Exploring the Dynamics of Bitcoin’s Circulating Supply

DEFINITION: A key metric within the cryptocurrency domain, particularly for Bitcoin, is the percentage of the circulating supply that remains stationary for at least one calendar year.

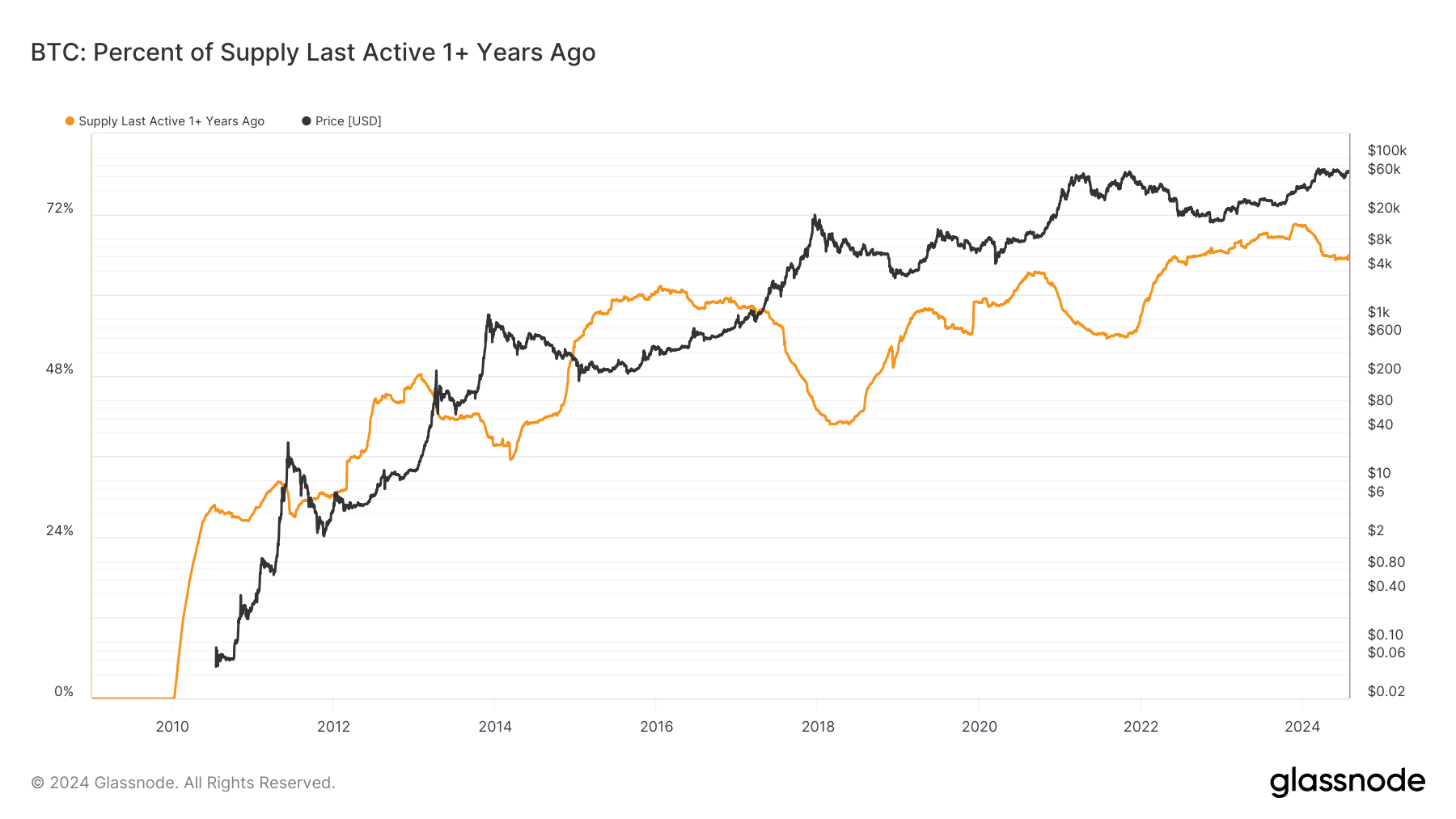

The dynamism within the Bitcoin marketplace is readily evident through the examination of its supply last active over a year ago. A noticeable downturn has been observed, moving from a high of nearly 70% at the outset of 2024 to approximately 66% by the end of July. This shift is telling of the underlying currents impacting market dynamics and investor sentiment.

The reduction in the portion of Bitcoin supply considered dormant underscores a pattern of increasing asset mobility amongst long-standing holders. This could be in anticipation of or reaction to prevailing market trends. Notably, the introduction of an ETF by Grayscale in January has sparked a wave of coin distributions among its GBTC holders, further catalyzing this movement.

Bitcoin: Percent of Supply Last Active 1+ years ago: (Source: Glassnode)

A historical analysis reveals that fluctuations in the percentage of dormant Bitcoin supply often precede notable price variations. The comprehensive view provided by extended period studies showcases cycles of accumulation and distribution among holders, with the recent decline hinting at a phase of heightened liquidity and trading vigor.

Despite the whirlwind of price volatility, Bitcoin has maintained a relatively stable price range between $60,000 and $70,000 since February. This suggests a market equilibrium is being established, even as previously inactive coins re-enter the trading sphere.

The evolving patterns of asset holders, especially in the wake of major milestones such as Bitcoin’s halving events, underline the market’s fluid nature. These instances often serve as catalysts for investors to reassess their positions and strategies, leading to significant shifts in the allocation of assets.

As the landscape of the cryptocurrency market continues to evolve, the behaviors and decisions of long-term holders offer invaluable insights. The shifts in dormant supply percentages are more than just numbers; they are a reflection of collective sentiment, strategic moves in response to the changing economic environment, and the perpetual quest for optimization in investment portfolios.

In conclusion, while the ebb and flow of Bitcoin’s dormant supply highlight the inherent unpredictability of the cryptocurrency market, they also underscore the robustness and resilience of Bitcoin as an asset class. Despite the fluctuations and the varying degrees of market optimism or pessimism, the foundational principles and the long-term vision of Bitcoin remain unshaken.

For those keen on diving deeper into the riveting world of decentralized finance and cryptocurrency movements, DeFi Daily News serves as a treasure trove of the latest insights and analyses. As we peer into the horizon, the interplay of dormant Bitcoin supply and market dynamics promises to remain a subject of keen interest and speculation, holding lessons and opportunities for the astute observer.

Pioneering through these uncharted territories requires a fine balance between strategic foresight and the agility to pivot in response to new information. The unfolding story of Bitcoin’s supply dynamics is but a chapter in the broader narrative of digital finance, beckoning us to read between the lines and perhaps, write our own verses in the ledger of blockchain history.