rewrite this content using a minimum of 1200 words and keep HTML tags

Analyst Weekly, October 19, 2025

Private Credit Flashpoint: What Just Happened?

Two high-profile borrower failures, Tricolor (subprime auto lender) and First Brands (leveraged auto-parts firm), shook confidence in the private credit complex and led to equity market volatility (distinct from recent regional-bank fraud headlines). Both used layered and opaque financing structures, including off-balance-sheet receivables funding and duplicated collateral. The fallout hit several regional and large banks, prompting >$300M in charge-offs and renewed scrutiny on “hidden” exposures. JPMorgan’s Jamie Dimon called it a “cockroach” moment, hinting at more surprises lurking in shadow lending.

Our View: Risk, Yes, But Not Systemic (Yet)

We see the October credit events as idiosyncratic blowups, not systemic fractures. Both companies operated in narrow, high-risk corners of the market: deep subprime, over-leveraged roll-ups. Losses were real, but concentrated.

Critically, most regional banks showed limited or fully reserved exposure, with no signs of widespread credit deterioration. This was a wake-up call on layered lending risk but not a repeat of SVB or 2008, in our view. That said, opaque funding structures, rising use of PIK interest, and fund interlinkages need closer monitoring into 2026. The good news is, we are in a decreasing rate environment, and not in a tightening cycle.

Q3 2025: Regional Banks Show Their Muscle

Despite headline fears, regional banks delivered a strong Q3. Themes:

Top-Line Strength: Mid- to high-single digit revenue growth at most firms, led by fee income rebound and stable NII. PNC, USB, Truist all saw record or near-record revenue.

NII and Margin Health: Net interest income held up well; several banks posted margin expansion (USB NIM +9bps). Loan demand stayed solid, and deposit costs began to plateau.

Capital Markets Rebound: Advisory and trading roared back. Investment banking fees rose >35% YoY in some cases. Wealth management and capital markets revenue surged across Citizens, Truist, USB.

Credit: Resilient with Pockets of Stress: NPLs were flat or falling; charge-offs modest. First Brands exposures were addressed via reserves. Banks like M&T, Citizens emphasized tight underwriting and high ACL coverage (>200% ACL/NPL ratios common).

Consumer Pulse: Stable and Spending: Card delinquencies improved QoQ at USB. Deposit flows were firm; spending levels healthy.

Private Credit: Contained, With Warnings: Most regionals had minimal or well-managed private credit exposure. Citizens (with ~$3.3B in private lending) emphasized diversified structures. M&T avoids NAV-based lending. Truist had no Tricolor exposure.

Q3 2025: Big Banks Are Back in a Big Way

US large-cap banks just posted their strongest collective quarter since 2021. The catalyst? A resurgent deal-making environment, buoyed by resilient consumer activity and sharp cost discipline. Investment banking staged a broad-based comeback, equity markets rallied, and earnings growth shifted from rate-driven to fee-led. With the Fed easing into a still-firm economy, banks are entering 2026 in measured growth mode, leaning on scale, capital, and client engagement.

Earnings Snapshot: Top-Line Acceleration

Revenue Growth: Most major banks (JPM, MS, GS, BAC) posted high-single to low-double digit YoY revenue gains. Fee income recovery and solid NII drove the upside.

Expense Control: Operating leverage was a theme: tight cost management allowed revenue gains to flow through.

Standouts: Morgan Stanley and JPMorgan cited strong client activity and broader market participation, rather than just volatility spikes.

NII: Still a Pillar, But Less Dominant

Net interest income held firm, supported by healthy loan growth and improved deposit mix.

Banks are guiding for continued NII strength into 2026, but with greater reliance on fee income as rate tailwinds flatten.

Loan demand is rising again, and consumer deposit behavior has stabilized — key inputs for forward NII growth.

Fee Engines Firing: M&A, Trading, Advisory

IB Revival: Deal flow rebounded across sectors, with most banks seeing double-digit gains in investment banking fees.

Equity Trading Surge: Q3 equity-trading revenue hit a 5-year high across the top six banks ($15.4B vs. $12.4B in Q2).

Volatility eased, but client engagement stayed high, a sign of positive conviction rather than fear-based positioning.

Broad Capital Markets Momentum: FICC and equities both delivered high single-digit growth at JPM, GS, MS, and BoA, as clients repositioned portfolios around rate paths and geopolitics.

Credit Quality: Strong, Orderly, and Predictable

Credit normalization continues in an orderly fashion.

Citi and PNC highlighted stable delinquencies and strong household balance sheets.

No major cracks in commercial real estate (CRE) or non-bank lending (NBFI) have emerged.

Provisioning remains disciplined, no signs of panic or credit dislocation.

Strategic Themes: Efficiency, Tech, and Policy Tailwinds

AI & Automation: Every major CEO referenced AI productivity gains, across underwriting, compliance, and service delivery.

Economic View: Macro is “resilient but late-cycle.” Consumers are still spending; corporates are cautiously re-leveraging.

Key Risks: Inflation and fiscal policy remain top concerns (highlighted by BoA, GS).

Regulation: Playing Field May Be Leveling

CEOs (Dimon, Scharf, Solomon) cheered the Fed’s more balanced tone on regulation.

Basel III Endgame may be softened; G-SIB surcharge recalibration expected.

Implication: Well-capitalized large banks could have more room to deploy capital, scale IB/trading capacity, and return capital to shareholders.

“Leveling the playing field” was a recurring phrase, signaling optimism about competitive positioning into 2026.

High Valuation, High Risk: Are Tesla and Netflix Reaching Their Limit?

