rewrite this content using a minimum of 1000 words and keep HTML tags

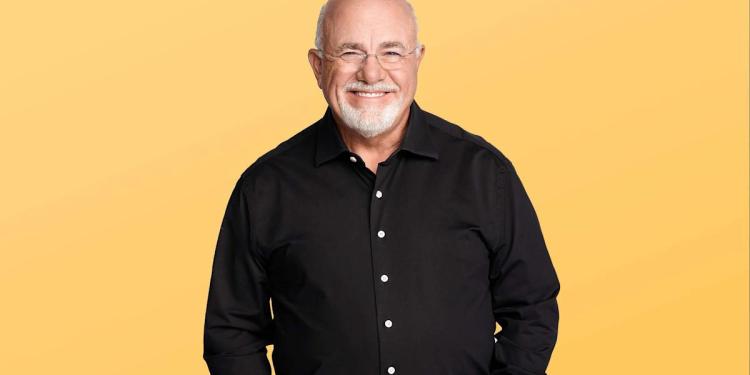

If Dave Ramsey is known for anything, it’s his strong views on how to handle — and, of course, not handle — your money. The nationally recognized money expert and radio host has built a massive platform by offering blunt, no-nonsense advice on where people go wrong with their finances and how they can fix it.

Read More: Most Experts Say Buy Index Funds. Charles Payne Says Do This Instead

Learn About: 3 Advanced Investing Moves Experts Use to Minimize Taxes and Help Boost Returns

In his decades on the air, he’s heard countless mistakes from the people who call in to his show. While some callers have tales of woe that feel like gawking at a smoking wreck of debt, making you grateful that you’ll never blow that much money in one go, Ramsey is also privy to some of the most common mistakes that people make when trying to build wealth. Despite your best intentions, there’s a good chance you’ve made one too.

The good news is that it’s not too late to fix those mistakes. But knowing what they are is the first step.

To hear Ramsey tell it, nothing instills accountability like sitting down every month and writing out your budget. Sure, you can try to remember it, but given that your budget is just one among other spinning plates in your mind, along with your grocery list and your kid’s ballet schedule, the odds aren’t exactly high that you will.

The problem, according to Ramsey, is that without a clearly defined budget you can turn to every month, you run the risk of simply not knowing where your money is going. While you might think that careful budgeting is only for people who are struggling to make ends meet, Ramsey has some stern words for you — or, rather, he did for a letter writer whose parents insisted that as high earners, they didn’t need to worry about budgeting.

“If you think doing a budget is only for people who have trouble making ends meet, think again. My wife and I have lived by a written, monthly budget every single month for about 30 years,” Ramsey wrote. “It doesn’t matter whether you’re a multimillionaire, or if you have just $100 to your name. Knowing exactly how much money you have — and where it’s going — is an essential part of managing your finances accurately and successfully.”

For You: 5 Ways ‘Loud Budgeting’ Can Make You Richer, According to Vivian Tu

If there’s one thing Ramsey hates, it’s debt. Credit card debt. Car loans. Student loans. Personal loans. He hates all of it. If Ramsey were in the Dune universe, instead of “fear is the mind-killer,” Paul Atreides might be saying, “debt is the wealth-killer.”

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link