Delve into the Weekly Market Summary Courtesy of eToro’s Expert Global Analyst Team, Encompassing the Most Up-to-Date Market Insights and Investment Perspectives.

A Crucial Eye on the ECB’s Next Move and Q3 Financial Performance

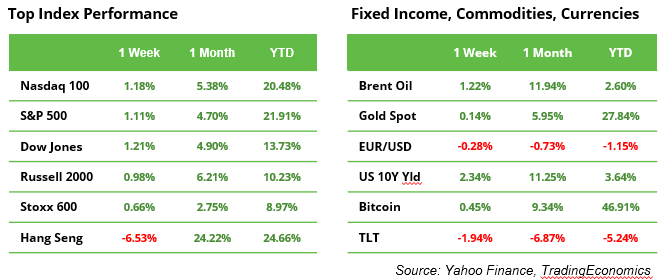

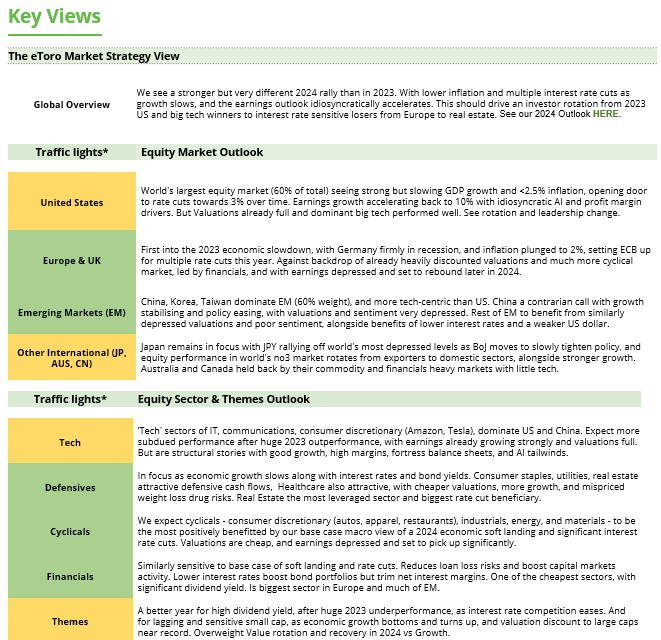

Last week’s financial landscape presented minimal fluctuations across the board. In the United States, the equity market experienced a surge, with the S&P 500 and Dow Jones indices surpassing expectations by reaching new heights at over 5,800 and 42,860, respectively. The aftermath of a robust job report from September saw the yield on the 10-year US Treasury ascend past the 4% mark. Contrarily, the Hang Seng index in Hong Kong witnessed a 6% decline amid conversations around potential economic stimuli that ultimately did not come to fruition. As global uncertainty persists, particularly concerning the evolving situation in the Middle East, Brent and WTI oil prices remained steady around the $79 and $75 marks respectively.

The spotlight this week shifts towards the United States with its forthcoming retail sales data and a selection of macroeconomic indicators emerging from China. However, the main events to watch will be the European Central Bank’s decision on rate cuts and the unveiling of Q3 earnings across several pivotal sectors, including financial services, technology, and healthcare.

