In the current financial atmosphere where pessimism seems to reign supreme among digital assets, principal cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) are bearing the brunt of heightened selling activities. In a similar vein, Cardano (ADA), despite witnessing substantial token accumulation by prominent investors often referred to as “whales,” is not immune to the bearish trends that could lead to significant price corrections.

Cardano Whales Ramp Up With 170 Million ADA Tokens

Detailed analysis provided by the on-chain data analytics group Santiment highlights an interesting trend: Cardano whales, or holders of more than 100 million ADA tokens, significantly increased their holdings by accumulating upwards of 170 million ADA tokens between August 27 and August 30, 2024. Such an aggressive acquisition spree, just before the much-anticipated Chang Hard Fork update of Cardano’s blockchain, was initially interpreted as a signal of strong optimism surrounding ADA’s future.

Cardano’s Precarious Price Forecast

However, reality bites back as the overall bleak sentiment in the market on August 30, 2024, triggered a severe reactionary maneuver for ADA, manifesting as a crucial drop beneath the ascending trendline that had been supporting its value since August 5, 2024. Previously, each touch upon this trendline heralded a price rally, yet the recent departure from this pattern suggests a potential 10% decrease, aiming for the $0.305 price point.

Currently positioned in a descending trend, ADA is struggling to find footing above the 200 Exponential Moving Average (EMA) on daily charts. Nonetheless, the Relative Strength Index (RSI) positions itself in oversold territory, implying a glimmer of hope for a price correction or reversal in the near future.

Unpacking ADA’s Crucial Liquidation Thresholds

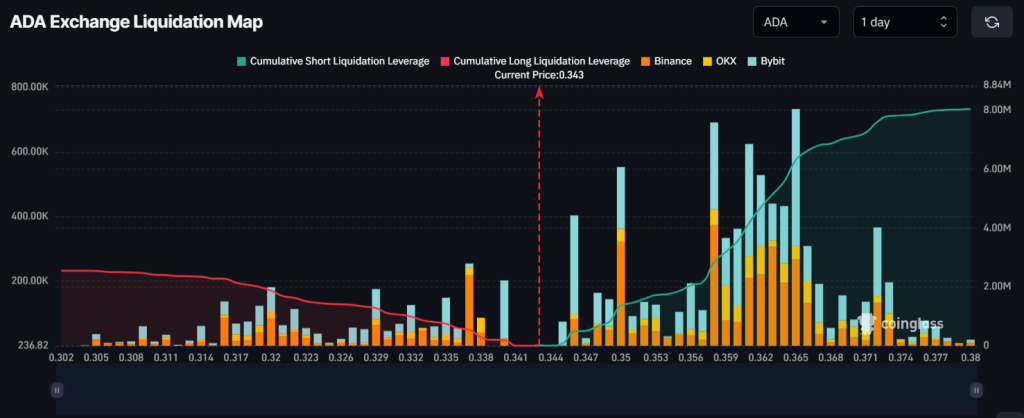

Amidst this downturn, short sellers have seized control, aggressively liquidating long positions. On-chain data from CoinGlass elucidates this scenario through the ADA exchange liquidation map, indicating a massive potential for short sellers to force millions of dollars’ worth of long liquidations.

As per current trends, the liquidation pivot points are stationed at $0.337 for the lower boundary and $0.365 for the upper limit. These zones have witnessed considerable over-leverage, setting the stage for potential financial upheavals.

The Ascendancy of Short Sellers in ADA’s Domain

With market sentiment veering towards negativity, a drop to the $0.337 level could trigger the liquidation of nearly $544,150 worth of long standing positions. Conversely, a market sentiment improvement that sees ADA’s price elevate to the $0.365 mark could lead to the liquidation of short positions valued at approximately $6.31 million. This recent minimal long position accumulation over the last 24 hours suggests a scenario where bulls are retreating, and bears firmly gripping the reins of the market.

At its current trajectory, ADA hovers near the $0.342 mark, experiencing a downturn exceeding 6% within the past 24 hours. Simultaneously, its open interest has witnessed a 4% contraction, signaling a broad-based apprehension and pessimism amongst traders, potentially in reaction to the overarching downward trend and market sentiment.

It’s a rough sea in the vast ocean of cryptocurrencies, with waves of uncertainty and storms of market volatilities. Cardano, despite its impressive technological infrastructure and a solid community foundation, is not sailing smoothly either. The actions of whales, market movements, and sentiment are reminiscent of the unpredictable tides within the cryptocurrency domain. As we’ve unpacked, while the accumulation by whales might point towards a confidence in ADA’s future potential and long-term value, short-term market dynamics and sentiment have a different story to tell, suggesting a possible rough patch ahead.

As the Cardano ecosystem braces for the Chang Hard Fork, it remains to be seen how these developments impact ADA’s journey. Will the whale’s substantial investment prove to be a masterstroke in the long run, or will the prevailing bearish sentiments suppress ADA’s ascent? Only time will tell. For cryptocurrency enthusiasts and investors alike, staying abreast of these market shifts is crucial. For more insights and updates on the pulse of digital finance, consider visiting DeFi Daily News, your destination for trending news in the decentralized finance ecosystem.

In wrapping up, entertainingly so, let’s take a moment to appreciate the wild rollercoaster that is the cryptocurrency market. It’s a realm where fortunes can be made or lost at the drop of a hat, where the strong-hearted dare to tread. Amid the chaos, the innovative spirit of blockchain continues to thrive, driving forward the quest for a decentralized future. So, here’s to navigating the high seas of crypto, armed with knowledge, insight, and a touch of humor to keep spirits high.