Amidst the ever-dynamic space of cryptocurrencies, the recent activities within the Ethereum futures market have presented an interesting narrative indicating whether the prevailing winds favor a bullish or bearish sentiment towards Ethereum (ETH). Analyzing the market’s sentiment is akin to reading the tea leaves, with futures market data offering a lens to gauge investor behavior and market trends.

An Uplift in Ethereum’s Market Sentiment

Delving into a fresh analysis courtesy of a CryptoQuant Quicktake post, an intriguing picture has been painted by scrutinizing the “Taker Buy Sell Ratio.” This particular metric stands out as it meticulously measures the volume of taker buy orders against taker sell orders on various derivatives platforms. A closer look at this ratio reveals the overarching market sentiment towards ETH by highlighting whether buyers or sellers are in the dominant position.

Logically, when the ratio tips above 1, it signifies a bullish market sentiment with the taker’s buy volume surpassing the sale volume, suggesting an increased interest in purchasing ETH at its current or anticipated price. This shift often heralds a positive market outlook, implying that investors are inclined towards a longer-term investment horizon, expecting the price to ascend.

Conversely, a ratio hovering below 1 would depict a bearish sentiment, where the market is crowded with a higher intent to sell rather than buy, typically anticipating a reduction in price or mitigating potential losses. This situation portrays a market dominated by caution and skepticism among traders and investors alike.

Illustrating this dynamic, a chart reflecting the 14-day simple moving average (SMA) of the Ethereum Taker Buy Sell Ratio uncloaks the market’s mood swings over the past few months:

This uplift not only reflects a robust buying interest within the perpetual market but also seems to herald a potential bullish trend over the mid-term. Should this upward movement in the Taker Buy/Sell Ratio persist, it might very well set the stage for a bullish rally, propelling Ethereum’s price towards new heights.

Yet, the trajectory of the 14-day SMA Toker Buy Sell Ratio in the immediate future remains a focal point of speculation. A continued upsurge would solidify the bullish setup for Ethereum, setting a compelling narrative for investors and market onlookers.

