In the ever-evolving landscape of blockchain technology, a fierce competition is unfolding between two titans of the smart contracts platform: Ethereum and Solana. Despite facing challenges such as scalability issues and elevated transaction fees, Ethereum continues to hold the title of superiority in the eyes of many within the crypto community. Sreeram Kannan, the innovative mind behind EigenLayer, a liquidity restaking platform, is a vocal supporter of Ethereum’s capabilities over its competitors, particularly Solana. As the third most valuable platform for smart contracts, trailing only behind Ethereum and the BNB Chain, Solana has been steadily climbing the ranks, securing more market share and solidifying its presence in the blockchain realm.

Is Ethereum Superior To Solana?

The rise of Solana is undeniable, yet Sreeram Kannan posits in a discourse on X that Solana’s commitment to low latency and synchronized global nodes comes at the expense of core functionalities. This priority setting may not resonate with all users’ needs and preferences.

Related Reading

Conversely, Ethereum’s approach has been noticeably different, with a strong emphasis on stability and decentralization. Kannan asserts that Ethereum is not just the pioneer but remains the most holistic smart contracts platform available. This assertion is supported by the significant volume of assets managed by EigenLayer on Ethereum, which, according to DeFiLlama, stands at an impressive over $12 billion.

Kannan acknowledges the efficiency of Solana but expresses concern over its global state machine, which he believes compromises the platform’s programmability and verifiability.

On the flip side, Ethereum is flourishing, especially in terms of performance, largely due to the success of rollups and their sweeping adoption. These off-chain solutions not only offer instant confirmations but are also surpassing web2 applications in performance. Additionally, Ethereum’s programmability has allowed EigenLayer to expand its features, spearheading cloud-scale programmability through decentralization of verifiable tasks.

Layer-2 Platforms Thriving: Why Is ETH Struggling?

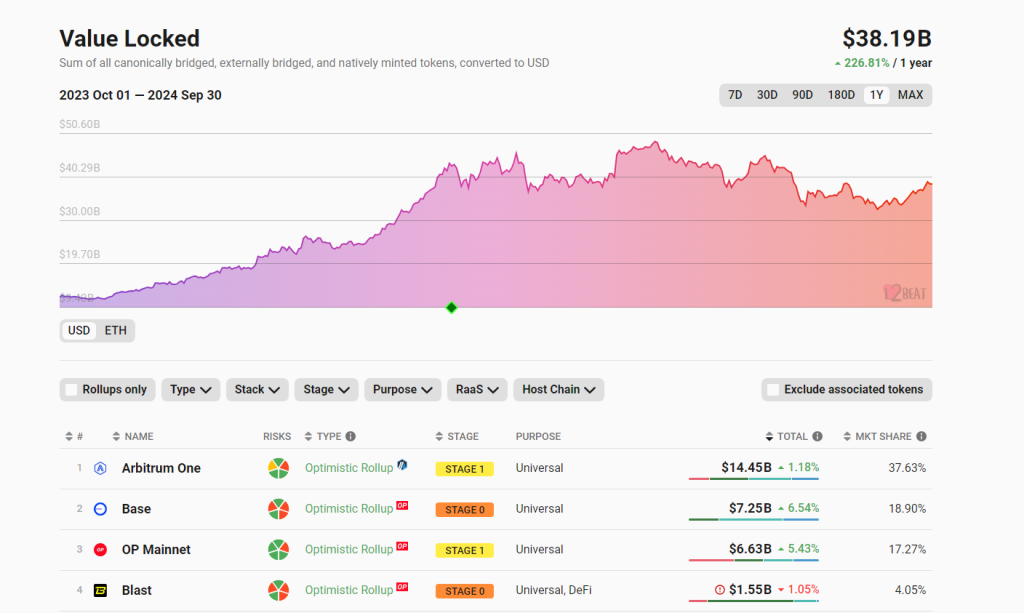

Mustafa Al-Bassam, the co-founder of Celestia, voices a similar support for Ethereum, highlighting features that are either absent or underdeveloped in other networks. In a narrative shared on X, he paints Ethereum as an “underrated” platform, especially applauding the bustling ecosystem of rollups that Ethereum boasts, which is declared as “the largest and most successful” to date. According to L2Beat, as of the end of September, the layer-2 ecosystem boasted management of over $38 billion in assets, with Arbitrum and Base taking the lead among the platforms.

Nevertheless, despite the bustling activity on Ethereum’s layer-2 platforms, ETH itself is experiencing a struggle in momentum. Analysis of the daily chart indicates an absence of significant upward movements, with bulls unable to push past the $2,800 mark, although a solid support exists at $2,400. This stagnation in price ascent can be partially attributed to the surge in layer-2 solutions, which diverts some activities off-chain, adding an inflationary pressure on the network. This scenario unfolds as solutions like Dencun are rolled out to further reduce costs for layer-2 transactions, as observed on Ultra Sound Money, where the burn rate of ETH shows a corresponding decline.

In conclusion, while the battle between Ethereum and Solana continues to unfold, with each platform showcasing unique strengths and facing distinct challenges, the journey towards optimization and widespread adoption is far from over. The blockchain space remains a thrilling spectacle of technological evolution, with developments on both platforms closely watched by enthusiasts and investors alike. For those keeping an eye on these and other trends in the decentralized finance sector, a visit to DeFi Daily News proves to be an enriching experience, offering a plethora of insights into the ever-vibrant crypto landscape.