The cryptocurrency market, known for its volatility, has been under a microscope recently, especially with the surprising downturn in Ethereum’s prices. This development has undoubtedly caused a stir among investors, leading to a whirlwind of discussions and speculations regarding the future trajectory of the market. The question on everyone’s mind is whether this downturn signifies a prolonged bear market or just a temporary setback.

Insights into the futures market offer a glimmer of hope, suggesting that the current bearish trend might be at its tail end, thanks to significant activities in long liquidations across various exchanges. According to the latest data from CryptoQuant, Ethereum’s futures market experienced a noteworthy liquidation event, the likes of which haven’t been seen since November 2022.

These long liquidations represent the forced closures of long perpetual positions due to the falling prices, igniting a series of liquidations across multiple exchanges. This particular event might signal a cooling down in the futures market as numerous leveraged positions get cleared out. According to CryptoQuant’s analyst, Shayan, such a market reset is often a precursor to a more stable market environment, which could reignite investor interest. If the market demand makes a comeback, it could potentially lead to a bullish surge as new buyers are usually attracted to a reset futures market.

Historical Context

Looking back at Ethereum’s historical pricing data, it’s evident that price drops often lead to significant spikes in long liquidations. For instance, a price dip in January triggered over $50 million in liquidations, which was shortly followed by a market recovery. In March, as the price plummeted below $3,200, the liquidations soared past $120 million, marking a notable drop in the market before its eventual rebound. The most striking instance occurred in August, where a sharp decline to $2,100 in Ethereum’s price caused liquidations to spike over $160 million.

After the exhaustion of leveraged traders in the recent downturn, spot buying pressure has seemingly taken the forefront, propelling ETH’s price to rebound to $2,700. This indicates a shifting market dynamic where direct purchases rather than leveraged buys are driving market movement.

Emerging Buying Interest?

Several key technical indicators hint at the Ethereum market finding its footing, possibly setting the stage for a bullish reversal. Notably, the Demand Index, which stands slightly in the negative territory at -0.1, is seen flattening out with a minor upward adjustment. This subtle movement suggests a reduction in selling pressure and the beginnings of growing buying interest.

Source: TradingView

The Accumulation/Distribution indicator, as well, is on an uptrend, resting at a significant 11.519 million. Such steady accumulation indicates consistent purchasing of Ethereum by investors, hinting at an impending substantial price movement. This accumulation, indicative of ‘strong hands’ entering the market, heightens the probability of a price surge in the foreseeable future.

Staking Withdrawals Contrast Bullish Sentiment

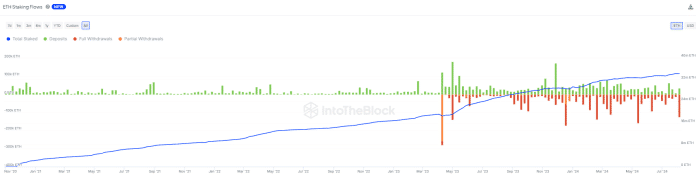

However, offering a contrasting view to the aforementioned bullish indicators, on-chain data reveal a worrisome trend. Ethereum has witnessed a substantial uptick in staking withdrawals, totaling over 122,000 ETH in just this past week.

Ethereum price vs ETH Staking Withdrawals

This spike in withdrawals, the highest since May, translates to roughly $521 million. Such a surge in withdrawals may indicate growing selling pressure as investors rush to unstake and potentially liquidate their Ethereum holdings. The resulting increased supply, if not matched by equal demand, could place further downward pressure on Ethereum’s price in the market.

In conclusion, while the market’s current stance might appear bearish at face value, underlying metrics and historical patterns suggest a nuanced narrative. The substantial liquidation events and subsequent market reset hint at potential stabilization and an impending investor interest revival. Yet, the burgeoning staking withdrawals serve as a cautionary tale, reminding investors of the market’s unpredictability. As we tread through these uncertain times, it’s pertinent to stay informed and cautious. For more insightful and trending news articles, visit DeFi Daily News.

Despite the contrasting signals from the market, the journey through the cryptosphere remains an enthralling adventure filled with twists and turns. Whether Ethereum’s price will soar to new heights or take a further plunge remains uncertain. Still, one thing is for sure: the cryptocurrency market will continue to captivate and fascinate with its dynamic nature and untold potential. So, strap in and enjoy the ride through the ever-evolving landscape of digital currencies, where each day offers new data, trends, and possibilities to explore.