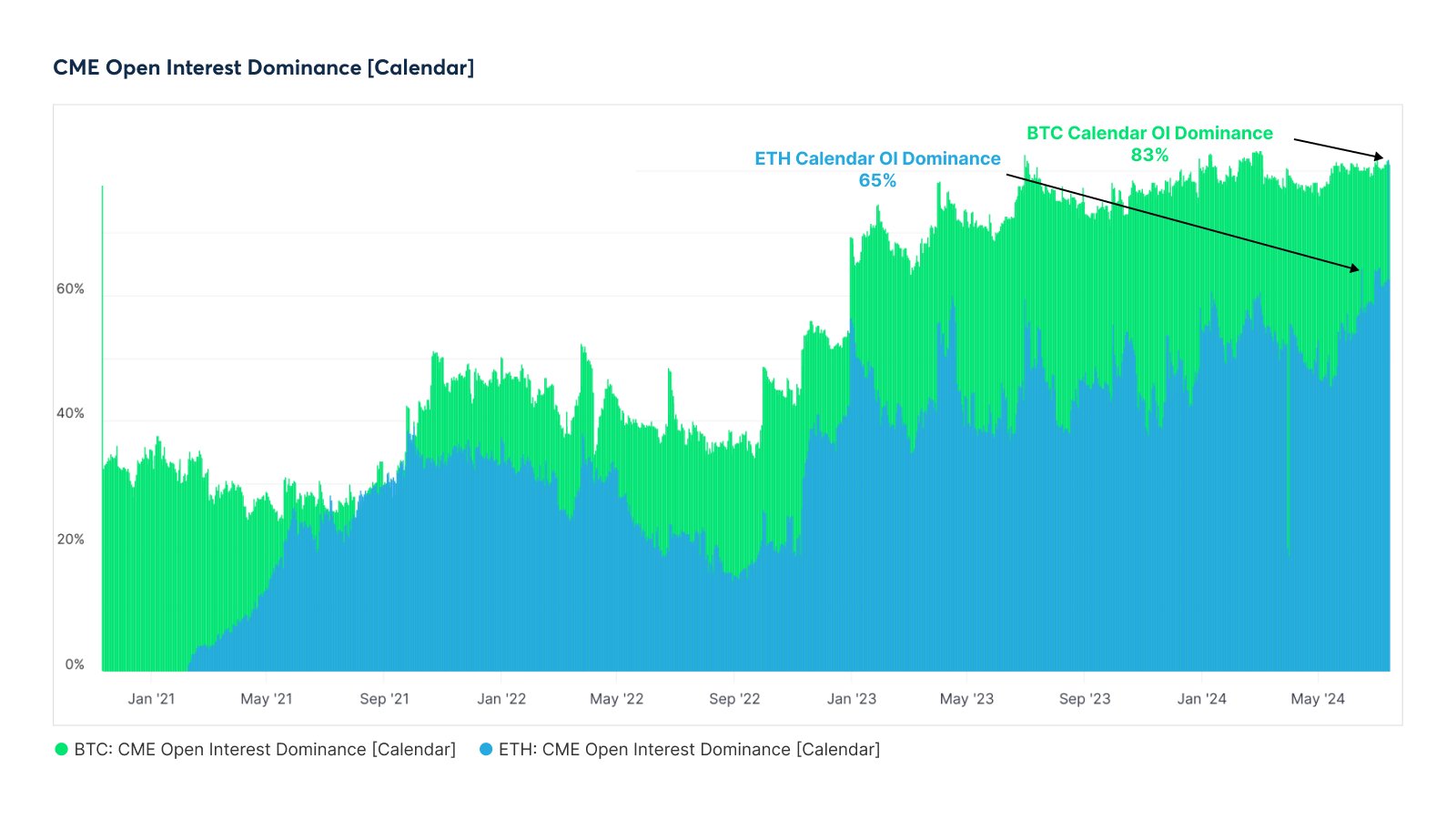

Transitioning to a broader lens on the futures market, a notable development has been the growing dominance of the CME Group within the calendar futures market, encompassing both Ethereum and Bitcoin. A recent analysis by Glassnode highlighted this trend, pointing out a significant share occupied by CME Group in the respective markets.

The graph illustrates the Open Interest dominance of the CME Group in the calendar futures market, carving out a notable slice for itself both in Bitcoin and Ethereum’s turf.

The Current Stand of Ethereum’s Price

A snapshot of Ethereum’s market position reveals a somewhat stagnant phase, with the price hovering around the $3,400 mark in recent days. Despite a sideways movement post a recent surge, observations from the market’s metrics offer a mixed basket of anticipation and cautious optimism amongst investors.

The depiction of Ethereum’s price points towards a latent potential for movement, albeit currently in a state of equilibrium, as suggested by the trading charts.

Substantiating the discourse around Ethereum and the broader cryptocurrency landscape, the DeFi Daily News portal serves as a treasure trove for diving deeper into trending news articles, delivering insights and detailed analyses on market movements, technological advancements, and leading narratives within the DeFi ecosystem.

Concluding Thoughts: A Riveting Dynamic

As the curtains draw on this exploration into Ethereum’s prevailing market sentiment and its impacts, it’s compelling to reflect on the dynamic nature of cryptocurrency markets. The oscillating indicators, evolving market dynamics, and the strategic positioning by trading behemoths like CME Group, all paint a picture of a market in constant flux.

The prospective landscape for Ethereum, as suggested by the interesting uptick in the Taker Buy Sell Ratio, combined with the broader strategic plays in the futures market, sets a stage rife with anticipation, strategies, and speculative opportunities. As this storyline unfolds, market enthusiasts, investors, and observers will do well to keep a keen eye on these evolving trends, steering through the volatility with informed insights and strategic foresight.

Featured image from Dall-E, CryptoQuant.com Glassnode.com, chart from TradingView.com