In the swirling eddies of global finance and geopolitical unrest, it’s becoming increasingly clear that the digital currency known as Bitcoin could be on the cusp of a golden era. BitMEX co-founder Arthur Hayes has been peering into the financial tealeaves, and what he sees is a future where the current tensions in the Middle East do not spell doom for the cryptocurrency but rather herald a significant uptrend in its value. Hayes posits that the ripple effects of any conflict will be acutely felt within the US economy, precipitating a surge in governmental expenditures alongside inflation rates that could only be described as prodigious.

Hayes elucidates a scenario where escalating military endeavors necessitate unprecedented levels of borrowing. This, in turn, would be offset by further expansion of the Federal Reserve’s balance sheet along with that of commercial banks, actions that could potentially erode the value of the US dollar. It is during these precarious times, Hayes argues, when conventional fiat currencies start to falter, that Bitcoin emerges as a beacon of stability – a bulwark against the inflationary tide. His argument gains added weight in light of the recent spike in the US Producer Price Index, which outstripped market predictions by rising to 1.8%, a clear harbinger of inflationary pressures and a clarion call to those seeking refuge in the more stable haven of Bitcoin.

Arthur Hayes. Image: Jackie Robinson Foundation

The War’s Impact On Bitcoin & Monetary Policy

The lessons of history are not lost on Hayes as he draws parallels between contemporary events and past US wartime economic strategies. He points out the tendency of the US to crank up the money printing press during conflicts, an action that invariably benefits Bitcoin. Hayes draws an analogy with the 1973 energy crisis, during which gold – another steadfast asset in times of financial uncertainty – saw its value skyrocket in response to rampant inflation. He opines that Bitcoin, often touted as the “digital gold,” is positioned to replicate this ascendancy in the face of the inflation and currency devaluation that typically accompany war-induced fiscal policies.

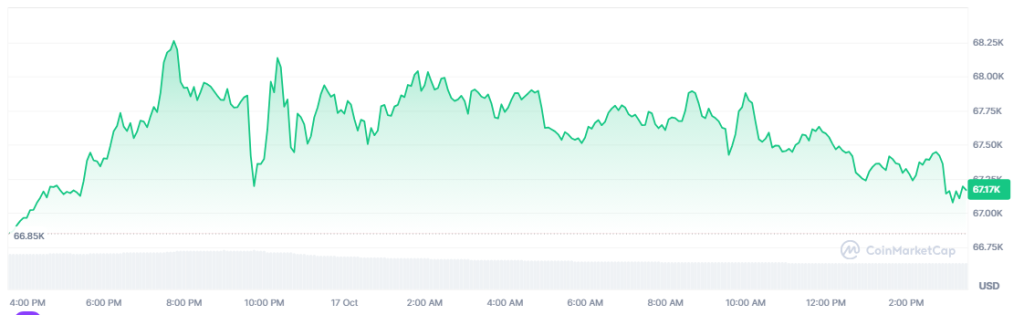

BTCUSD trading at $67,199 on the daily chart: TradingView.com

Further complicating the economic tableau is the prospect of escalating energy prices spurred by intensified Middle Eastern conflicts. Should critical infrastructure come under threat, Hayes predicts an inflationary spiral that would only stoke the fires of demand for Bitcoin, as investors increasingly view it as a financial safe haven – a repository of value in a world where traditional energy sources are in peril.

Strategic Considerations For Investors

Though Hayes’s outlook for Bitcoin is fundamentally optimistic, he exercises caution, judiciously scaling back his exposure to the more volatile altcoins. His strategy is a hedge against the potential for geopolitical strife to derail market stability. His observation is that debt-financed, spendthrift policies are likely to sustain Bitcoin’s growth over the long term, continuing a trend that has been observed over historical epochs. If Bitcoin can outmatch the expansion of the Federal Reserve’s balance sheet, it validates its role as a hedge against the dilution of traditional fiat currencies.

In the face of political turmoil, Hayes advocates for a conservative approach to investing: protect oneself and one’s capital at all costs. He posits that allocating capital to Bitcoin serves as an insurance policy against the erosion of currency value and purchasing power in unpredictable times. With geopolitical instability a constant backdrop, Bitcoin remains well-poised for continued growth.

For further reading on Bitcoin’s prospects and the wider financial landscape, be sure to check out DeFi Daily News for more trendy articles like this.

Conclusion: The Digital Gold Rush

In a world rife with economic uncertainty and geopolitical tensions, the allure of Bitcoin continues to grow. As currencies waver and stock markets tremble, Bitcoin stands as a digital monument to stability, a beacon for those navigating the stormy seas of international finance. Arthur Hayes’s insights into the potential for Bitcoin to capitalize on these conditions offer not just a beacon of hope for investors, but also a strategic blueprint for navigating the future of currency. In this age of digital gold rushes and fiscal upheavals, Bitcoin may just be the newfound ‘Eldorado’ for the savvy investor. So grab your digital pickaxes, folks – there’s gold in them thar hills!