rewrite this content using a minimum of 1200 words and keep HTML tags

Starbucks has struggled to keep pace with the overall markets. Will new management help? The Daily Breakdown dives in.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Friday’s TLDR

SBUX has an MVP CEO

But the turnaround will take time

And expectations are climbing

Deep Dive

Starbucks has been battered from its highs, down 30% from its 2021 peak. Overall, the S&P 500 has done quite well in that span, rising about 35%. So while shares of Starbucks could be doing a whole lot worse, they have clearly underperformed the overall market. Will that change going forward?

New Management

It was clear that Starbucks was struggling and that its leadership team was flailing, so in September, Starbucks lured away Chipotle CEO Brian Niccol to run the company. Niccol cost a pretty penny to bring in — no pun intended — but shareholders were willing to take the risk.

That’s based on his resume, which includes a successful run at Taco Bell, then jumpstarting Chipotle after a string of food-related illnesses tarnished its brand. Under Niccol’s leadership from March 2018 to August 2024, Chipotle’s revenue doubled, profits increased seven-fold, and the stock climbed more than 800%.

The hope here is that Niccol can help turn around Starbucks. The reality is that it will take more than a quarter or two to fix.

Growth Expectations

When it comes to the fundamentals, there’s good news and bad news.

The bad news is, analysts expect earnings to fall 26% this fiscal year — ouch. The good news is, Starbucks’ fiscal year ends in September. The other good news is that consensus estimates call for 20% earnings growth in each of the next two years, and nearly 20% growth in the third year.

If Niccol & Co. achieve that feat, the stock may very well be undervalued at today’s prices.

Risks

Remember when we did the Fundamental Analysis Boot Camp?

Unfortunately, Starbucks isn’t exactly cheap at current levels. At least, that’s based on its forward price-to-earnings ratio (or the fP/E), which takes the stock price (P) and divides it by expected earnings (E).

Think of it like this: Even if SBUX stock price stays flat, a decline in earnings makes the stock more expensive from a valuation perspective.

This is where investors have to decide if the stock is right for them.

The Bottom Line

The risk/reward proposition is clear.

On the one hand, you have a major potential turnaround in the works under proven leadership. If it works, shares of Starbucks could have notable upside from current levels. However, if the turnaround takes longer than expected or doesn’t materialize to the degree that’s expected, then the stock’s returns may be disappointing.

It would be less risky to wait and see if the turnaround at Starbucks is taking hold. Investors who wait risk having the stock rise in anticipation of this development, then are forced to buy in at higher prices (albeit with more potential stability in the fundamentals). On the flip side, those who buy in early stand to benefit the most if the turnaround succeeds. But they also stand to risk more if the stock comes under pressure.

Want to receive these insights straight to your inbox?

Sign up here

The Setup — Starbucks

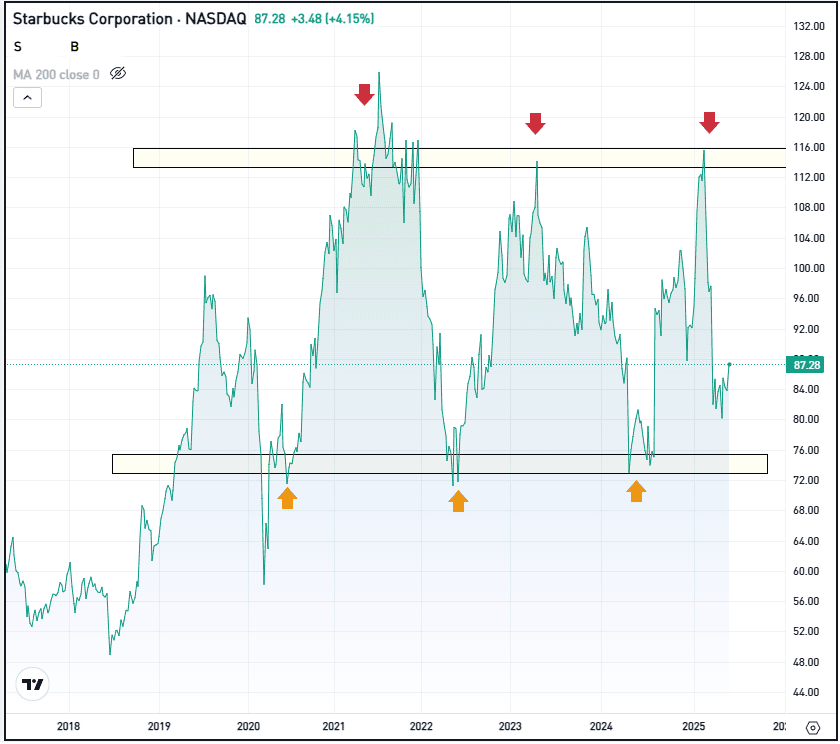

Starbucks shares popped from the mid-$70s in August on news of Niccol’s hire and rallied all the way to $117.46 in March 2025 — less than 10% from all-time highs. However, the pullback has been swift, sending shares back down into the $70s before the latest bounce.

For several years now, shares have been stuck between approximately $75 and $115:

Going forward, investors want to see SBUX find support in the $70s and eventually rebound higher. If support fails to hold, lower prices could be in store, potentially down into the mid-$60s. However, if the rebound gains steam, the $115 range — which SBUX hit a few months ago — could be back in play.

Options

Investors who believe shares will move higher over time may consider participating with calls or call spreads and can use long-dated options to participate. If speculating on a long-term rise, investors might consider using adequate time until expiration.

For investors who would rather speculate on the stock decline or wish to hedge a long position, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link