Realized volatility stands as an essential gauge within the financial market, offering a quantitative measure of fluctuations in asset prices over a specific timeframe. This fundamental metric, the standard deviation of returns from the mean return of a marketplace, shines a light on periods of heightened risk when its values ascend. Unlike its counterpart, implied volatility, which deduces expectations of future volatility, realized volatility lays bare the historical volatilities, providing a rearview mirror on market dynamics.

At its core, realized volatility is computed on the log returns for a predetermined time horizon or a rolling window, transforming it into a time-sensitive observable. In practice, when calculating the annualized daily realized volatility for assets like Bitcoin, the daily returns are first determined, then amplified by a factor of the square root of 365, offering insights over a rolling window of one week.

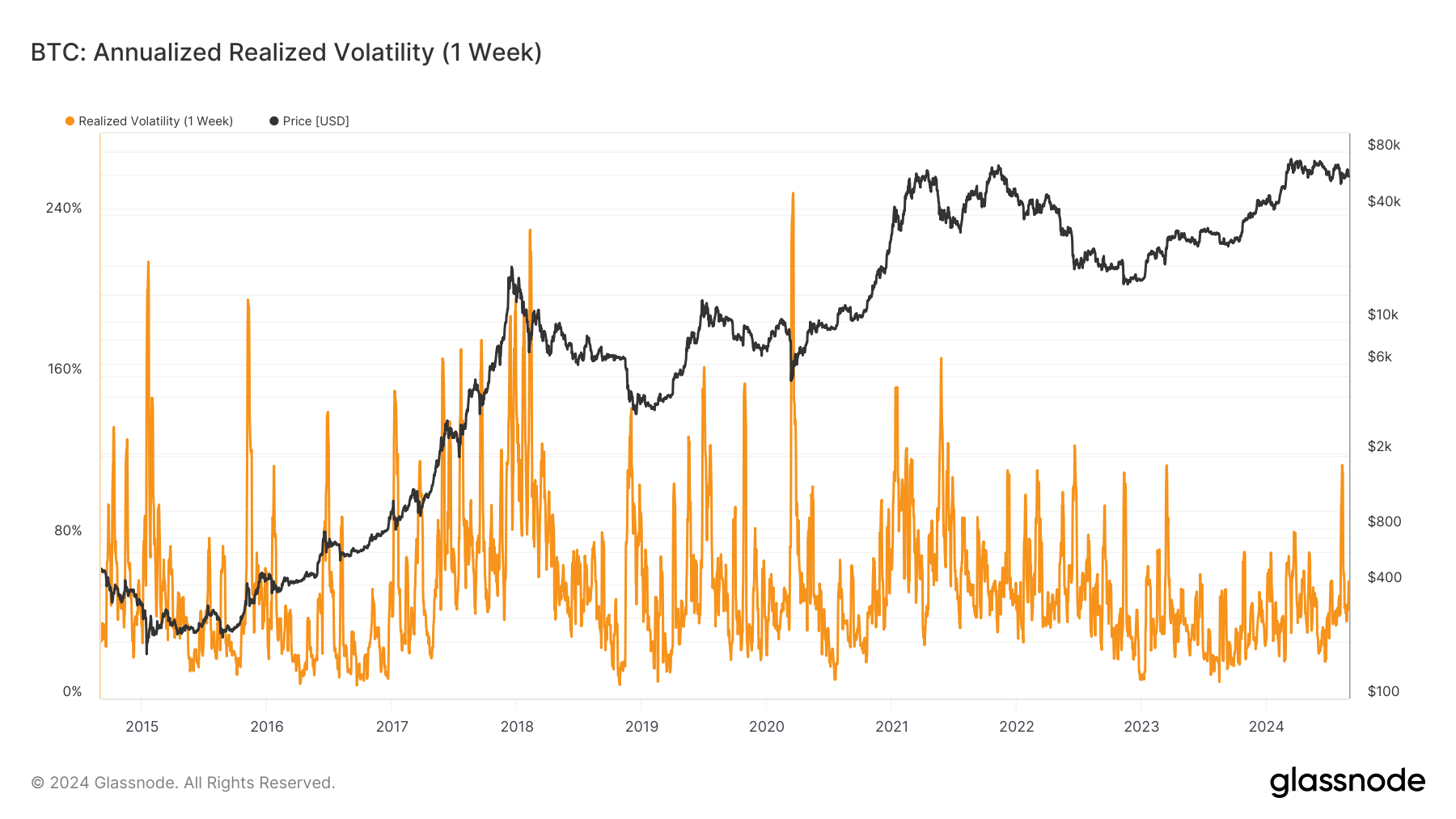

The volatile landscape of Bitcoin has been marked by its susceptibility to dramatic fluctuations in realized volatility, particularly in the recent years post-2023. Graphical representations vividly illustrate these shifts, with the annualized realized volatility of Bitcoin over 1-week windows spotlighting significant disturbances within the timeframe of 2023.

A noteworthy period emerged in September 2023, when Bitcoin’s volatility was on the lower spectrum, only to surge precipitously by November 2023. This spike in volatility coincided with a remarkable escalation in Bitcoin’s valuation, climbing from an approximate $20,000 to a staggering $60,000 in the same stretch. However, as 2024 dawned, a stabilization in Bitcoin’s price was mirrored by a subsidence in volatility, marking a period of relative calm after the storm.

Reflecting on historical data stretching back to 2015, Bitcoin’s journey through waves of realized volatility is apparent, with notable spikes aligning with episodes of swift price adjustments. These fluctuations are not merely random; they mirror the market’s response to an array of macroeconomic stimuli and the intrinsic trends within the cryptocurrency landscape. As Bitcoin edges closer to the mainstream, embracing its identity as a mature asset class, these volatility patterns might yield valuable foresight into market mood and the possible trajectories for price movements.

The storyline of Bitcoin’s realized volatility reaching its apex in August, registering heights unseen in over a year, stands as a testament to the ever-evolving nature of the cryptocurrency market.

For those keen to dive deeper into the whirlpool of evolving trends and news within the decentralized finance realm, turning towards DeFi Daily News furnishes an abundance of the latest, most captivating insights akin to the tumultuous journey of Bitcoin’s realized volatility.

**Conclusion: A Voyage Through the Vibrant Seas of Volatility**

Navigating the high seas of cryptocurrency markets, especially the tumultuous waves of Bitcoin’s volatility, proves to be a voyage filled with exhilarating highs and profound lows. From the serene waters of stability to the precipitous crests and troughs guided by market sentiment and global economic winds, each chapter in Bitcoin’s journey offers an enthralling narrative of resilience and adaptability.

As we dissect the complex fabric of realized volatility, unraveling its intricate weave provides a kaleidoscopic view of Bitcoin’s market dynamics. Such an exploration is not merely an academic exercise but a thrilling odyssey that captivates the imagination, challenging us to ponder the untapped potentials and unforeseen horizons awaiting discovery within the digital currency landscape.

In the annals of financial lore, the saga of Bitcoin’s volatility is a compelling epic, replete with heroes and adversaries, triumphs, and trials. It is a narrative that mesmerizes, educates, and entertains, prompting a rousing applause for the resilience and innovation at the heart of the cryptocurrency saga.

Let us then, with eager anticipation and unwavering curiosity, continue to chart the course through these electrifying waters, embracing both the tranquility and the tempests as we journey towards uncharted territories in the endless quest for knowledge, prosperity, and the sheer joy of discovery in the magnificent saga of Bitcoin and the broader cryptocurrency universe.

Source link