In the dynamic world of cryptocurrency, Ethereum, the blockchain behemoth, is facing its own set of challenges amid fluctuating market conditions. As we dissect the situation on September 12, the observation is stark: Ethereum is wrestling to gain momentum, its value hesitating beneath the $2,400 mark. The narrative woven by the daily chart is one of gradual decline, with ETH unable to break free from the downward pull. Notably, the price range between $2,400 and $2,800 has emerged as a formidable battleground, where hopes of recovery meet the reality of liquidation.

The situation acquires a grimmer hue when we consider Ethereum’s revenue streams, which have receded to levels last seen in May 2020. This decline in revenue is not just a number but a reflection of decreased activity and diminished fees paid to validators for processing transactions and executing smart contracts on the Ethereum blockchain. Despite the gloomy revenue outlook, certain analysts maintain a bullish stance on Ethereum’s prospects. Their optimism is not unfounded but rests on solid developments within the Ethereum ecosystem.

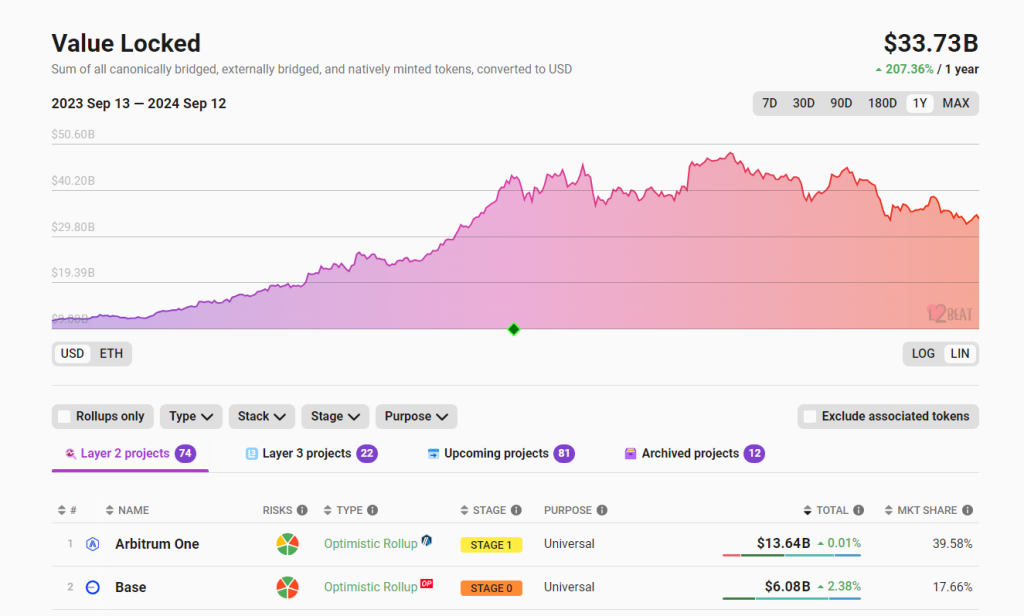

The reduction in gas fees – a long-standing pain point for Ethereum users – is touted as one of the significant improvements that bolster confidence in Ethereum’s future. Over time, the Ethereum community has witnessed several upgrades aimed at reducing transaction costs on the mainnet. The congestion and skyrocketing gas fees witnessed during the last bull run in 2020-2021 spurred the development and adoption of layer-2 solutions, such as Arbitrum, OP Mainnet, and Base. These platforms have not only locked in billions in total value (TVL) but have also secured user trust, according to L2Beat data.

What’s particularly encouraging about these layer-2 solutions is their resilience against security breaches, which has played a crucial role in maintaining user confidence in off-chain transaction processing. The burgeoning popularity of these platforms has not escaped the notice of major technological and cryptocurrency exchange entities, with Coinbase and Sony among the notable firms throwing their weight behind these solutions.

As Ethereum continues its relentless pursuit of scalability, the recent Dencun upgrade stands out as a milestone in the network’s evolution, further reducing layer-2 gas fees and making the process more efficient. This journey towards scalability is critical in understanding Ethereum’s potential for future growth, especially considering the challenges it faced in retaining users due to prohibitive gas fees, which pushed many towards alternatives like Solana, Tron, and Avalanche.

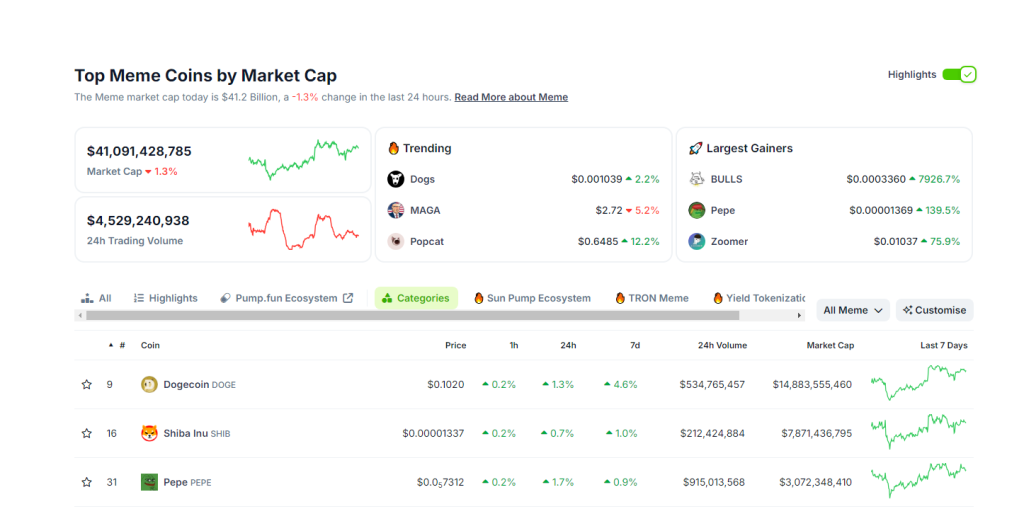

In a testament to Ethereum’s enduring appeal, meme coin activity on the network remains robust, diverging from the trends observed on platforms like Solana and transitioning to networks such as Tron. Platforms including Coingecko highlight Ethereum’s ability to retain significant meme coins such as Pepe and Floki, with others like Brett finding a home on Base, a testament to the network’s expansive ecosystem.

Ethereum’s post-Merge era has been characterized by efforts to scale on-chain functionalities to new heights. According to Ethereum co-founder Vitalik Buterin, the roadmap to achieving superlative scalability involves a series of upgrades from the Purge to the Splurge, culminating in the implementation of Sharding. This development will empower the Ethereum network to process millions of transactions every second seamlessly, a stark departure from its current capabilities and a potential game-changer in how on-chain transactions are handled.

In wrapping up this exploration of Ethereum’s current predicaments and its undiminished potential for future growth, it’s pertinent to recognize the blockchain’s resilience and adaptability. Despite facing immediate challenges, Ethereum’s journey illustrates the relentless pursuit of innovation and improvement. For enthusiasts, investors, and onlookers keen on keeping abreast of the latest in the DeFi space, the developments on Ethereum offer valuable insights and lessons. Those eager to dive deeper into the evolving narratives of decentralized finance can find a wealth of information and analysis at DeFi Daily News, your go-to source for trending news articles in the dynamic world of cryptocurrencies and blockchain technology.

Source link