Onchain Highlights

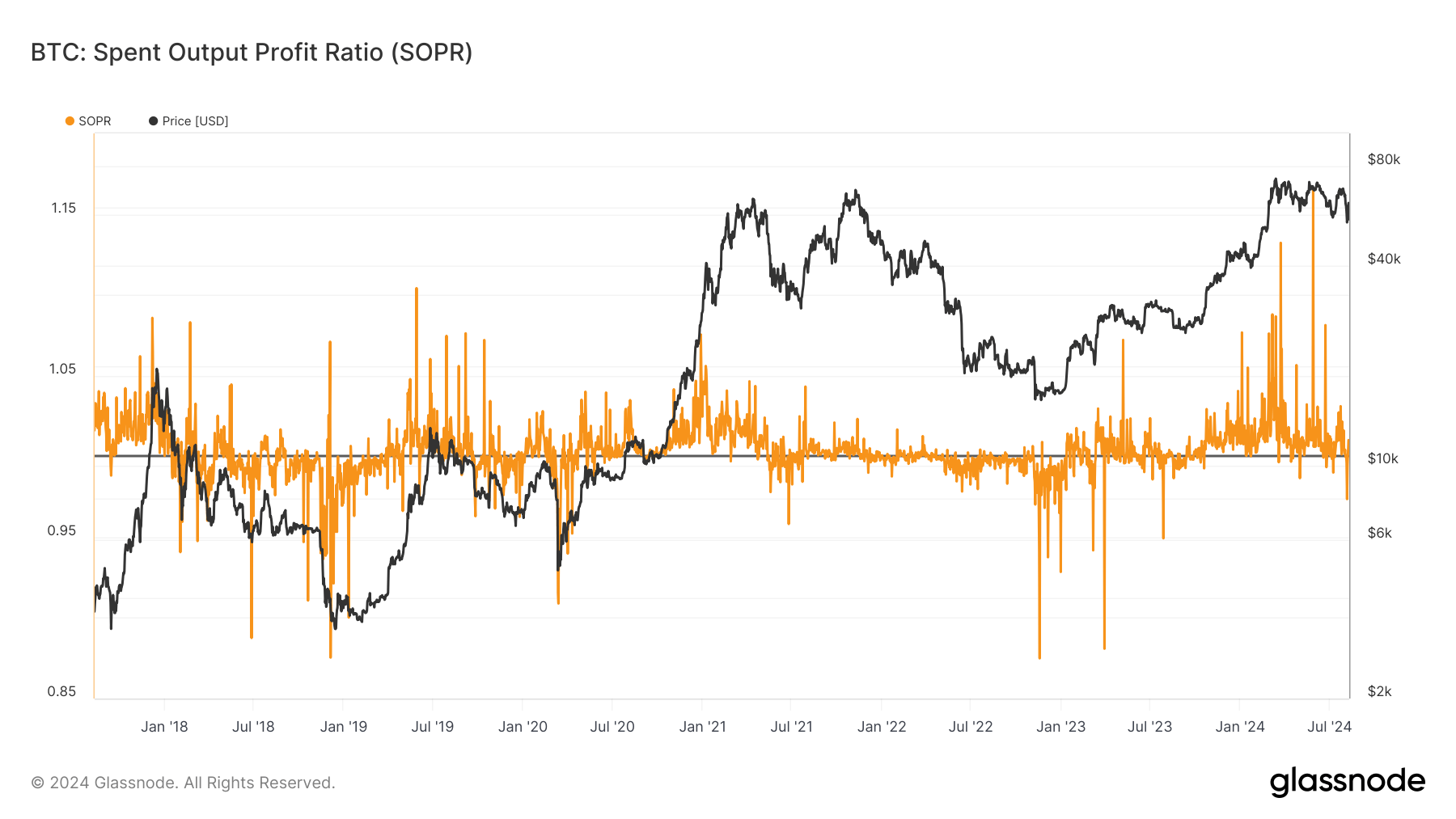

DEFINITION: A critical metric within the blockchain analytical sphere is the Spent Output Profit Ratio (SOPR), an indicator that provides valuable insights by assessing the profitability of spent outputs. This ratio is calculated by dividing the realized value (in USD) at the time of sale by the value at the time the output was created, also in USD. In simpler terms, it can be understood as the selling price over the purchase price of a digital asset.

The Bitcoin SOPR has been a subject of keen observation throughout the year 2024, offering a fascinating glimpse into market dynamics and investor behavior. A SOPR value consistently at or above the threshold of 1.0 suggests a predominant trend of profits being realized on spent outputs. This has indeed been the case for the majority of the period in review, highlighting the profit-taking strategy employed by many within the Bitcoin ecosystem.

Nevertheless, the narrative took an intriguing turn in recent months, more specifically around July and early August, when the SOPR experienced significant downturns, momentarily falling below the 1.0 mark. Such moments are indicative of a larger proportion of market participants selling their Bitcoin at a loss, which could be attributed to several factors including market corrections or broader economic uncertainties prompting a rush to liquidate positions despite unfavorable prices.

The trajectory of the SOPR since 2018 has intriguingly mirrored the price action of Bitcoin, demonstrating a significant correlation between the two. Peaks in the SOPR often coincide with bull markets, where notable price rallies enable investors to sell with substantial gains. The rollercoaster journey of the SOPR, notably in the aftermath of Bitcoin’s halving events, underscores the volatility and speculative nature inherent in cryptocurrency markets. This volatility is a testament to the market’s maturation process, grappling with the implications of reduced miner rewards on supply dynamics and investor sentiment.

In the context of the current trading environment, where Bitcoin teeters around the $60,000 mark, scrutinizing the SOPR becomes even more pivotal. The behavioral pattern of this ratio in the coming days and weeks could offer a prescient glimpse into whether the market is poised to tread back into a realm of widespread profitability or whether investors need to brace for the possibility of enduring further losses.

Conclusion

Wrapping up, the evolution of the Bitcoin SOPR throughout 2024 provides a vivid illustration of the complex interplay between market dynamics, investor sentiment, and macroeconomic factors. Observing these fluctuations not only helps us understand the present landscape but also equips us with insights for future maneuvering. As we continue to navigate through the unpredictable terrains of the cryptocurrency market, the SOPR serves as a beacon, guiding strategies and shaping expectations. Amidst all the technical analysis and market speculations, let’s not forget the rollercoaster of emotions and the thrills that come with investing in the world of digital assets. Here’s to hoping that our investments soar high, defying gravity, and bringing us not just profits, but also the joy of participating in a financial revolution.

For those hungry for more trend analyses and market insights, be sure to dive into DeFi Daily News for a wealth of informative content.