rewrite this content using a minimum of 1200 words and keep HTML tags

The Daily Breakdown takes a closer look at Salesforce, which has its valuation trading near the lows, while business remains strong.

The TLDR

Salesforce still has growth

The valuation is historically low

Margins and profits are up

Deep Dive

After lagging the broader market and all of its sector peers from Q3 2024 to Q1 2025, tech enjoyed a massive rebound in Q2 as it climbed more than 20% and hit new record highs. One name within the space that didn’t enjoy the run, though? Salesforce.

Shares of CRM climbed just 1.6% in the second quarter. While shares are up slightly over the past 12 months (+3.7%), the stock is down more than 20% so far in 2025. That’s despite boasting solid growth expectations and a valuation that’s near a low point.

Digging Into the Business

Salesforce is a cloud-based software company specializing in customer relationship management (or “CRM” — making for a fitting ticker). Its main products — including Sales Cloud, Service Cloud, Marketing Cloud, and Data Cloud — help businesses manage sales, customer service, marketing, and data analytics. Revenue primarily comes from subscription fees, with additional income from consulting and support services. AgentForce, one of its newer tools, has gained quick traction across industries.

Salesforce may not be at its peak growth phase, but it’s still expected to churn out steady results:

The company is in its fiscal 2026 year and consensus estimates call for roughly 9% to 10% revenue growth this year, in 2027, and in 2028. On the earnings front, (GAAP) estimates call for growth of ~14% this year, ~16% in 2027, and 21% in 2028.

Remember, we don’t like to look too far out on expectations, but that gives a pretty good idea of the expected growth in the coming quarters and years.

Valuation

When we look at the forward price-to-earnings ratio — which divides the stock price (P) by expected earnings (E) — we notice that it tends to trough in the low 20s and, at least over the last few years, peak in the low 30s. Currently at just 22, CRM stock is cheap by this metric based on the past five years.

Want to receive these insights straight to your inbox?

Sign up here

Diving Deeper

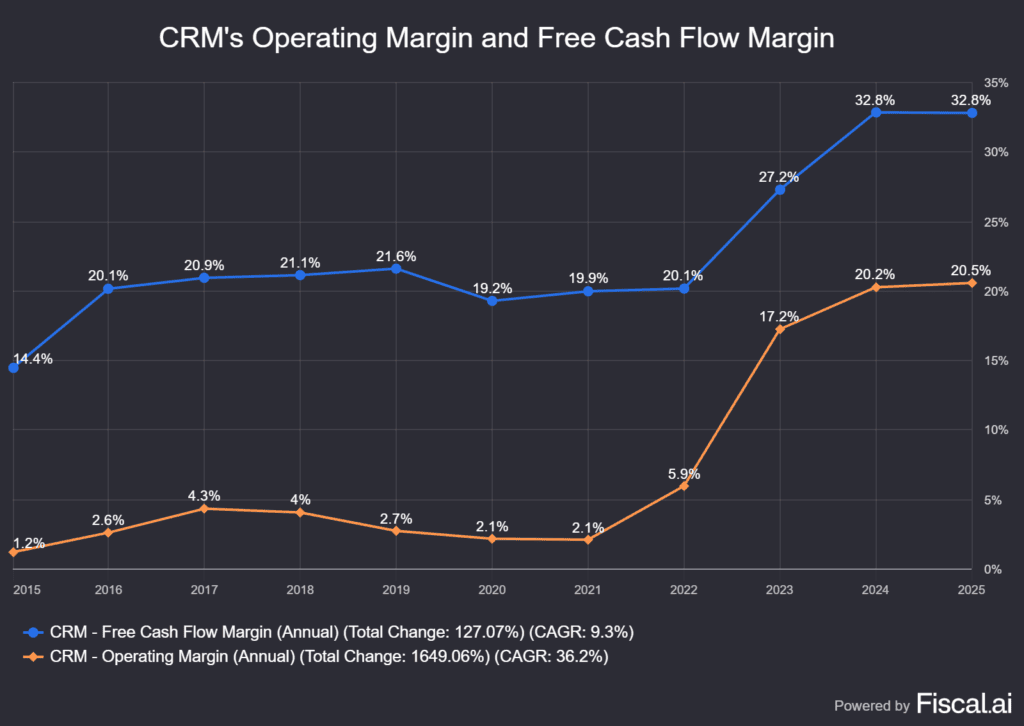

As we dig deeper into Salesforce’s business, notice how the company’s operating margins (in orange) stagnated between the 2% to 4% range for several years. Likewise, the company’s free cash flow margin — which measures how efficiently a company converts its revenue into cash after covering operating expenses and capital expenditures — hovered near 20% in that same span (from 2016 through 2021).

Then both metrics broke higher. As the company’s margins expanded, it allowed profits and free cash flow to rise. It’s one reason that we’ve seen the valuation come down so much as well.

Risks

Maturing companies can be hard to evaluate. In CRM’s case, profits and margins are up, the valuation is down, and while growth is still pretty solid, it’s not what it once was. By nature, that’s generally going to result in a lower valuation — which we’re seeing now.

But will the current valuation measures hold? Meaning, will a forward P/E ratio in the low 20s continue to draw in buyers and support the stock? A lower valuation is one possible risk for CRM. Another is more obvious: too high of growth expectations. If growth is lower than expected, then even if the valuation stays the same, that equates to a lower stock price. Whether that potential growth slowdown would be company-specific or the result of the broader economy doesn’t matter.

The Bottom Line

With its $250 billion market cap, Salesforce has proved to be a force within tech. Despite steady growth expectations and a big improvement to its operating and free cash flow margins, the valuation remains low relative to its historical range.

Does that make it a buy, or will investors opt for other stocks instead?

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link