rewrite this content using a minimum of 1000 words and keep HTML tags

Ethereum has come under heavy selling pressure over the past few days as the broader crypto market entered a deep corrective phase. Yet, despite the volatility and widespread fear, ETH has managed to hold firmly above the key $3,000 level — a zone many analysts consider essential for maintaining the broader bullish structure.

Now, as price stabilizes and buyers begin to re-emerge, several market observers are starting to call for a potential recovery, arguing that Ethereum may be nearing the end of its downturn.

Adding fuel to this narrative is the continued accumulation from major players, most notably Tom Lee’s Bitmine. Tom Lee — a well-known Wall Street strategist, co-founder of Fundstrat Global Advisors, and long-time Bitcoin and Ethereum bull — has been one of the most influential voices in the digital asset market for nearly a decade. His firm Bitmine operates as a large institutional crypto investment entity focused on long-term accumulation, market-making, and strategic positioning during periods of fear.

According to recent on-chain data, Bitmine has continued buying ETH even as prices fell, signaling strong conviction in the asset’s long-term outlook. This behavior stands in sharp contrast to the broader market, where short-term holders have been capitulating.

Bitmine Continues Accumulating ETH Despite Market Weakness

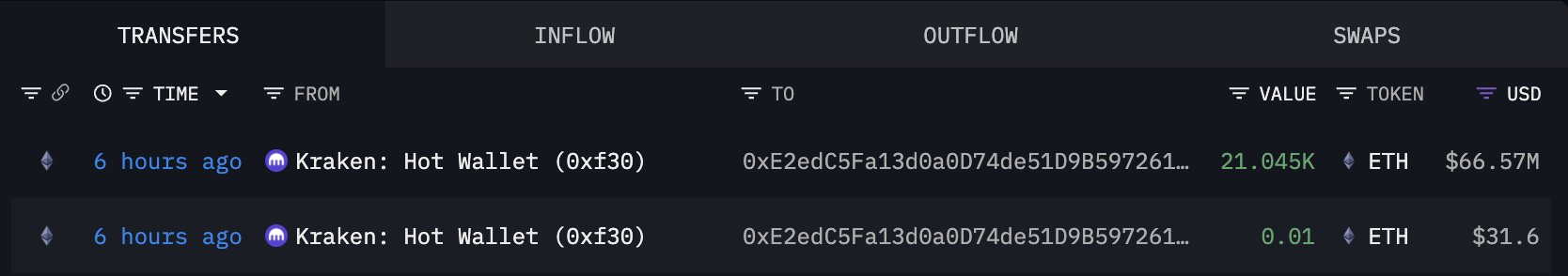

According to fresh on-chain data from Lookonchain, accumulation activity around Ethereum is far from slowing down. A newly flagged wallet, 0xE2ed, believed to be associated with Tom Lee’s Bitmine, received 21,054 ETH (worth $66.57 million) from Kraken just a few hours ago. This move reinforces the view that large, sophisticated players are treating the recent correction as an opportunity rather than a threat.

The timing of this transfer is notable. Ethereum has been under sustained selling pressure for weeks, with sentiment turning sharply bearish as the market grappled with fear, liquidations, and a broader rotation into stablecoins. Yet despite this environment, Bitmine-linked wallets continue to absorb supply aggressively.

This pattern aligns with Bitmine’s broader strategy: accumulating high-quality crypto assets during periods of uncertainty to position for long-term upside. Large inflows to accumulation wallets during drawdowns have historically suggested strong conviction among institutional players, often preceding phases of recovery and renewed strength.

Suppose this wallet is indeed tied to Bitmine. In that case, it signals that some of the market’s most well-capitalized participants remain confident in Ethereum’s long-term value, regardless of short-term volatility.

ETH Price Analysis: Testing Long-Term Support Amid Heavy Volatility

Ethereum’s weekly chart shows the asset navigating a critical zone as price hovers just above $3,000, a level that has historically acted as a major demand area. After weeks of sustained selling pressure, ETH has pulled back from the $4,500 region and is now retesting its long-term moving averages. The 200-week MA, in particular, is positioned closely beneath the current price, acting as a structural anchor that has supported Ethereum in previous cycle corrections, including the deep capitulation seen in mid-2022 and the recovery phase of 2023.

The recent candle structure reflects heightened volatility, with long wicks suggesting strong reactions from buyers near the $3,000 threshold. Volume has increased slightly during this downturn, indicating active participation from both sellers locking in profits and buyers positioning for potential reversal. Yet ETH remains below its 50-week MA, showing that short-term momentum continues to lean bearish.

Still, the broader pattern resembles earlier cycle pullbacks where Ethereum retraced sharply before forming higher lows and resuming its macro uptrend. If ETH can maintain this support band and reclaim the $3,300–$3,500 region, it may signal renewed strength. But a weekly close below $3,000 risks opening the door to deeper correction targets near $2,700.

Featured image from ChatGPT, chart from TradingView.com

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link