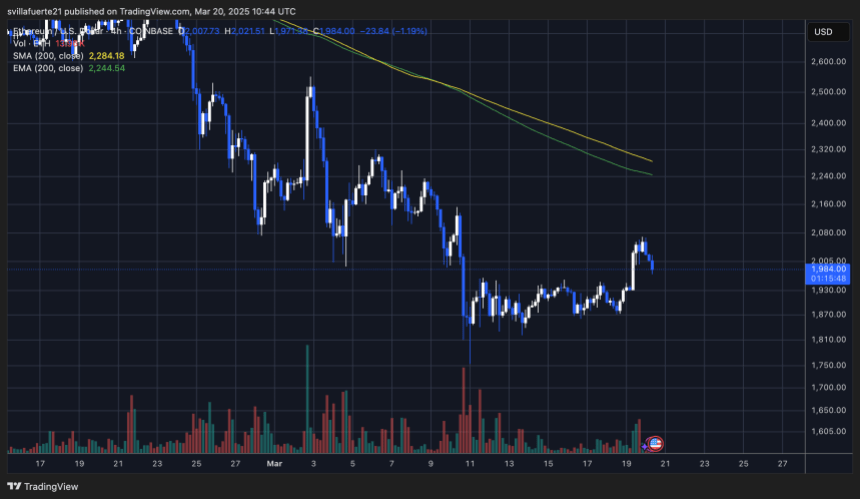

Ethereum has experienced a crucial surge above the $2,000 mark, a key level that bulls have struggled to reclaim since March 10. This breakout brings renewed optimism, as analysts believe a stronghold above this level could trigger a rally toward higher prices. However, if ETH fails to maintain support above $2,000, a significant drop could follow, leading to further market instability.

Related Reading

Macroeconomic uncertainty and trade war fears have continued to shake the crypto market, with Ethereum being one of the most affected assets. The recent price action reflects investor caution, as global financial conditions remain unpredictable.

Top analyst Jelle shared a technical analysis on X, revealing that ETH is trading at a critical level that will determine its long-term direction in the coming weeks. Bulls must sustain momentum to solidify a bullish structure, while bears are watching for signs of weakness to drive prices lower. With ETH at a pivotal juncture, the next few trading sessions could be decisive for its trajectory.

Ethereum at a Crossroads: Breakout or Breakdown?

Ethereum has lost over 57% of its value since mid-December, with bulls struggling to reclaim higher prices as selling pressure dominates the market. Despite occasional relief rallies, ETH has remained under key resistance levels, leaving investors uncertain about its next move. Speculation about a potential recovery and a continuation of the downtrend are colliding, as price action shows no clear direction.

The $2,000 level has become the ultimate test for Ethereum. Bulls must defend this price with conviction to sustain any meaningful recovery. Losing this support could lead to a sharp decline, pushing ETH into deeper bearish territory.

Jelle stated in his analysis that either ETH is about to put in a massive reclaim or it’s about to jump off a cliff. The $2,000 level is the key limit that will determine Ethereum’s next move. If bulls can maintain strength above this mark, a push toward $2,300 and beyond could follow. However, failure to hold $2,000 would signal further downside, with the next major support sitting around $1,750.

Ethereum’s fate hangs in the balance, and the coming days will be crucial in deciding whether it regains bullish momentum or continues its descent.

Related Reading

Ethereum Battles to Hold $2,000: Key Levels to Watch

Ethereum is currently trading at $1,980 after days of struggling below the crucial $2,000 mark. Bulls managed to briefly push the price above this level, but sustaining it is now the real challenge. Holding above $2,000 is critical for Ethereum’s recovery, as it would signal strength and open the door for a rally toward the $2,200 mark.

The $2,200 level is the most important resistance for ETH to reclaim in order to confirm a bullish reversal. A successful break and consolidation above this point would indicate that bulls are regaining control, potentially leading to a move toward higher targets.

However, if Ethereum fails to hold above $2,000, selling pressure could increase, leading to a deeper correction. A drop below this level could trigger a sharp decline, pushing ETH toward the $1,800 support zone. If this support fails, the next major liquidity level would be around $1,750, where buyers might step in to prevent further downside.

Related Reading

Ethereum is at a critical turning point, and the coming sessions will determine whether bulls can establish a strong foothold above $2,000 or if another wave of selling pressure will drive prices lower.

Featured image from Dall-E, chart from TradingView

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link