rewrite this content using a minimum of 1200 words and keep HTML tags

Target stock has been crushed, losing two-thirds of its value from its prior peak. The Daily Breakdown digs into its valuation and dividend.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

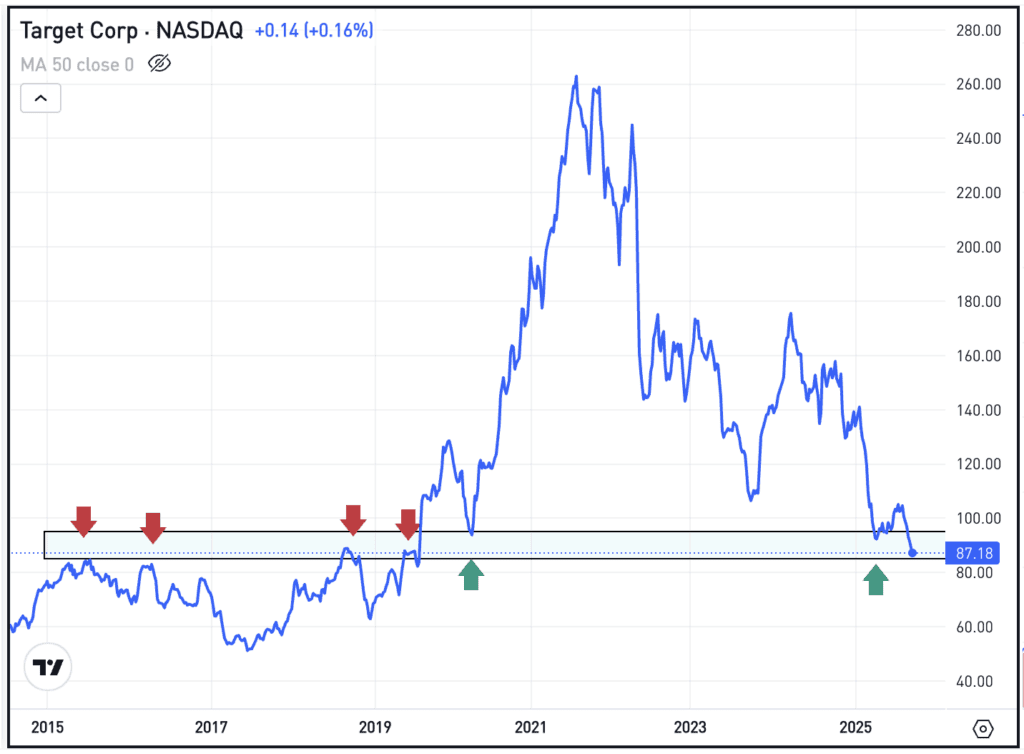

It’s been a really rough stretch for Target, with shares down more than 35% in 2025 and down about 67% from its record high made near $269 in late-2021 — which was near the height of the prior bull market. While the S&P 500 recovered from the bear market, Target hasn’t done so.

Companies like TJX, Walmart, Costco and Amazon have done a stellar job at managing evolving consumer preferences and macro-level changes. Target used to be on that list too.

For context, Target’s record high was almost four years ago (about 200 weeks ago, to be exact). In the same amount of time leading up to that peak, shares were up about 300%. Further, from the start of 2010 to the end of 2020, TGT shares rose 264%. With the dividend included — i.e. “total return” — that figure climbs to 393% (vs. returns of “just” 235% and 317% for the S&P 500, respectively).

Can Target Be Fixed?

When giant retailers struggle to move products — think of Lululemon’s recent woes — it creates an enormous issue for the company. As sales drop, inventory bloats and margins contract. Target has been forced to lower its guidance over time as operational issues lingered.

Last quarter, the company announced Michael Fiddelke as its new CEO, hoping that the change can help spark a turnaround. New CEOs can face tough hurdles, and as a result, management can provide disappointing guidance — known on Wall Street as “sandbagging” — to help lower the bar. We’ll see if that ends up being the case for Target in 2026.

Last quarter, Target reported disappointing results, but reaffirmed its full-year outlook. If the business is truly near a trough, perhaps the stock has a chance to rebound. When we look at the valuation metrics above — the forward price-to-earnings (P/E) and price-to-gross-profit ratios — both metrics are at their trough levels of the past decade.

In other words, if the business has bottomed — which remains to be seen — then the valuation could point to a cheap stock, historically speaking.

Want to receive these insights straight to your inbox?

Sign up here

Diving Deeper — The Dividend & Technicals

Target is profitable, even if profits haven’t grown much over the past few years. And while its valuation may be reflecting that lack of growth, one aspect to the retailer’s story is its dividend.

Target has not only paid but has actually raised its dividend for more than 50 consecutive years. Regardless of bear markets or recessions, this company has been very consistent in this regard, as TGT stock now yields more than 5%.

The Chart

Shares are trading down into an interesting area on the chart, as the $85 to $95 zone had been resistance from 2015 into 2019, and has been support since 2020. Bulls might see this technical part of the equation, the low valuation, and the consistent dividend, and decide a long position is warranted. Keep in mind though, if the $80 to $85 area does not hold as support, nothing says TGT stock can’t keep sliding lower.

The Bottom Line: Retail can be a tough gig. Once a big decline has occurred, many investors are hunting for value. Sometimes they find it, while other times it turns into a value trap. From here, Target could become either one.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link