rewrite this content using a minimum of 1200 words and keep HTML tags

Analyst Weekly, November 24, 2025

Bitcoin: The Market’s Early Signal

Bitcoin’s taking a real breather, down about 33% (as of Nov. 22 close) from its October peak to around $80K after a $2.2B wave of liquidations. It’s not the first time crypto’s been stress-tested: the October 10 selloff wiped out $19B in leverage, draining liquidity from the system.

Flows in Flux

Spot Bitcoin ETFs have seen a pause in inflows, while some Digital Asset Treasuries (DATs) are rebalancing and stablecoin supply is tightening; all signs of a market cooling off after months of heavy activity. We remain cautious in the short term, but we are confident in the long-term fundamentals.

What factors are influencing the corrections?

Bitcoin’s dominance rises as altcoins suffer deeper losses, but pressures from tight liquidity, institutional selling, and weak demand, remain.

Macro and liquidity: the delay in rate cuts by the Fed and the temporary liquidity drain have weighed on risk assets. The short-term correlation between global liquidity and the price of bitcoin is well documented.

Technical: breakdown of key support levels and the moving average crossover (known as the death cross), which reinforces selling pressure.

Institutional flows rotating: part of the capital has moved towards fixed income or defensive equities, while the crypto ecosystem consolidates.

Short-term pressure may give way to a more constructive environment in the coming weeks if global liquidity improves.

4Q25: Temporary scarcity (tariff shock, shutdown, delayed stimulus).2026: We expect liquidity rebound as Fed easing and fiscal flows kick in.

Big Picture

Zoom out, and the story hasn’t changed: adoption, tokenization, and institutional integration continue to advance. But right now, it’s all about global liquidity tightening, and Bitcoin’s doing what it always does best: warning us first. We believe the major drawdown in the past few weeks also invite long-term holders to review their cost basis and potentially re-evaluate their accumulation strategies when thinking long term.

Volatility Whiplash: Rate Cuts Steal the Show

Last week’s wildest chart wasn’t stocks: it was rate cut odds. On Thursday, traders saw just a 35% chance of a December Fed rate cut. By Friday, that shot back above 60%, another wild swing in a market that’s been flip-flopping for weeks on when the Fed will finally ease up.

Market volatility last week stemmed more from rate expectations than equity price action.

Fear Lingers Beneath the Surface

Even though the VIX (the “fear index”) looks relatively stable, traders are paying up for downside protection. The cost of puts versus calls (known as skew) is sitting near the highest levels in two years.

That means investors are still nervous about another drop, even if things look steady on the surface.

US Jobs Report: Decent on Paper, Weak Under the Hood

September’s delayed jobs report looked fine at first glance, +119,000 jobs added, but the details told a softer story. The trend keeps repeating: jobs reports look fine at first, but later get revised weaker once the full data rolls in.

August got revised down to -4,000 jobs, making it the second negative month of 2025.

Prior months were revised lower by 33,000 jobs.

The unemployment rate rose +0.1% to 4.4%, with the labor force participation rate also up to 62.4%.

The freshest jobs data isn’t looking great: ADP’s weekly payrolls slipped by 2,500 in early November.

The Fed’s split but the voters lean dovish.

Most members want to stay put for now since data’s been messy, but the key voters,like Governor Waller and NY Fed’s John Williams, are open to a December rate cut.

Our takeaway for the week: Expect heightened sensitivity to incoming economic data and central bank rhetoric. Market volatility is likely to remain elevated as investors attempt to price in the timing of the Fed’s next move.

