In a bold move to counteract economic deceleration, China has unveiled a comprehensive economic stimulus package, signaling the government’s proactive approach to tackling the slowdown and rejuvenating the property market’s downturn. Orchestrated by the People’s Bank of China (PBOC), this multifaceted initiative marks the country’s most significant financial intervention since the pandemic-induced economic measures. Despite the noteworthy effort, there’s a shadow of doubt among financial experts regarding the potential effectiveness of the PBOC’s liquidity injections, with several raising concerns over the tepid demand for credit amongst businesses and consumers alike. Interestingly, lacking in the announcement were direct measures aimed at propelling real economic activities. However, this skepticism didn’t deter David Tepper, the billionaire behind Appaloosa Management, from expressing his unyielding optimism on CNBC. When quizzed about his investment preferences in China, Tepper’s response was nothing short of bullish: “Everything! ETFs, I would do futures – everything.”

This strategic development tails closely behind the Federal Reserve’s significant rate cut last week, easing the pressure on the yuan, which has been appreciating against the US dollar. So, what exactly encapsulates China’s monumental stimulus package?

Picture source: Etoro 1 Day chart

The Crux of the Stimulus Measures:

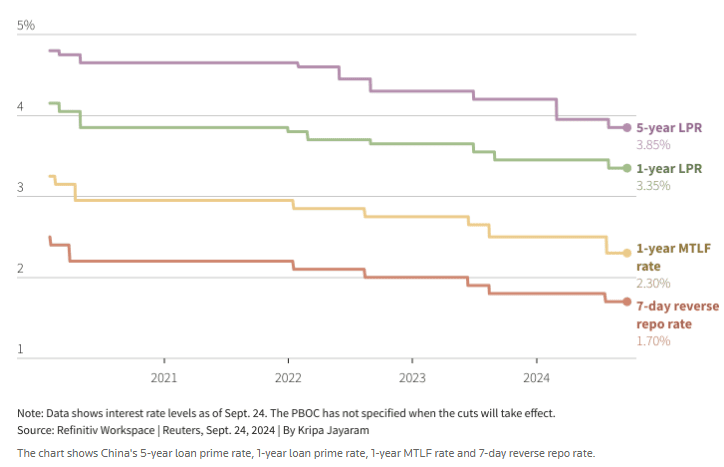

The PBOC’s blueprint for revival predominantly orbits around monetary easing, enriched with an aim to slash the reserve requirement ratio (RRR) by half a point. This cut alone pledges to unlock around $142 billion for new lending ventures, with the potential for additional reductions as the year unfolds. Alongside, the PBOC plans to trim key interest rates integrating a 0.2 percentage point slice off the seven-day reverse repo rate, narrowing down borrowing costs throughout the economic spectrum.

Complementing these monetary adjustments, the package also extends its hand towards the mortgage and property market sphere:

- Interest rates for existing mortgages will dip by 0.5%, paired with a declination to 15% in the minimum down payment for second homes, aiming to stabilize the shaky property market.

Turning the lens towards the capital market:

- The introduction of a $71 billion liquidity swap mechanism majorly targets funds and insurers, intending to invigorate stock market dynamism. Concurrently, commercial banks will enjoy low-interest loans, encouraging share buybacks and amplification of stock holdings.

Picture source: Reuters

Picture source: Reuters

Window of Investment Opportunities:

Such economic maneuvers are set to fan the flames of opportunity across various sectors:

