Ethereum (ETH), the second-largest cryptocurrency by market capitalization, has experienced a highly volatile trading period since the dawn of August, oscillating within a daily price range of $2,300 to $2,800. This fluctuating performance has been a significant point of discussion within the cryptocurrency community, especially over the past few days. The asset has encountered stiff resistance around the $2,600 threshold, a development that has sparked a wave of analysis and speculation among both investors and market watchers. The inability of ETH to convincingly break and hold above this price level has injected a dose of pessimism regarding its immediate price prospects.

Related Reading

Comparatively, Bitcoin has displayed a more robust performance throughout the year, which has further accentuated the underwhelming nature of Ethereum’s market movements. A report from Farside Investors has thrown light on a notable decrease in the interest levels for Ethereum ETFs. This growing disinterest is perceived as a reflection of broader market uncertainties about Ethereum’s ability to maintain its competitive edge. The cooling investor enthusiasm towards Ethereum ETFs is seen as a bellwether for the platform’s future market trajectory.

As Ethereum grapples with its price resistance at $2,600, the broader market sentiment remains tethered to a wait-and-see approach. The forthcoming days are deemed crucial for Ethereum to demonstrate its market strength and possibly reclaim a growth trajectory. This pivotal phase in ETH’s market journey is under intense scrutiny, making it a defining moment for the cryptocurrency.

Ethereum ETFs’ Underwhelming Performance

The introduction of Ethereum ETFs was met with considerable excitement. However, the aftermath of their launch has been anything but stellar. Analysis from Farside Investors has pointed out a stark downturn in the performance of these financial instruments. In fact, both inflow and outflow activities have dwindled to nearly negligible levels, underscoring a dramatic dip in sustained investor interest post-launch. This lackluster response starkly contrasts the surge of anticipation that marked their debut, painting a gloomy picture for Ethereum ETFs.

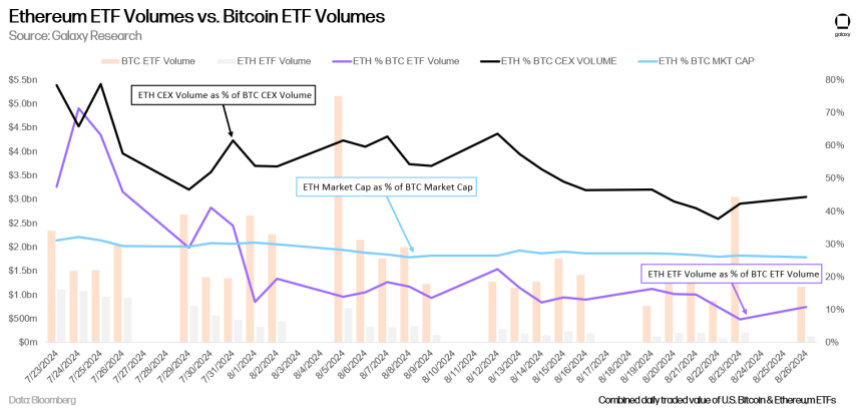

Adding to Ethereum’s woes, data from Bloomberg, disseminated by Galaxy Research, indicates that Ethereum ETFs experience significantly lower trading volumes compared to their Bitcoin counterparts. This volume discrepancy is particularly noteworthy when viewed against the backdrop of the ETH/BTC trading volume and market cap ratios on centralized exchanges (CEX). Despite Ethereum’s pronounced presence in the market, it appears that its ETFs fail to captivate a commensurate level of investor interest, especially when juxtaposed with Bitcoin ETFs.

This prevailing market sentiment suggests a discernible preference among investors for Bitcoin or even alternative cryptocurrencies like Solana, over Ethereum. The diminished allure of Ethereum ETFs highlights a broader market consensus where Bitcoin retains its supremacy, leaving Ethereum and its associated financial products in its wake. This scenario prompts a probing inquiry into the future viability of Ethereum ETFs and their capacity to attract investment in a competitive cryptocurrency landscape.

Related Reading

ETH Price Action

Presently, Ethereum is priced at $2,522, an indication of the prevailing market uncertainty as it continues to trade below the pivotal $2,600 mark since last Tuesday. This price bracket once acted as a robust support level through the larger part of August but has now transitioned into a critical resistance barrier. This shift suggests that Ethereum may be on the brink of further price depreciations in the near term.

For Ethereum bulls to wrestle back control and instigate a price ascendancy, overcoming the $2,600 resistance level is essential. A successful breach of this threshold could set the stage for a rally towards the $2,820 high, potentially signaling a bullish reversal for Ethereum. Conversely, failure to surpass the $2,600 mark could perpetuate the ongoing downtrend, with the next critical support level poised around $2,310.

Related Reading

The intricate tug-of-war between the support and resistance levels at the $2,600 junction underscores its strategic significance in dictating the near-term price direction of Ethereum.

Cover image from Dall-E, Chart from Tradingview

An Entertaining Conclusion

As the whirlwind of speculation and analysis continues to envelope Ethereum, the cryptocurrency community watches with bated breath. Will Ethereum ascend like a phoenix and reclaim its glory, or will it remain ensnared in the $2,600 labyrinth? Only time will unravel this enigma. For those thirsting for more titillating tales from the crypto realm, point your compass towards DeFi Daily News, your treasure trove for all things DeFi and beyond.