Published: July 24, 2024 at 10:19 am Updated: July 24, 2024 at 10:19 am

Edited and fact-checked:

July 24, 2024 at 10:19 am

In Brief

The crypto market experienced significant instability due to the US presidential election, leading to a sharp increase in liquidations of $174 million in a single day.

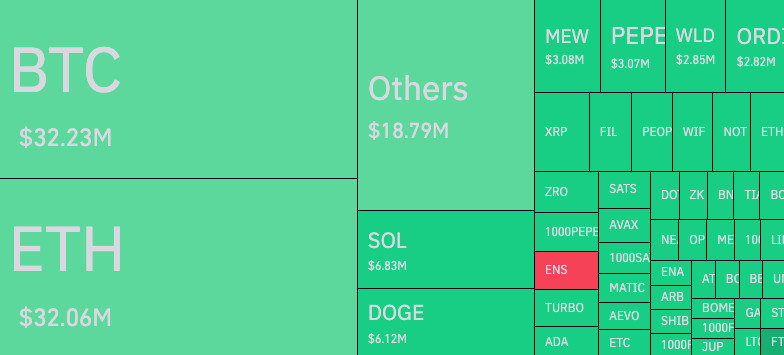

Massive instability was experienced by the crypto market as the US presidential election drama took an unexpected turn. A sharp increase in liquidations, amounting to about $174 million in a single day, demonstrated the market’s susceptibility to political developments and the interdependence of digital assets and global finance.

Photo: CoinGlass

Reaction of the Market to Biden’s Withdrawal

President Joe Biden’s unexpected declaration that he was withdrawing from the 2024 presidential contest served as a trigger for current market turbulence. The crypto ecosystem was rocked by this news, which caused a quick and significant market response. Data from CoinGlass shows that approximately $67 million in leveraged long bets were liquidated in the short 30-minute period that followed the news.

The biggest cryptocurrency by market capitalization, Bitcoin, was most severely affected in the short term. The price of Bitcoin dropped sharply by 2.3%, from $67,713 to $65,880. Many traders were taken aback by this abrupt decline, especially those with leveraged holdings.

Photo: CoinGecko

But the market swiftly recovered, displaying its usual volatility and resiliency. Not long after the first decline, the price of Bitcoin shot up to a 24-hour high of $68,480. The market saw more volatility as a result of this quick rebound, with almost $34 million in leveraged short bets being liquidated as the price spiked higher.

Broader Crypto Market Impact

This political bombshell has an impact on more than just Bitcoin. On July 21, the cryptocurrency market saw $134.5 million in total liquidations over the course of a 12-hour period. This sum included $81.1 million in long cryptocurrency holdings and $53.4 million in short crypto positions.

$31.1 million worth of Ethereum (ETH), the second-largest cryptocurrency, was liquidated. Another well-known participant in the cryptocurrency market, Solana (SOL), has $8.6 million in liquidations. These numbers highlight how far the news has affected the whole crypto ecosystem.

Photo: CoinGlass

Photo: CoinGlass

The majority of these liquidations affected large cryptocurrency exchanges, with Binance and OKX processing $64.5 million and $44 million, respectively. The concentration of activity on the top exchanges emphasizes how important it is for them to facilitate market movements and absorb shocks when volatility is high.

Photo: CoinGlass

Political Implications and Crypto Market Sentiment

The intricate relationship between politics and cryptocurrency prices is shown in the market’s response to Biden’s exit. Certain political results are seen by many market players as more advantageous for the cryptocurrency business, which has an impact on trading choices and market mood.

The creator of the cryptocurrency research company 10x Research, Markus Thielen, provided analysis on the behavior of the market. He speculated that because Biden had positioned himself as a pro-crypto candidate, there was a risk that his absence originally increased Donald Trump’s chances of winning. Trump’s recent declarations that he wants all Bitcoin mining to take place in the US are seen to have some positive effects for the sector.

Vice President Kamala Harris is now known to be the Democratic candidate for the next presidential election, but the political environment is still unstable. Investors and experts will be watching this developing scenario intently to see how the market reacts.

Key Events and Predictions for the Crypto Market

The cryptocurrency market is preparing for a number of major events that might further affect prices and trade activity once the first shock wears off. Great things are expected to happen in relation to the July 27th Bitcoin 2024 Conference in Nashville. Donald Trump, the former president, is scheduled to speak at the conference, and his words may have an impact on the direction of Bitcoin’s price.

Elon Musk’s 2021 statement at a Bitcoin event, which first caused a market indicators decrease but was followed by a significant rise, is being compared by some experts. There are rumors that Trump’s speech may have a comparable impact and push Bitcoin to all-time highs.

The launch of the Ethereum ETF, which is scheduled to start trading on July 23, is another important development for market players. Experts in the field, such as Bitwise Chief Investment Officer Matt Hougan, are upbeat about the ETF’s possible influence on Ethereum’s price; some estimates indicate that it may raise ETH above $5,000 by the end of 2024.

Photo: CoinGecko

It appears like Bitcoin may be ready for major growth based on the recent change in the Fear and Greed Index from high fear to greed. The latest price forecasts from prominent experts, together with the shift in market attitude, have instilled cautious confidence among investors.

It’s important to remember, though, that the cryptocurrency market is still quite erratic and subject to sudden swings depending on a variety of variables. The latest liquidations are a clear reminder of the dangers involved in trading cryptocurrency with a high degree of leverage.

The market’s susceptibility to international political events is shown by the spike in cryptocurrency liquidations that coincided with the US election drama. These connections between political happenings and market movements are probably going to get stronger as the crypto ecosystem develops and integrates with established financial markets.

Crypto traders and investors need to be on the lookout for advances in the industry’s technology as well as wider geopolitical events that may have an influence on market dynamics. There is a good chance that the cryptocurrency market will undergo major structural changes and price volatility in the upcoming weeks and months.

As usual, it’s critical for players in the cryptocurrency space to use prudence while trading and investing, doing extensive research and evaluating their risks. The recent volatility in the market is a strong reminder of how crucial risk management techniques are while negotiating the unpredictable world of cryptocurrency trading.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.

Viktoriia is a writer on a variety of technology topics including Web3.0, AI and cryptocurrencies. Her extensive experience allows her to write insightful articles for the wider audience.