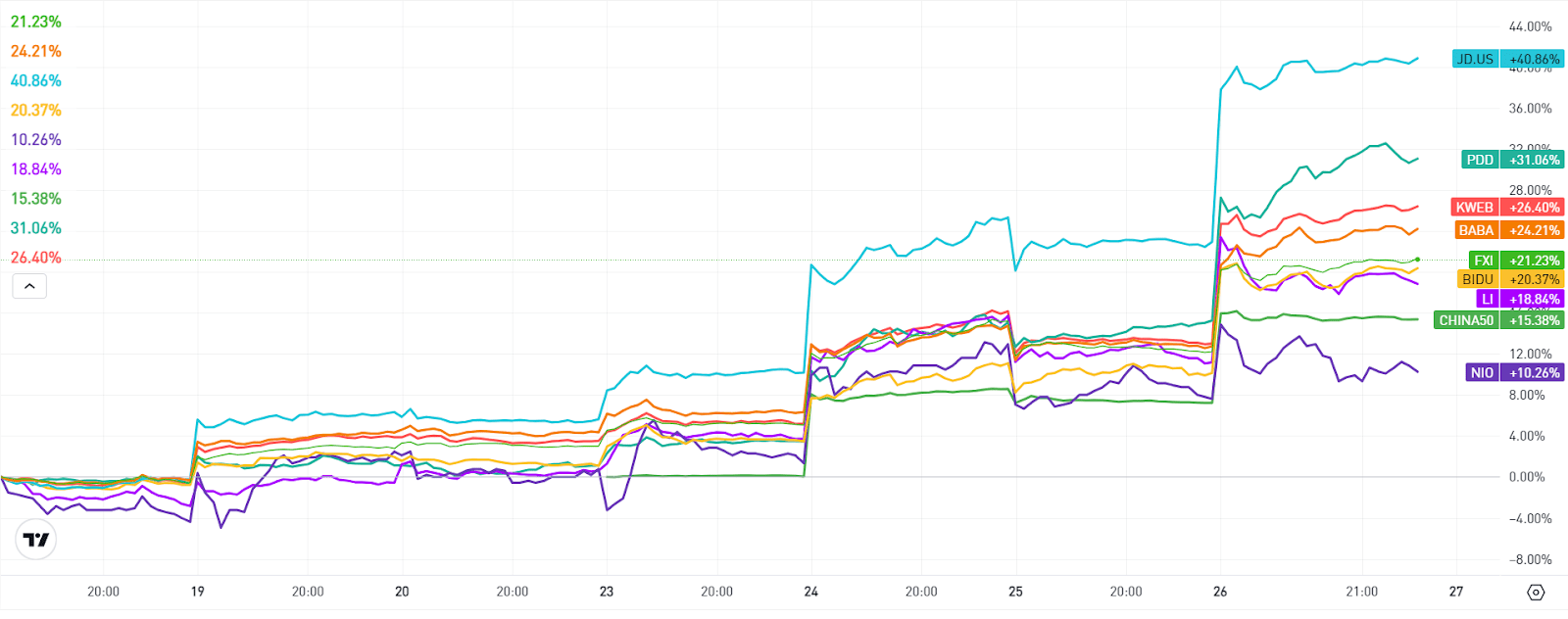

- U.S.-listed shares of preeminent Chinese firms like Alibaba ($BABA), PDD Holdings ($PDD), and Li Auto ($LI) witnessed a surge, recording upticks as high as 12% in some instances.

- The stimulus injects a new lease of life into global demand for raw materials, nudging copper prices upwards, courtesy of China’s position as the industrial metals’ top consumer.

- Real estate-focused investments, although entailing considerable risk, are likely beneficiaries of mortgage rate reductions, promising a brighter horizon for Chinese property companies and real estate funds.

