rewrite this content using a minimum of 1200 words and keep HTML tags

PepsiCo stock rallied on earnings, but the stock has struggled over the last few years. Is it finally time for a comeback?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Friday’s TLDR

PEP rallied on earnings

Growth, valuation remain low

Dividend has been raised for 53 years

Deep Dive

On July 17th, PepsiCo stock climbed 7.5% after the firm reported better-than-expected revenue and earnings results.

Although there have been positive observations about PEP stock — like its valuation and dividend yield — there is no masking its poor performance. Going into earnings, shares were down 11% on the year and almost 18% over the past 12 months. Shares are still down 26.5% from its record high in May 2023.

Further, PepsiCo has underperformed Coca-Cola over the last one, three and five years. So bulls want to know: Can PepsiCo sustain this momentum and turn things around?

Unpacking the Business

PepsiCo is a global food and beverage leader. Last year, the company generated $27.4 billion in North American food sales and $27.7 billion in North American beverage sales.

The company’s known for its more obvious beverages — like Pepsi and Mountain Dew — but its umbrella also covers Gatorade, Aquafina, Naked Juice, Bubly, and Tropicana, among others.

On the food side, some obvious soda pairings include Ruffles, Lays, Doritos, and Rold Gold, but other brands include Sabra, Siete, Tostitos, SunChips, Quaker, and Smartfood.

Carbonated Comeback?

Unfortunately, PepsiCo’s business has run into a few roadblocks. It’s adapting to shifting consumer preferences — such as demand for natural ingredients and the rise of GLP-1 medications — while addressing challenges in its North America food segment through pricing adjustments, portfolio changes, and operational improvements. It’s also battling through its own macro- and tariff-related headwinds.

Analysts expect a slight earnings decline this year, with adjusted earnings forecast to fall 1.8%. Estimates for next year (fiscal 2026) and the following year call for a return to mid-single-digit growth of around 6%. Revenue is forecast to climb in the low-single-digit range in fiscal 2025, 2026, and 2027.

It’s clear that growth isn’t blistering, but is that priced into the valuation? Looking at PepsiCo’s forward P/E ratio since 2012, it tends to trough around 17x and peak near 27x.

While growth may be subdued, some investors may find PepsiCo’s valuation attractive enough to justify a long position — even after the recent rally. They may gain confidence in that decision if, in future quarters, PepsiCo proves to have hit a trough in its growth outlook.

For what it’s worth, analysts currently have an average price target of roughly $155 per share.

Want to receive these insights straight to your inbox?

Sign up here

Diving Deeper — The Dividend

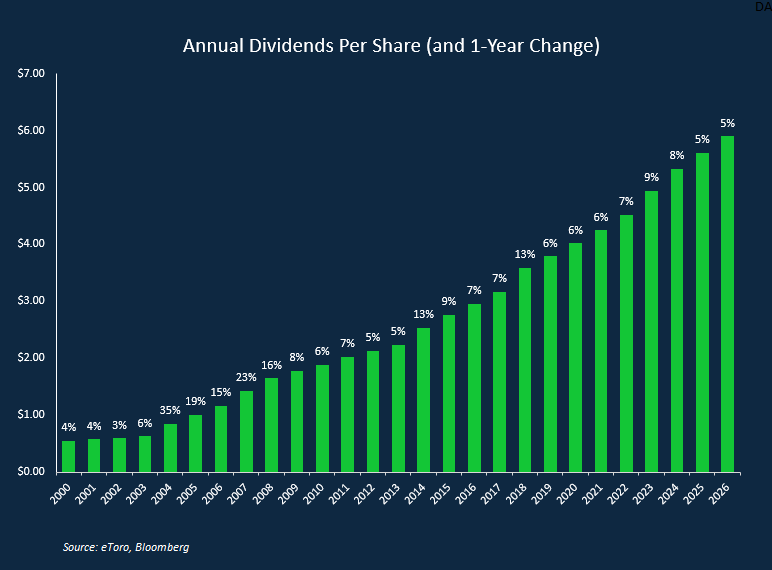

Even after the recent rally, PEP stock still pays a dividend yield of roughly 4%.

No dividend is ever guaranteed, but a handful of companies have solidified themselves as dependable dividend payers — known as Dividend Kings, Champions and Aristocrats — and PepsiCo is one of them, having raised its dividend for 53 consecutive years.

Risks of Going Flat

The top-down risks include the global economy and tariff-related hurdles. And while currency fluctuations are currently a tailwind, they could become a headwind in the future.

Getting more granular, there’s a risk that PepsiCo could face customer-specific struggles — consumers that don’t want or can’t afford to keep buying pricier and pricier snacks. PepsiCo has been diversifying into healthier alternatives, but execution and consumer preferences could be a risk moving forward.

The Bottom Line: Growth stalled, but investors hope they’ve seen the worst of it. While execution risks are still possible, a near-4% dividend yield and a relatively low valuation may be enough to get investors to consider PEP stock.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link