rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

In focus: Tariff War; Q4 earnings season in full swing

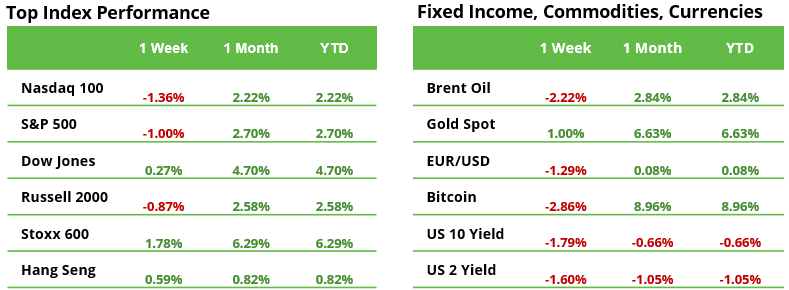

Never a dull moment in markets. Last week, markets have managed to recover from DeepSeek-related sell-offs but came under pressure later in the week due to President Trump’s tariff proposals. The Nasdaq 100 finished the week at -1.4%, the S&P 500 -1.0%, while European markets surged by +1.8%. Meanwhile, Bitcoin was down -2.9%, Brent oil -2.2%, and gold gained +1.0%.

This week, investors will closely monitor developments in Trump’s tariff strategy and the anticipated retaliatory measures from key trading partners as tariffs on Canada, Mexico, and China are expected to take effect on February 4th. Market participants will assess the broader economic fallout and inflationary risks tied to these measures. Also on the radar are critical events including Eurozone inflation data release, the Bank of England’s rate decision, the U.S. January jobs report, and a busy earnings week featuring major companies like Amazon, Google, and PayPal.

Enthusiasm in European Equities Reached Highest in Two Years

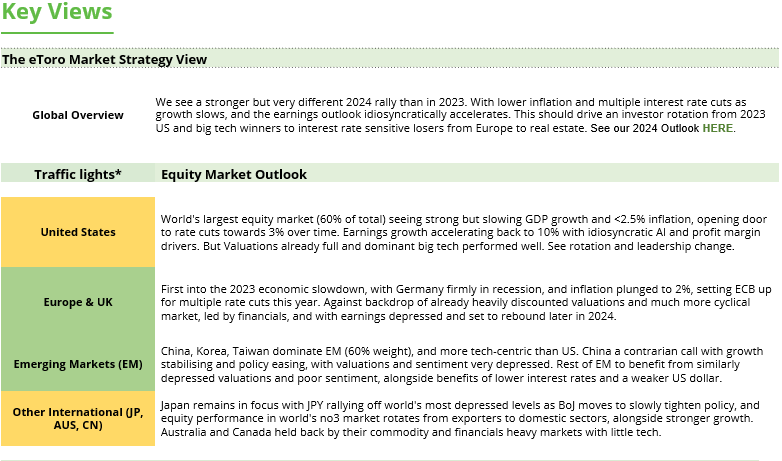

Investor sentiment for European equities has turned positive in January, showing the strongest momentum relative to the US equities in two years. Enthusiasm is apparent in investor surveys: Bank of America’s latest global fund manager report shows a sharp pivot toward Europe, with the largest monthly increase in exposure since 2015 and the second-largest ever. Notably, the survey predates Trump’s inauguration.

So, why the renewed enthusiasm despite ongoing economic stagnation and political uncertainty across major European economies? One key factor is valuation: the 12-month forward P/E of European stocks stands at 13.5x, significantly lower than World (18.0x), U.S. (22.0x), and Japan (13.6x). This valuation gap remains even after excluding the most expensive “Mag 7” stocks from U.S. indices. If Europe experiences positive developments—such as peace in Ukraine or restored political stability, particularly in Germany and France, and manages to avoid tariffs from the Trump administration—this undervaluation could translate into a rewarding investment opportunity.

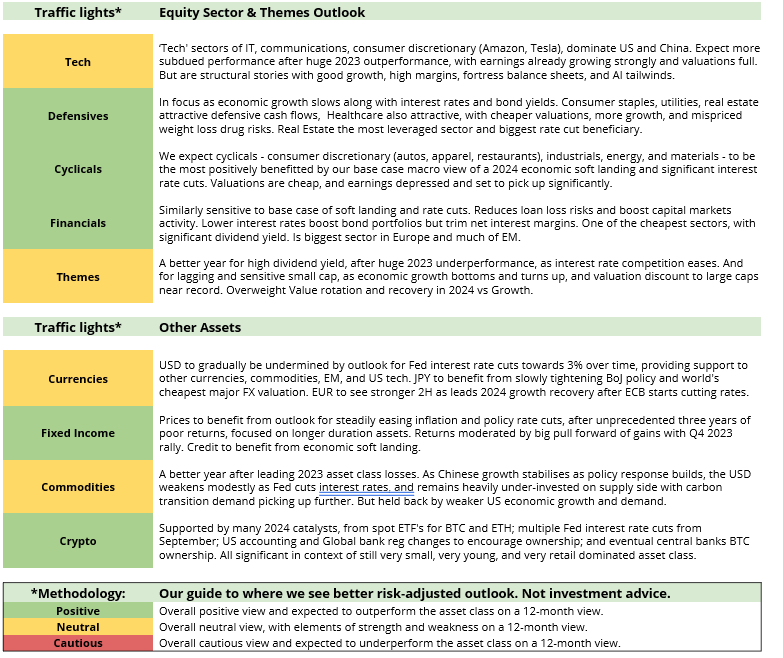

Focus of Week: Strategic Investments in Commodities

Recent market dynamics have highlighted the distinct role commodities play in investment portfolios. Their behaviour differs from traditional assets like equities or bonds due to their reliance on real-time macroeconomic forces—primarily supply and demand—rather than projections of future cash flows. This gives them a unique role in portfolios, particularly during heightened policy uncertainty.

Inflation Protection: Commodities have historically maintained a strong correlation with inflation, making them a powerful hedge against unexpected price surges. Over the past 30 years, they have shown an inflation beta of 6 to 10, meaning that even a small allocation to commodities can provide outsized inflation protection for a broader investment portfolio.

Diversification and Risk Reduction: Commodities may offer diversification due to their low correlation with traditional asset classes like equities and bonds. This may help reduce overall portfolio risk and enhances stability. In equity-heavy portfolios, commodities may play a crucial role by counterbalancing equities’ negative skew—where equities face sharp losses during downturns—through positive skew. Commodities often experience large, event-driven price gains, particularly during supply disruptions, natural disasters, or geopolitical shocks. These gains can help offset losses in other areas of the portfolio, providing protection during crises.

Event-Driven Gains: Commodities, especially within the energy and agricultural sectors, benefit from positive event risks. For example, unexpected supply shocks—such as oil supply disruptions or policy changes—can cause sharp price spikes, boosting returns during periods when other assets may be underperforming.

Overall, commodities act as a multi-faceted asset class, providing inflation protection, diversification, and resilience during market shocks, making them a vital component of a well-rounded investment strategy.

Earnings and events

Macro

3 Feb. Eurozone Inflation, US ISM Manufacturing PMI

6 Feb. BoE Rate Decision, US Jobless Claims

7 Feb. US Unemployment, Michigan Consumer Expectations

Earnings

3 Feb. Palantir

4 Feb. PayPal, Advanced Micro Devices, PepsiCo, Google, Pfizer

5 Feb. Walt Disney

6 Feb. Amazon

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link