The world of cryptocurrency is a roller coaster of highs and lows, with Ethereum’s recent price movements serving as a prime example. Having ascended to a peak of $2,729 just last Friday, Ethereum has since plummeted by 15%, a development that has left both analysts and investors in a state of vexation. This dip has challenged the previously bullish outlook many held, as Ethereum appears to struggle in sustaining its momentum for a rise.

Adding to the industry’s concerns, several market spectators have voiced predictions of an impending deeper slump. They fear the price might spiral down to yearly lows, potentially touching $2,150, should it breach the current support. This unsettling possibility has breathed new life into the market’s anxiety, filling it with a sense of dread and uncertainty as Ethereum’s price trajectory remains ambiguous.

Related Reading

This recent downturn has significantly jolted investors’ confidence. The entire market is now on tenterhooks, desperately seeking a sign or a clear direction in Ethereum’s price movement. Analysts are poring over charts and data, attempting to discern if Ethereum can reestablish its support levels and potentially embark on an upward journey once again.

These forthcoming days are deemed critical for Ethereum’s market behavior. Investors are bracing for what is anticipated to be a period of pronounced volatility, a reaction to the fluctuating market conditions that have recently taken hold.

Ethereum Testing Crucial Support Line

At this junction, Ethereum finds itself at a crucial crossroads, one that could significantly influence its trajectory in the weeks ahead. The altcoin’s next movements are predicted to be pivotal, with analysts keenly observing whether Ethereum can demonstrate resilience in maintaining its position as the second-largest cryptocurrency by market capitalization. Should it falter and break below the key support levels, it might signal an impending broader market downturn.

The expectation for an Ethereum rebound is palpable, especially as it teeters above a critical support line deemed by many as a potential catalyst for a rally towards new heights. Carl Runefelt, a prominent analyst, has recently shared his perspective on the platform X, underscoring the current trendline that’s bolstering the ETH price.

Runefelt’s analysis comes with a stern warning: Ethereum’s price might see a steep decline if it fails to uphold the current trendline. He suggests that $2,150 could be the next critical point of focus if the support line is breached.

Related Reading

A tumble to these figures could trigger a mass exit of investors who were anticipating a bullish continuation. Should Ethereum lose this key support, it would likely usher in a period of uncertainty and significant volatility, keeping market participants on their toes for the forthcoming developments.

ETH Price Action Details

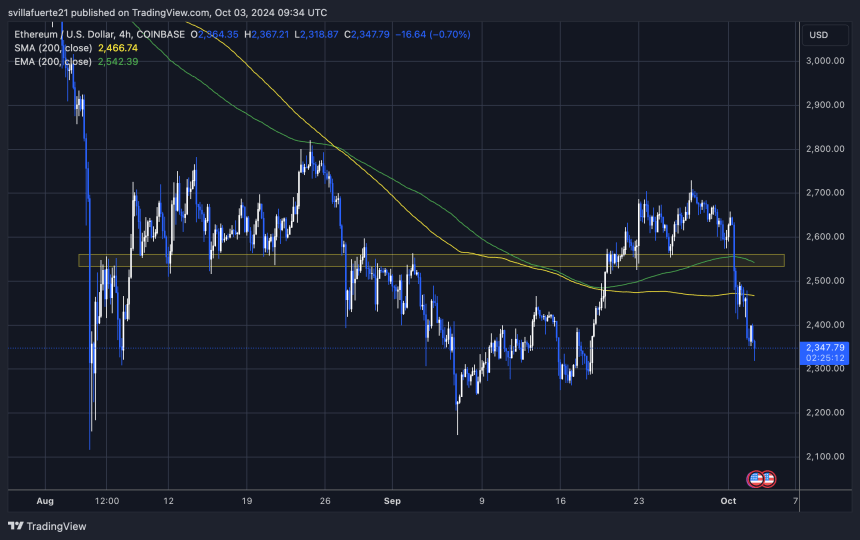

Currently, Ethereum trades at $2,350, having failed to chart a higher high above $2,820. This inability to sustain momentum and break past crucial levels has disheartened the bullish side of the market. Ethereum’s recent price action has seen it fall below the 4-hour 200 exponential moving average (EMA) at $2,542 and the simple moving average (MA) at $2,466.

These technical indicators are instrumental in deciphering short-term market trends. Their loss as support points has amplified concerns about Ethereum’s potential for further declines.

For Ethereum to pivot back into a bullish domain, it’s crucial for it to surmount the 4-hour 200 EMA and the 4-hour MA, solidifying these levels as support. Such a shift would be a robust indication of Ethereum’s recovered strength, potentially setting the stage for an upward price revision.

Nevertheless, a deeper correction looms if Ethereum cannot recapture these vital markers. With critical support pegged around $2,100, a slide beneath this threshold could spell even more trouble. The investment community is watching with bated breath, as the upcoming days are expected to be pivotal in determining whether Ethereum can stall its downward trend or if it will descend further.

Featured image from Dall-E, chart from TradingView

Conclusion: The Ethereum Conundrum

As we witness the tumultuous journey of Ethereum in the market, its future remains a topic of intense speculation. The recent price actions serve as a reminder of the volatile nature of cryptocurrencies. Financial experts and enthusiasts alike are keeping a close eye on Ethereum’s support levels, hoping for a rebound that could reignite the bullish sentiment.

Amidst these uncertain times, predictions vary, ranging from optimistic forecasts of new peaks to cautionary tales of further declines. The consensus, however, leans towards a watchful wait-and-see approach, with the underlying belief in the transformative potential of Ethereum as a cornerstone of the cryptocurrency world.

Engaging in this digital asset sphere requires both nerve and acumen, as market dynamics shift with little warning. But for those who navigate it wisely, the rewards can be substantial. For enthusiasts seeking the latest in Ethereum and other market movements, staying informed is crucial.

For more trending news articles like this, be sure to visit DeFi Daily News. This platform offers insightful analyses and updates on the ever-evolving world of decentralized finance, helping you stay ahead in the game of cryptos.