rewrite this content using a minimum of 1000 words and keep HTML tags

Join Our Telegram channel to stay up to date on breaking news coverage

BitMEX co-founder Arthur Hayes says Ethereum (ETH) could soar up to $20K this cycle, fueled by buying from Ethereum treasury firms and “absolutely insane” US money printing.

CryptoBanter co-founder Ran Neuner asked Hayes in an interview if he thinks ETH will drop to $3K before it goes on to set a new all-time high (ATH) or if another scenario will play out.

“The chart says it’s going higher,” he said. “I think ETH goes ten, twenty thousand before the end of this cycle. Once it’s broken through then you know there’s a gap of air.”

Arthur Hayes just admitted he bought back ETH because “the chart says it’s going higher.”

He sees Ethereum running up to $20K this cycle.

When asked $ETH vs $SOL?

He’s overweight $ETH 🚀 pic.twitter.com/Yd3q1t0aCe

— SamAlτcoin.eth 🇺🇸 (@SamAltcoin_eth) August 21, 2025

His prediction comes as the Ethereum price surged more than 7% in the past 24 hours to trade at $4,603.78 as of 10:40 a.m. EST.

ETH surged along with other cryptos after Fed Chair Jerome Powell, speaking at the Jackson Hole summit, said the economic backdrop in the US “may warrant adjusting our policy stance,” thus suggesting interest rate cuts are in play for September.

Ethereum Treasury Companies Main Driving Force

Hayes said the growing number of companies that are raising money to buy the altcoin to build Ethereum treasuries is behind his bullish thesis.

As ETH’s price rises, he predicts that it will be easier for those companies to raise more money, which will lead to more buys and subsequently send the ETH price higher.

That’s as companies like SharpLink Gaming, which is led by Ethereum co-founder Joseph Lubin, and BitMine Immersion Technologies, led by Fundstrat CIO Thomas Lee, continue to buy more ETH.

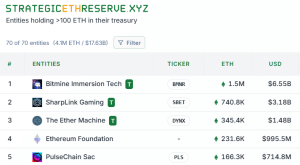

Data from StrategicETHReserve shows that 69 Ethereum treasury firms currently hold 4.10 million ETH.

Top 5 biggest ETH treasury firms (Source: StrategicETHReserve)

BitMine is the current leader with 1.5 million ETH valued at $6.55 billion on its balance sheet. In second place is SharpLink Gaming with its 470.8K ETH holdings valued at $3.18 billion.

“The sky’s the limit,” Hayes said.

Government Will Go “Absolutely Insane” And Print Money

Another key factor driving the ETH price higher will be US money printing.

He said government officials “haven’t gotten into their groove of how they’re going to print money yet.”

“They’re putting in all the pieces” and “teasing different ways” in which they could print more money, Hayes said.

He predicts that by mid-2026 the market will have some more clarity around the Trump-Fed clash. Specifically, whether Trump will fire Powell for someone else and who the next Fed Chair will be.

After that, he believes the government will “go absolutely insane with how much money they’re going to print.” He expects this printing to carry on until Trump leaves office.

That could lead to a “protracted” crypto market cycle that breaks out of the usual 4-year trend and lasts up until 2027 or 2028, he said.

Hayes’ base case is that “we’re going to have a massive bull market” for all the types of financial assets connected to anything that Trump “believes is important between now and when he exits office.”

The only thing that voters care about “is their wallet,” he said. He subsequently argued that if voters feel they are not “advancing economically” while Trump is in office, then they will just pick “the other guy.”

Hayes Prefers ETH Over SOL For This Cycle

Hayes said both ETH and Solana are ”gonna go up,” but added that SOL will “probably not” beat ETH. While ETH “is the bigger asset to move,” there is “a lot of money chasing it,” he said.

As such, Hayes says he would be “more overweight ETH.”

Related Articles:

Best Wallet – Diversify Your Crypto Portfolio

Easy to Use, Feature-Driven Crypto Wallet

Get Early Access to Upcoming Token ICOs

Multi-Chain, Multi-Wallet, Non-Custodial

Now On App Store, Google Play

Stake To Earn Native Token $BEST

250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link