Picture source: eToro 15 minutes chart

Picture source: eToro 15 minutes chart

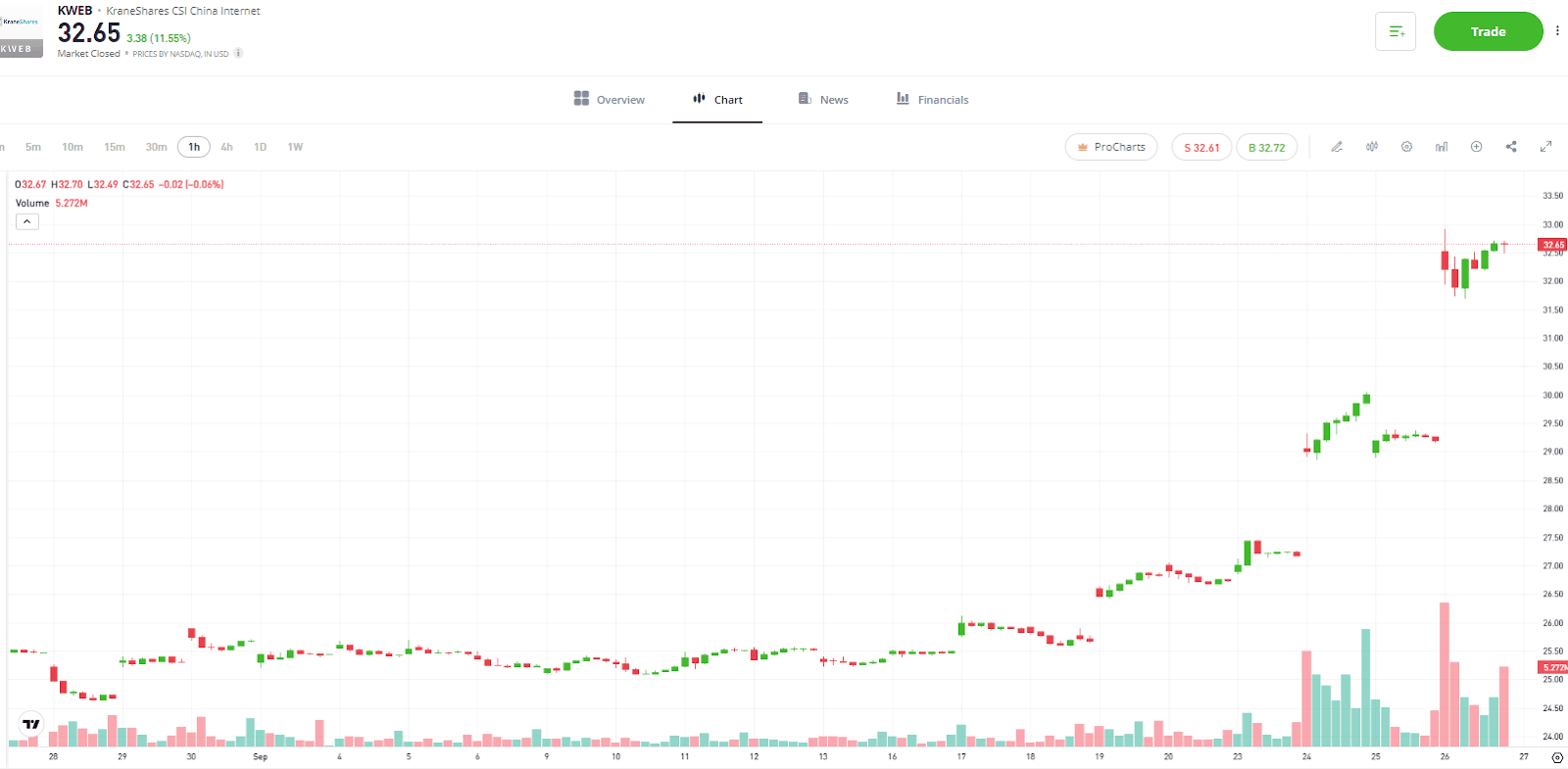

Diving deeper into investment avenues, Exchange-Traded Funds (ETFs) tracking Chinese equities such as KraneShares CSI China Internet ($KWEB) or individual U.S.-listed stocks from Alibaba ($BABA), JD.com ($JD), Baidu ($BIDU), NIO ($NIO), and Li Auto ($LI) have displayed optimistic market responses to the stimulus package with noticeable surges (as depicted above).

…

… Charts source: eToro

Charts source: eToro

Diligent observers might note the KraneShares CSI China Internet ETF ($KWEB) encapsulating the essence of optimistic market trends with a remarkable 28% gain over the past month, thanks in part to anticipatory sentiments surrounding the stimulus package. While a nostalgic glance at the long-term chart reveals a peak trading point of 104 USD in 2021, indicating that while immediate prospects appear promising, the stimulus might pave the way for sustained economic and corporate performance improvements.

Dave Tepper’s insatiable appetite for Chinese equities following the Federal Reserve’s rate cut is telling of the potential he sees in the market. Doubling down on his investment strategy, Tepper envisions a plethora of buying opportunities in a landscape where Chinese stocks are presenting themselves as more economically viable than their U.S. counterparts. According to him, the prospect of acquiring stocks characterized by single-digit P/E ratios juxtaposed with double-digit growth estimates provides a stark contrast to the relatively inflated valuations observed in the S&P.