European Central Bank’s Decisive Moment

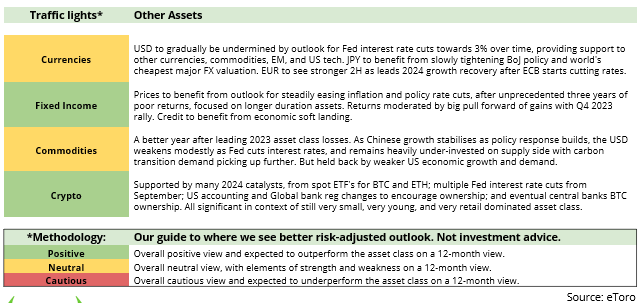

Market anticipations lean towards a 25 basis points reduction in interest rates by the ECB, configuring them to 3.25% this Thursday. There’s a growing consensus that the central bank might implement more aggressive and swift rate adjustments than previously contemplated. With analysts forecasting continuous rate cuts into March, all eyes will be on Christine Lagarde’s commentary in the ensuing press discussion. This speculation is fueled by inflation dipping below 2% for the first time in two years and Germany’s economic woes as it grapples with a looming recession for the second consecutive year. As Germany represents a substantial portion of the Eurozone’s GDP (28.6%), lower borrowing costs could potentially invigorate orders, boost industrial production, and elevate exports. Nevertheless, for sustainable growth, a gamut of additional measures, such as fiscal incentives and fostering innovation, are considered crucial.

The Global Powerhouses: US, China, and the European Union

On October 18, China is poised to reveal its initial estimation of the Q3 GDP growth, with the US and Euro Area to follow on October 30. Predictions suggest a slight deceleration in China’s growth to 4.6% from the 4.7% noted in Q2. In a surprising turn, the US showcased robust growth at 3.0% previously, while the Euro Area recorded a modest 0.6% growth. Amid these revelations, the trade tensions between China and the EU continue unabated as both strive to reclaim their erstwhile economic vigor.

Unraveling China’s Stimulus and Beyond

China’s attempt to rejuvenate its economy through stimulus packages is seen as a pivotal step, yet it falls short of addressing the nation’s entrenched structural challenges. With a significant portion of the populace grappling with the depreciation of property assets, the risk of deflation looms large alongside consumer hesitancy. For the stock market to reflect genuine growth, it’s imperative that such financial boosts permeate the real economy, a sentiment that necessitates enhanced transparency regarding the planned economic measures. Moreover, despite a somewhat optimistic outlook, the veil of diminished transparency over China’s stock market may act as a deterrent for investors. However, commodities present an avenue for indirect investment, given China’s dominant demand for copper and gold on the global stage.

Hurricane Milton’s Brew: A Surge in Orange Juice Prices?

Florida, accounting for 70% of the US orange juice production, recently found itself in the wrathful path of hurricane Milton, jeopardizing major citrus-producing areas. This catastrophe compounds existing challenges, including dwindling production levels and surging prices. Last month witnessed orange juice futures in New York soar to unprecedented levels due to diminished outputs from both Florida and Brazil, the latter suffering from historic drought and greening disease afflictions. Should Milton’s impact prove substantial, it could further constrict supply lines, propelling orange juice prices to even loftier peaks.

Anticipated Earnings and Key Events

As we traverse further into the week, earnings announcements from technology titans such as ASML, TSMC, and Netflix will be meticulously analyzed for signs of a potential rebound in tech stocks following a Q2 downturn. Additionally, LVMH’s revenue update will serve as a bellwether for Western companies’ performance in the Chinese market.

Macro and Earnings Outlook:

17 Oct. ECB rate decision, US Retail sales

18 Oct. China’s Q3 GDP growth, industrial production, retail sales

20 Oct. Assessment of China’s foreign direct investments, previously seen at -31.5%.

Eminent Earnings Announcements:

15 Oct. Engagements from Bank of America, Citigroup, Goldman Sachs, UnitedHealth, Johnson & Johnson, LVMH

16 Oct. Updates from ASML, Morgan Stanley, Abbott Laboratories, Alcoa

17 Oct. Reports from TSMC, Infosys, Nestle, Netflix, Intuitive Surgical

18 Oct. Announcements from Procter & Gamble, American Express

A Gratifying Close to Our Market Overview

To cap off this comprehensive market overview, it’s evident that while challenges persist across various sectors and geographies, opportunities for astute investments remain abundant. From the anticipation surrounding central bank decisions to the intrigue of corporate earnings seasons, the fabric of global financial markets continues to weave a narrative of resilience amidst uncertainty. As we reflect on the possibilities and navigate these tumultuous waters, staying informed and engaged becomes paramount. For more thought-provoking news and analysis, visit DeFi Daily News, your destination for timely and trending financial insights.