rewrite this content using a minimum of 1200 words and keep HTML tags

Meet the “toll booth” of digital transactions: Visa. The Daily Breakdown dives into this company’s business to see what’s going on under the hood.

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Deep Dive

Yesterday we looked at the charts for Visa and today we’re taking a deeper dive into the fundamentals. Visa shares have struggled since the stock hit a record high in June, down about 7.5%. Despite that, Visa is up about 26% over the past year and sports an impressive long-term track record, up 368% over the last decade. For context, the S&P 500 is up “just” 233% in that span.

The Business

Investors know Visa as a credit and debit card company — that much is obvious. But it’s often referred to as the “toll booth” of digital transactions. MasterCard enjoys a similar distinction. And while there are other credit card companies — like American Express, Capital One, and Synchrony Financial — they also function as banks. While there are pros and cons to each business model, Visa and MasterCard command much higher profit margins with their business.

Growth

Visa has grown its revenue and earnings at a compound annual growth rate (CAGR) of 11.1% and 15.7%, respectively. Looking forward, analysts expect impressive results as well, including:

Revenue growth estimates*: 11.4% in 2025, 10.6% in 2026, and 10% in 2027.

Earnings growth estimates*: 15.3% in 2025, 12.3% in 2026, and 12.7% in 2027.

*Estimates according to Fiscal.ai

Want to receive these insights straight to your inbox?

Sign up here

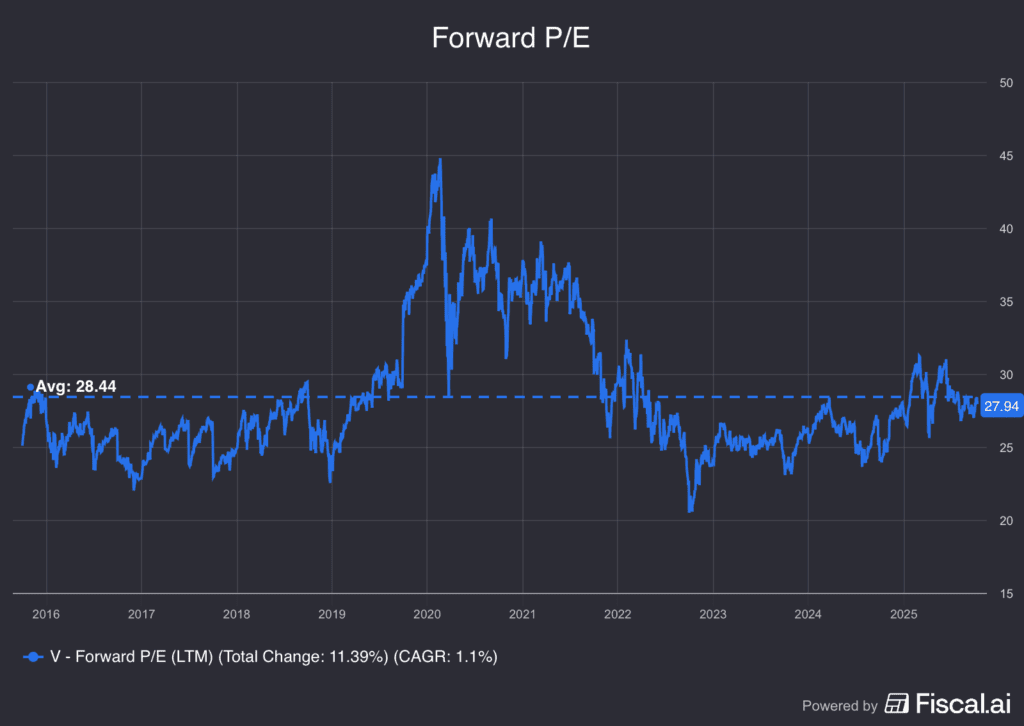

Diving Deeper: Valuation

Trading at roughly 28x forward earnings expectations, Visa stock is about in-line with its long-term average. The stock has been considered relatively cheap when shares trade at about 23x to 24x forward earnings and expensive in the low- to mid-30x. Historically, many investors have justified Visa’s premium valuation due to its elevated growth rates and high margins.

Risks & Bottom Line

The main risks to Visa are pretty obvious: Market volatility and economic activity.

If market volatility picks up, Visa isn’t immune. For instance, the stock suffered a peak-to-trough decline of ~18.5% earlier this year amid the tariff tantrum. While this was actually better than the S&P 500’s swing of 21.3%, it’s still a big swing.

The other risk would be an economic slowdown or a recession. Because Visa is a global company, a global or US slowdown would be a negative for many businesses — credit card companies included — especially when it comes to consumption.

The Bottom Line: Investors who believe Visa will continue to generate strong top- and bottom-line growth may justify the stock’s valuation, which is at a slight premium to the S&P 500 but roughly in-line with its long-term average. Those who view the stock as unattractive at current levels may wait for Visa’s valuation to potentially dip to a more attractive level or they may not like Visa’s business and decide to disregard it altogether.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link