Nikkei Pulls Back, but Uptrend Remains Intact

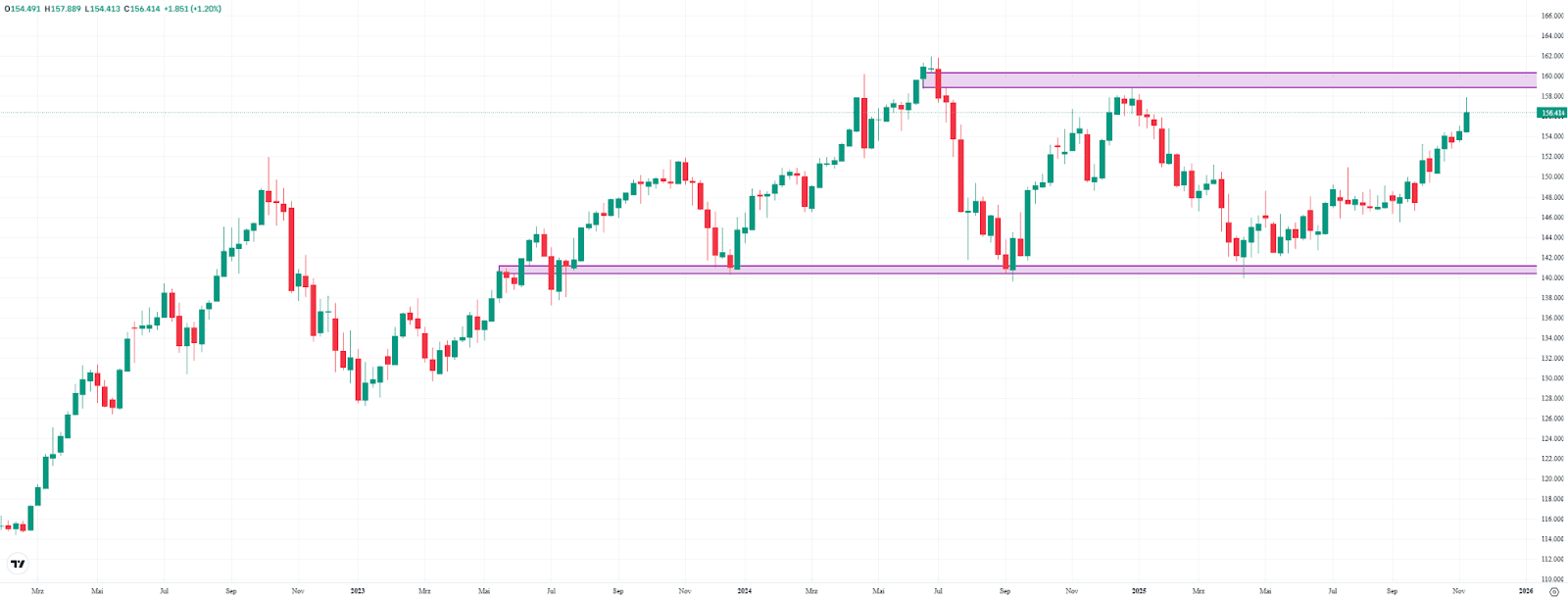

The Japanese stock index Nikkei (JPN225) ended last week down 3.4% at 48,710 points. This widened the gap to its record high to over 7%. Nevertheless, the overall uptrend remains intact, as seen in the higher highs and higher lows over recent years (see chart).

Interestingly, the index managed to hold the lower boundary of its support zone (Fair Value Gap) between 48,490 and 49,930 points last week. From a technical perspective, this suggests a good chance of a rebound and possibly a new all-time high.

However, if this zone were to break, the next key support area would be between 43,220 and 44,480 points. Since the market remains in an extended upward phase, the Nikkei could withstand deeper pullbacks without putting the long-term uptrend at risk.

Nikkei, weekly chart. Source: eToro

USD/JPY: Yen Continues to Lose Ground

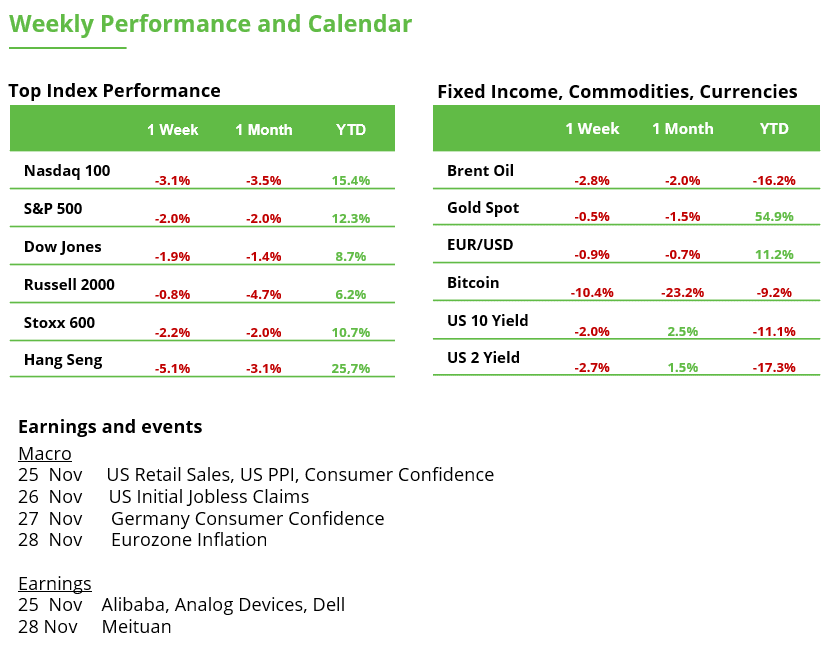

The USD/JPY rose 1.2% last week to 156.41. Since the April low, the yen has lost around 12% against the dollar. Back then, support around 140 was once again defended – a level that has repeatedly prevented a deeper sell-off in recent years.

At present, much points to a test of the resistance zone (Fair Value Gap) between 158.85 and 160.33. It wouldn’t be the first attempt. Buyers were rejected at this level back in January. However, the more often a resistance is tested, the higher the chance of a breakout.

A break above last year’s high would push the pair to its highest level since 1986 and unleash further upside potential. For now, it remains to be seen whether buyers will be stronger this time or face another rejection, as they did in January.

USDJPY, weekly chart. Source: eToro

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link