In the ever-evolving world of cryptocurrency, Ethereum stands out as a beacon of potential, hinting at significant market movements that capture the attention of investors and analysts alike. Recently, the digital currency has found itself in what can only be described as a classic accumulation phase, following a notable correction that saw its price dip to $2,116 just 20 days prior. However, the resilience of Ethereum has been nothing short of remarkable, as it swiftly recouped its losses, climbing to loftier heights and signaling a bullish momentum that can no longer be ignored.

Related Reading

The intrigue surrounding Ethereum’s price action has significantly intensified, with the cryptocurrency community avidly watching for signs of an impending surge. Bolstered by its recovery from the recent lows, a wave of optimism has swept over the market. Esteemed market pundits are now putting forth predictions that see ETH soaring to $3,000 in the imminent future. This potential ascent is viewed as a pivotal moment within Ethereum’s current market cycle, embodying the digital currency’s robustness and the unwavering confidence investors place in its enduring value.

As Ethereum meticulously accumulates and consolidates its gains, the anticipation of a substantial breakout builds. This impending breakout is poised to catapult Ethereum into new territories, marking an exhilarating chapter in its journey.

Ethereum Price Structure Suggests A Coming Breakout

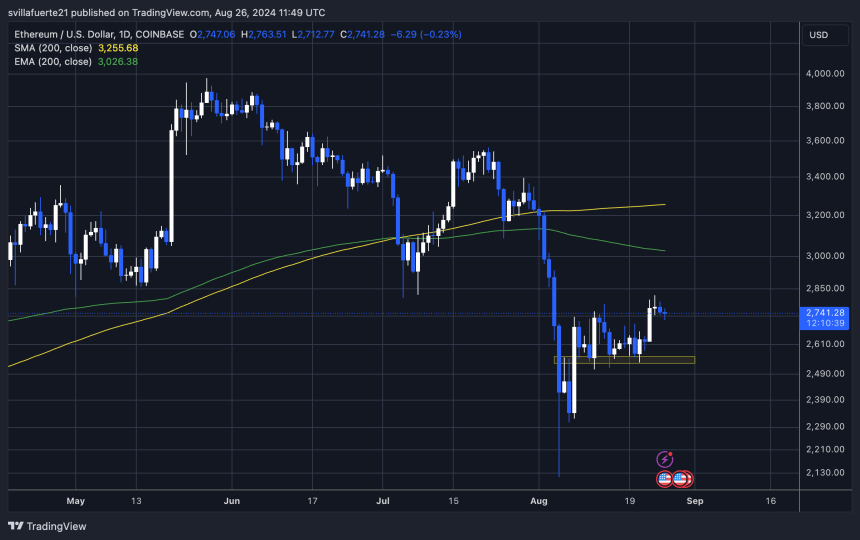

Following a period of prolonged consolidation that tested the patience of many, Ethereum now appears on the brink of initiating a climb towards higher valuations. Castillo Trader, a noted analyst and adept trader, recently took to X to share his technical analysis on Ethereum. According to his insights, Ethereum is expected to momentarily dip to a lower demand level at $2,611 before ardently pursuing the elusive $3,000 threshold. The 4-hour chart analysis by Castillo suggests we are at the cusp of a significant market movement.

The allure of the $3,000 level extends beyond its psychological appeal; it formerly served as a foundation of support before capitulating at the month’s inception. Surpassing this threshold and securing its position above it could signal the commencement of a long-term bullish trend for Ethereum.

Related Reading

This looming breakout is expected to catapult Ethereum into a new bullish epoch, as the ecosystem seeks to emerge from a period marked by stagnation, eyeing heights that have remained uncharted. The coming days are deemed crucial for Ethereum’s trajectory, with its direction heavily reliant on the ensuing market dynamics.

ETH Technical Analysis

Currently priced at $2,743, Ethereum’s future movements are shrouded in mystery, with potential paths diverging. There’s speculation that ETH might first retract to a lower demand zone around $2,500 before rallying towards $3,000. Such a retest could forge a potent foundation for a lasting upward trend. Yet, the volatile nature of the market implies that Ethereum might skip this retracement and directly leap towards the $3,000 benchmark.

The unpredictable swings of the market highlight Ethereum’s capricious nature, serving as a reminder of the inherent risks and rewards. A pivotal marker in Ethereum’s technical analysis is the daily 200 exponential moving average (EMA), situated at $3,026. Surmounting this barrier would unequivocally signal a bullish continuation, immensely reinforcing the optimistic outlook.

Related Reading

A conclusive breach through the $3,000 psychological barrier and the subsequent encampment above the 200 EMA would not only affirm the market’s strength but also cement the bullish sentiment pervading among traders and investors. Such a development would likely ignite a sustained rally, placing Ethereum on a trajectory towards unprecedented peaks.

Featured image created with Dall-E, chart from Tradingview.com

For individuals keen on staying abreast of the latest trends and insights in the world of decentralized finance (DeFi), perusing DeFi Daily News can provide enriching content that caters to a wide array of interests within the crypto space.

Conclusion

As Ethereum tiptoes the line between a compelling recovery and the cusp of a breakout, the crypto domain waits with bated breath. The convergence of technical indicators and market sentiment suggests an exciting period ahead for Ethereum. Whether it’s the charm of round numbers or the solidity of technical analysis, the $3,000 level represents more than just a number; it’s a gateway to Ethereum’s potential watershed moment.

In this high-stakes game of digital currencies, Ethereum’s current accumulation could very well be the prelude to a symphony of market movements that could redefine its trajectory. With the community’s eyes fixated on forthcoming developments, Ethereum’s journey is a compelling saga of resilience, anticipation, and the unyielding pursuit of new horizons. As we continue to chart this remarkable voyage, the only certainty is the promise of more drama, more excitement, and undoubtedly, more gains. Tune in, for Ethereum may just be gearing up for its magnum opus.