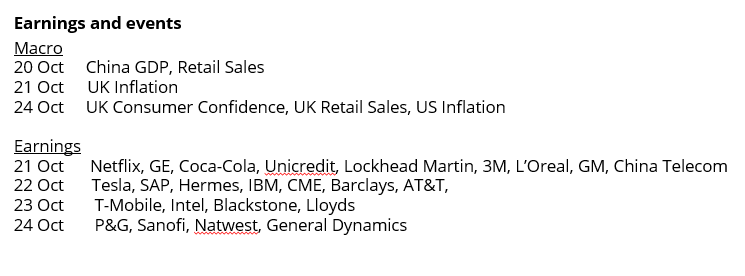

The US earnings season is now entering its hot phase, with the first major tech companies reporting results. Netflix on Tuesday and Tesla on Wednesday. Both are considered investor favorites. Their business models couldn’t be more different, but they share one thing in common: a high valuation.

That creates pressure to deliver and makes both stocks vulnerable to price corrections. Furthermore, Tesla is currently valued about five times higher than Netflix (forward P/E: 208.6 vs. 41.7), which makes things particularly interesting. Investors will be watching closely.

Expectations For Q3 Results

The results are expected to show that Netflix remains on track for success, continuing to grow strongly with solid fundamentals:

Netflix expects revenue to rise 17.3% year over year to $11.52 billion.

Analysts forecast an earnings jump of 27.6% to $6.89 per share.

Tesla, on the other hand, is struggling with declining profitability:

Analysts expect earnings to drop 27.8% to $0.52 per share.

Revenue likely rose only 4.3% to $26.67 billion.

Technical Picture

The Netflix stock remains up 34% year to date, despite the correction in June. About two and a half times stronger than the S&P 500. Since August, trading has been calmer, with the stock moving sideways. It currently holds above a medium-term support zone between $1,164 and $1,172, giving it a small buffer. Last week, the stock closed 1.5% lower at $1,199.

Netflix, Weekly Chart. Source: eToro

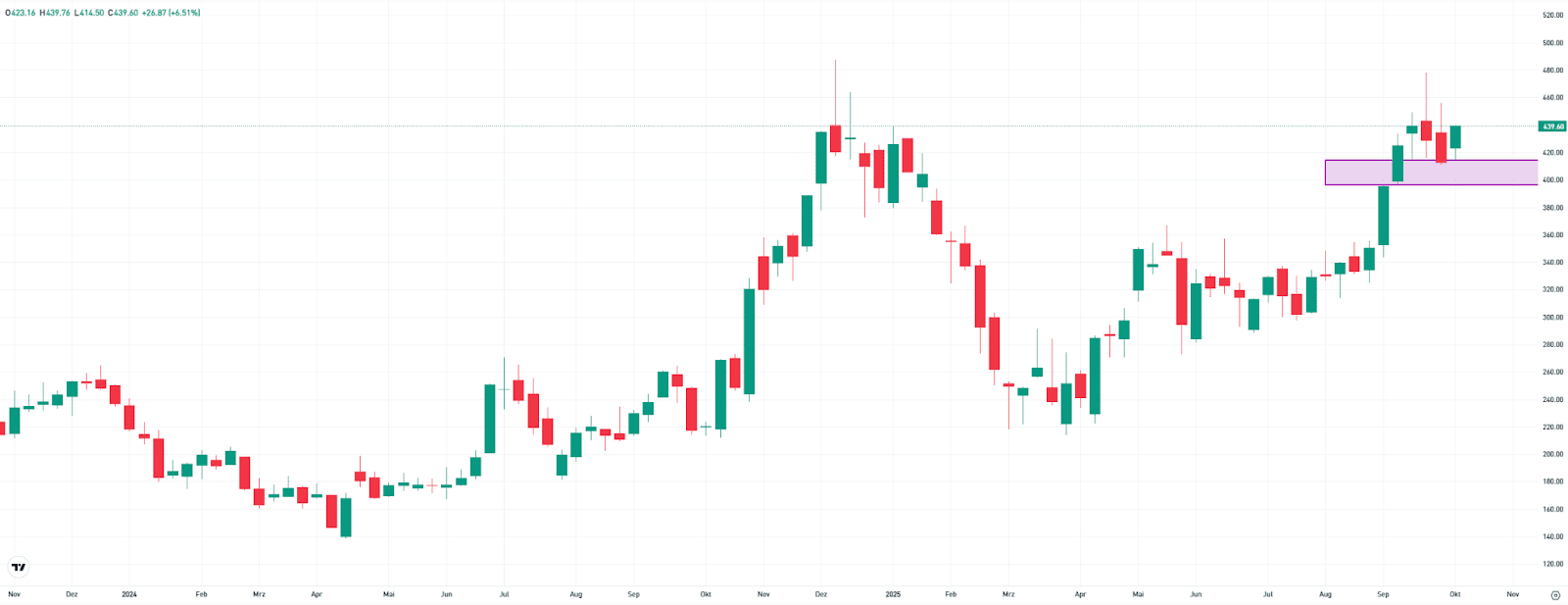

Tesla also has short-term support, providing technical tailwind in the $396–414 range. Last week, the stock closed 6.4% higher at $439. Tesla has spent most of the year recovering losses from the first quarter. At one point, the share price had nearly halved, but it is now up almost 9% year to date. The gap to the December record high remains in the double digits.

Tesla, Weekly Chart. Source: eToro

Volatility Is Almost Guaranteed

We’ll likely see some caution in the market ahead of the upcoming quarterly results. So far, there have been no major sell-offs, and investors appear to remain confident. Both Netflix and Tesla are holding above key support levels, indicating technical strength. For now, things are quiet. But that could change quickly if the results or guidance fall short of expectations.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link