In the ever-evolving world of cryptocurrencies, Ethereum has recently found itself at a crossroads, capturing the attention of investors and traders alike. The digital currency’s inability to surpass the $2,500 threshold on Monday has stirred discussions and speculations across the market. With the entire crypto ecosystem on the edge of their seats, the anticipation for a potential surge looms large. Nonetheless, a growing unease regarding a further price drop casts a shadow over Ethereum’s immediate future.

Related Reading

Insightful data from IntoTheBlock, a renowned analytics firm, points to a precarious situation. Should Ethereum’s value slip below the $2,300 mark, a significant sell-off might ensue, placing additional downward pressure on its price. This prediction has engendered a palpable tension among the trading community, who are now eagerly awaiting tangible signs that Ethereum can maintain its footing above this pivotal support level.

Amidst a backdrop of market uncertainty, Ethereum’s imminent moves are crucial. Investors are clinging to the hope of bullish momentum, yet they proceed with caution, fully aware of the ramifications a drop below $2,300 could herald. The upcoming days are deemed critical for Ethereum, potentially defining its price trends in the near future.

Ethereum Price Testing Crucial Demand

Ethereum now teeters on a crucial juncture, with its price fluctuating uncertainly between key levels. These could dictate significant profits or losses, making it a critical period for ETH stakeholders. Currently, the currency trades within a narrow margin, prompting analysts and investors to closely monitor support and resistance thresholds.

Ali, a top analyst and enthusiast, recently highlighted data from IntoTheBlock on X (a social media platform), underscoring the significance of the $2,300 benchmark. Reportedly, around 2.4 million addresses acquired close to 52.6 million ETH at this juncture, designating it a substantial demand zone. A breach below this point could unleash a cascade of sell orders as investors rush to mitigate their losses, thereby elevating the stakes for Ethereum’s stability above this level.

Preserving its position above this crucial support could alter market sentiment towards Ethereum, potentially propelling it towards a rally. Ali’s analysis underscores the coming days as monumental in determining Ethereum’s price trajectory.

Related Reading

The forthcoming performance at the $2,300 level is set to dictate Ethereum’s short-term destiny, possibly laying the groundwork for an ascent or paving the way for a profound price correction.

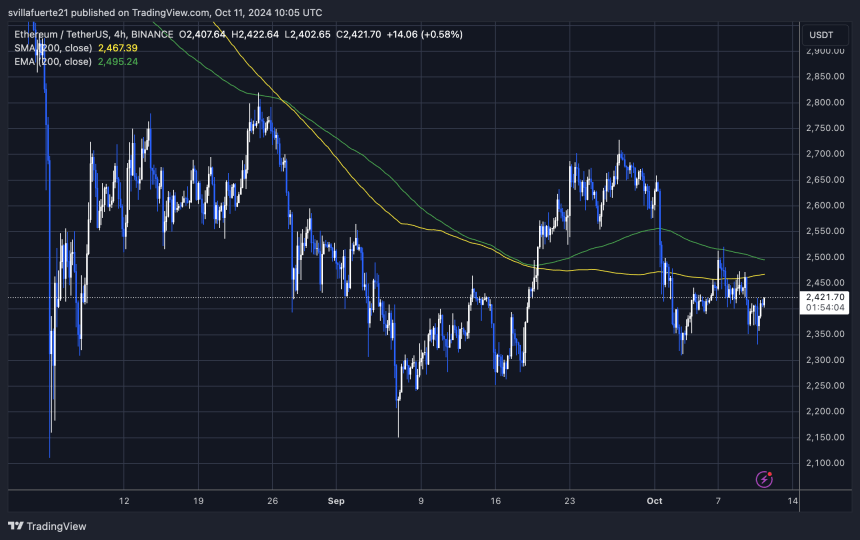

ETH Technical Analysis

Currently, Ethereum is trading at $2,420, marking a minor 3% recovery from its dip towards the $2,330 support zone. Despite this rebound, the price lingers just below pivotal moving averages – less than 2% from the 4-hour 200 MA (at $2,467) and approximately 3% shy from the 200 EMA (at $2,495). These figures represent significant resistance levels in the short run.

For a bullish resurgence, Ethereum needs to surpass these averages and eye resistance levels beyond $2,500. A definitive break above would herald the return of investor optimism, keen for sustained upward momentum.

Related Reading

Failure to reclaim dominance over these technical indicators might exacerbate the risk of a more severe correction. Under such circumstances, Ethereum could find itself retreating to lower support zones, with a potential downturn to $2,150. Market participants are vigilantly observing these developments, recognizing that Ethereum’s forthcoming actions will play a significant role in shaping the immediate market dynamics.

Featured image from Dall-E, chart from TradingView

Conclusion: An Entertaining Ethereum Encore?

As Ethereum pirouettes on the precipice of pivotal price points, the crypto community holds its collective breath. Will it be a dazzling rally or a dramatic dip? The tension is palpable, akin to the final act of an opera, where the audience is uncertain if the finale will be triumphant or tragic. With investors and traders playing the role of an anxious audience, Ethereum’s next moves on this financial stage could either spell a standing ovation or somber silence. Amid this climactic crypto crescendo, enthusiasts and skeptics alike are reminded of the volatile virtuoso that is the digital currency market. For those yearning for more thrilling tales from the crypt(ocurrency world), don’t miss out on the latest developments at DeFi Daily News. Join us as we follow Ethereum’s journey, eagerly awaiting to see if it takes a bow under the spotlight of success or exits stage left into the shadows of correction.