The investment landscape for digital assets has recently experienced a noteworthy shift, as indicated by the latest findings from the CoinShares weekly report. It reveals that digital asset investment products around the globe saw a significant $147 million hemorrhage in net outflows last week, marking a pivotal change in the investment tide. This occurrence snapped a streak of net inflows that had been enjoyed over the preceding three weeks, illustrating the volatile nature of the market and the shifting sentiment among investors.

The period of net outflows comes after a notable spell of enthusiasm in the digital assets space, raising eyebrows among market watchers. Despite this setback, it’s important to highlight that digital asset products didn’t retreat in all aspects. Indeed, against this backdrop of outflows, there was a 15% surge in trading volumes, suggesting a heightened level of trading activity among investors. This increase comes at a time when the broader cryptocurrency market is witnessing a downturn in activity, making the spike in trading volumes within digital assets all the more significant.

James Butterfill, the Head of Research at CoinShares, provides insights into the motivation behind the recent outflows. He attributes this movement to unexpectedly robust economic data emerging from the United States, which rattled investors by diminishing the likelihood of significant rate cuts. These macroeconomic developments seem to have soured investor appetite for digital assets in the short term, as the anticipation of continued monetary policy tightening prompts a reassessment of risk and reward within the crypto sphere.

“Higher than expected economic data last week, reducing the probabilities for significant rate cuts are the likely reason for the weaker sentiment amongst investors.”

Examining the situation from a regional perspective reveals a mixed bag of trends. Canada and Switzerland stood out with bullish sentiments, gathering inflows of $43 million and $35 million, respectively. This contrasts sharply with the fortunes of the United States, Germany, and Hong Kong, which led the outflow charge with $209 million, $8.3 million, and $7.3 million vacating digital asset investments respectively. Such divergence highlights the varied investor responses and strategies deployed across different jurisdictions in the face of global economic cues.

Investors focus on Bitcoin and Ethereum

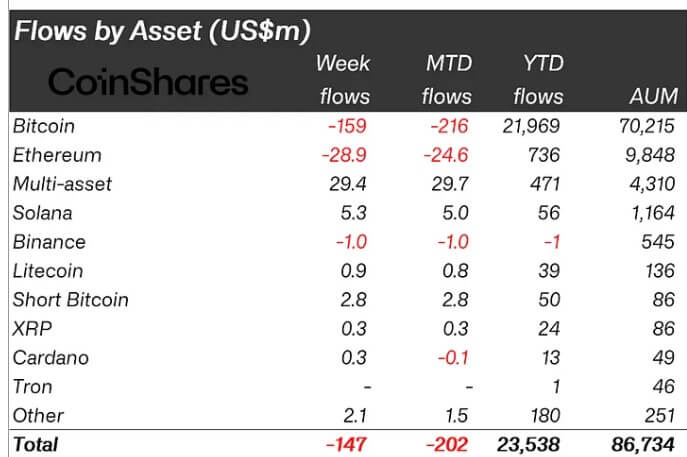

Despite the overall net outflows, investors showed pointed interest in specific digital currencies, with Bitcoin being at the focal point. Bitcoin-related products were particularly hit, experiencing $159 million in outflows. These movements align closely with Bitcoin’s price volatility during the same period. Yet, in an interesting twist, short-Bitcoin products, which benefit from a decrease in Bitcoin’s price, witnessed inflows of $2.8 million, indicating a segment of investors are betting against Bitcoin in anticipation of further price declines.

Bitcoin’s price dynamics have been quite a rollercoaster, with CryptoSlate’s data highlighting a recovery to around $63,000—a 2% uplift within 24 hours after a troubling dip to below $60,000 last week. Such price action exemplifies the volatile heartbeat of the crypto market, where fortunes can shift rapidly, sometimes within the scope of hours.

Ethereum, emerging from a five-week stint of outflows, unfortunately, returned to the red with $29 million exiting the investment sphere last week. Butterfill suggested a subdued investor interest in Ethereum as a possible cause. On a more positive note, Solana managed to capture investors’ imagination, drawing in $5.3 million in inflows. This indicates a selective appetite among investors, who are possibly diversifying their focus towards altcoins with promising fundamentals or technological advancements.

Defying the overall trend of outflows, multi-asset investment products painted a different picture. They garnered net inflows totaling $29.4 million, continuing a remarkable 16-week streak of positive investment inflows. Their cumulative tally has swelled to $431 million, underscoring their growing appeal among investors. Multi-asset products, by providing exposure to a broad spectrum of digital assets, offer a more diversified investment strategy, which has clearly resonated with the market since June. They now account for 10% of the assets under management among global crypto fund managers, reflecting their burgeoning popularity as a hedge against the volatility inherent in singular digital asset investments.

Finally, as we unravel the complexities of the digital asset investment landscape, a blend of caution and optimism remains. The recent outflow underscores the sensitivity of crypto markets to broader economic indicators, yet the resilience in trading volumes and selective inflows into certain digital currencies and multi-asset products signal a maturing market that is learning to navigate the waves of uncertainty.

For investors, the key takeaway is the importance of staying informed and agile. As the crypto space continues to evolve, those who adapt to its rhythms and nuances are likely to find opportunities even in the face of challenges. The digital asset market, with its rapid shifts and twists, holds lessons and avenues for growth, making it a continuously intriguing frontier for investment exploration.

For those eager to delve deeper into the pulse of the digital asset and decentralized finance world, DeFi Daily News stands as a beacon of timely and insightful news articles. It’s your window to staying ahead in the ever-evolving landscape of cryptocurrencies and blockchain technologies, offering a rich tapestry of information that can empower your investment decisions and spark engaging conversations around the future of finance.

In wrapping up, the shifting sands of the digital asset investment market continue to challenge and intrigue. The recent outflow phenomenon underscores the market’s sensitivity to macroeconomic factors, yet it also highlights areas of resilience and interest among investors. As digital assets navigate through these turbulent times, the market’s depth, diversity, and dynamism come to the forefront, offering a fascinating realm for those willing to explore, learn, and adapt. In the world of crypto investments, change is the only constant, and in this change lies both risk and opportunity. Engaging with trusted news sources like DeFi Daily News can significantly enhance the quality of decisions made in this vibrant and unpredictable market. Drawing from insights, trends, and analysis, investors and enthusiasts alike can navigate the crypto waters with greater confidence, discovering potential havens and new horizons in the digital finance ecosystem.