rewrite this content using a minimum of 1000 words and keep HTML tags

I remember hearing about thorium back in my Wall Street days.

For decades, analysts pitched it as a “cleaner, safer” alternative to uranium because it couldn’t be weaponized and produced far less radioactive waste.

The U.S. had even built a working molten-salt thorium reactor at Oak Ridge National Lab in the 1960s. But despite its success, the project was ultimately abandoned.

That’s because uranium was already embedded in global supply chains, and the Cold War-era military establishment didn’t have any use for nuclear material that couldn’t fuel a bomb.

So thorium was shelved. And in the U.S., it has remained dormant for the past 50+ years.

But China seems to be waking up to thorium’s potential as a nuclear fuel source…

And it could change the balance of global energy leadership for decades to come.

One Million Tonnes of Leverage

In January, Chinese officials confirmed a massive thorium discovery at the Bayan Obo mining complex in Inner Mongolia.

Source: NASA

This site was already known as the world’s richest rare earth deposit. Now it’s estimated that 1 million tonnes of thorium oxide are also embedded in these rock formations.

But the U.S. has known about thorium for decades. So what’s the big deal with this recent find?

Most nuclear reactors today rely on uranium-235 to power them.

But uranium is rare and volatile.

It can also be a political liability because uranium-based power creates long-lived radioactive waste, and uranium reactors carry a non-trivial risk of meltdown.

Fukushima and Chernobyl are two prime examples of what happens when these reactors fail under pressure.

Thorium, by contrast, is significantly more abundant in the Earth’s crust than uranium. That makes it easier and cheaper to source over time.

It also produces less than 1% of the long-lived radioactive waste generated by traditional uranium-based reactors.

And it can be used in molten-salt reactors, which operate at atmospheric pressure and include passive safety features that dramatically reduce the risk of catastrophic failure.

That means there are significant advantages to using thorium to create nuclear reactors.

And that brings us back to China’s recent thorium discovery.

According to internal estimates, this new find is enough to meet China’s domestic energy needs for up to 60,000 years at current consumption levels.

So while the U.S. and most other countries are still betting on uranium-based nuclear expansion — or scrambling to scale renewables — China is fast-tracking the infrastructure to turn their new thorium find into energy.

China has already built a prototype 2 MW molten-salt thorium reactor, and it’s also constructing a 10 MW demonstration reactor in the Gobi Desert.

If these reactors are successful, the next phase could be industrial-scale deployment, which could eventually power China with a secure, domestic, low-waste energy platform.

It would also represent a missed opportunity for the U.S.

After all, we led the world in molten-salt reactor research during the Cold War.

During the late 1960s, scientists at Oak Ridge National Laboratory built and successfully operated a functioning molten-salt reactor. It ran on thorium fuel and proved both safe and efficient.

But in the 1970s, federal support dried up, and the program was quietly shelved in favor of uranium-based reactor designs.

Today, China is using much of that declassified U.S. research as a foundation for the new reactors it’s building.

Meaning, we might have unknowingly given China an edge in the race to artificial superintelligence (ASI).

Here’s My Take

It’s too early to know whether thorium will become a dominant fuel source.

But the world is beginning to realize it can’t meet its future energy needs with solar panels and wind farms alone.

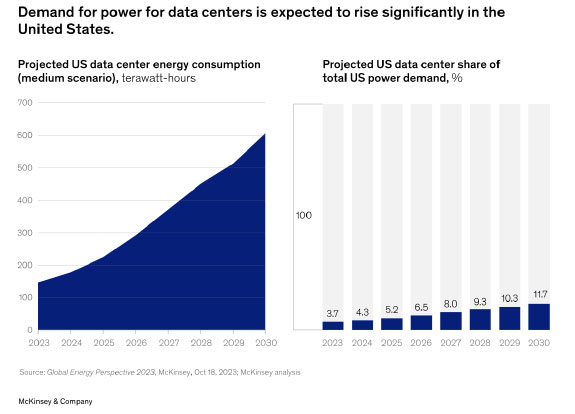

That’s because AI is driving exponential demand for stable, high-density power, particularly from data centers.

Big Tech is well aware of this. Just last week, Meta signed a 20-year deal to power its AI operations with nuclear energy, joining a growing list of companies turning to next-gen power sources to meet rising demand.

But if China’s thorium initiatives can scale, it could cement Beijing’s position as the global leader in next-generation nuclear power.

At the very least, it would give China leverage over yet another critical strategic resource.

At scale, it could lead to true energy independence.

Either way, it would give China an edge in the race to ASI.

Because the U.S. is still grappling with an aging power grid, regulatory delays and a lack of political consensus on how to modernize its energy strategy.

If we intend to win the race to ASI, we have to commit to investing in the future by ramping up our energy infrastructure.

Otherwise, we might end up watching from the sidelines while China beats us to it.

Regards,

Ian KingChief Strategist, Banyan Hill Publishing

Ian KingChief Strategist, Banyan Hill Publishing

Editor’s Note: We’d love to hear from you!

If you want to share your thoughts or suggestions about the Daily Disruptor, or if there are any specific topics you’d like us to cover, just send an email to dailydisruptor@banyanhill.com.

Don’t worry, we won’t reveal your full name in the event we publish a response. So feel free to comment away!

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link