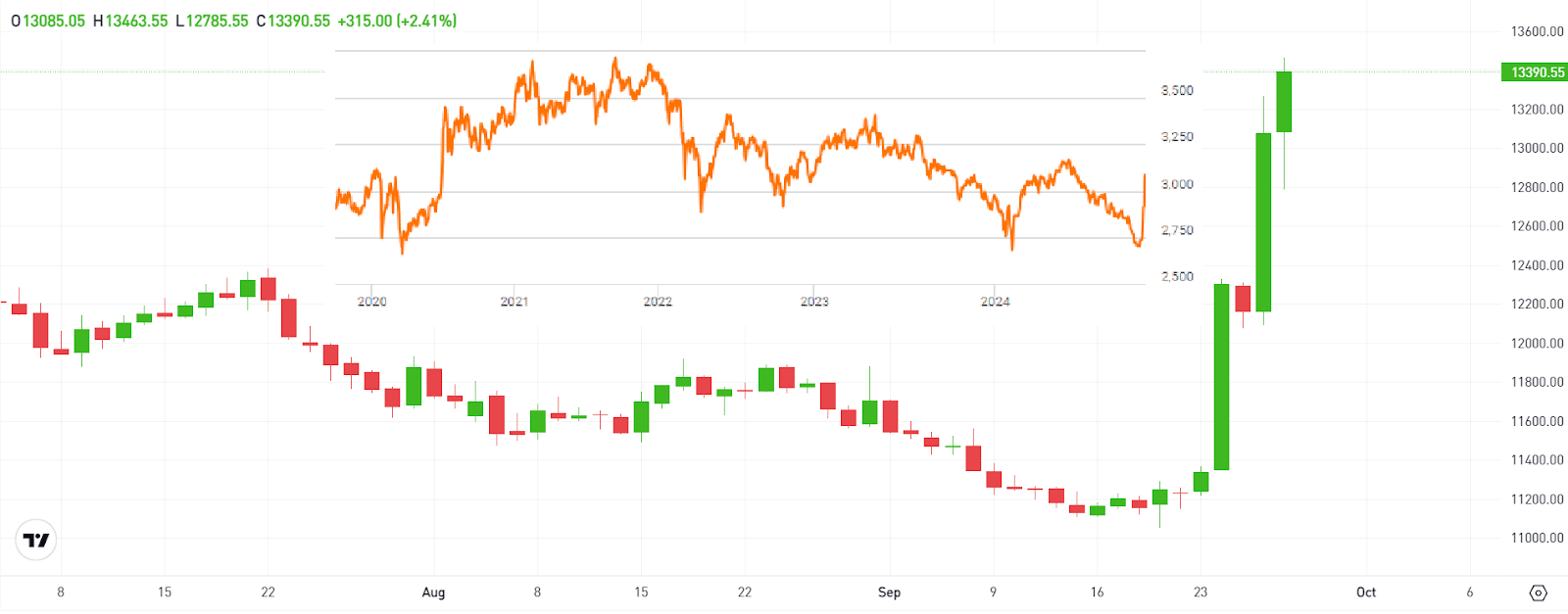

Source: eToro CHINA50 1 Day chart, Seeking Alpha 5Y chart

Source: eToro CHINA50 1 Day chart, Seeking Alpha 5Y chart

The Shanghai Index’s ($CHINA50) appreciable 12% ascendancy over the past five days coupled with its positive reverberations across Asian markets underscores the anticipatory economic upliftment stemming from China’s stimulus. Despite a modest year-to-date return and a rather subdued performance over the past twelve months and five years, the Shanghai Index suggests an untapped growth potential for Chinese financial markets. However, it’s crucial for investors to tread carefully, balancing the tantalizing prospects with the inherent risks tied to market volatility, geopolitical tensions, and governmental interventions.

In conclusion, while China’s stimulus package unfurls a canvas of opportunities across varied sectors, it beckons investors to navigate with insight, critical analysis, and an acute sense of timing. As the market dynamics evolve, staying informed and judicious becomes quintessential. For more insights and trending articles, visit DeFi Daily News. Amidst the vibrant economic landscape, the symphony of risks and opportunities plays on, charting the course for a potentially lucrative yet challenging investment journey. Entertaining the thought of diving into the Chinese market? Now might just be the right time to consider the plunge, albeit with a well-orchestrated strategy and an eye on the broader economic cues.