rewrite this content using a minimum of 1000 words and keep HTML tags

Bitcoin (BTC) and Ethereum (ETH) have been hit with massive selling pressure as fear grips not just the crypto market but also U.S. stocks. The entire crypto sector has struggled amid negative macroeconomic conditions, with investors uncertain about the market’s next major move.

Global trade war fears and erratic policy shifts from U.S. President Trump’s administration have fueled volatility and uncertainty, creating a hostile environment for investors. As a result, the U.S. stock market has plunged to its lowest levels since September 2024, dragging crypto prices down alongside traditional assets. With no clear relief in sight, traders remain on edge as both stocks and crypto fight to hold key support levels.

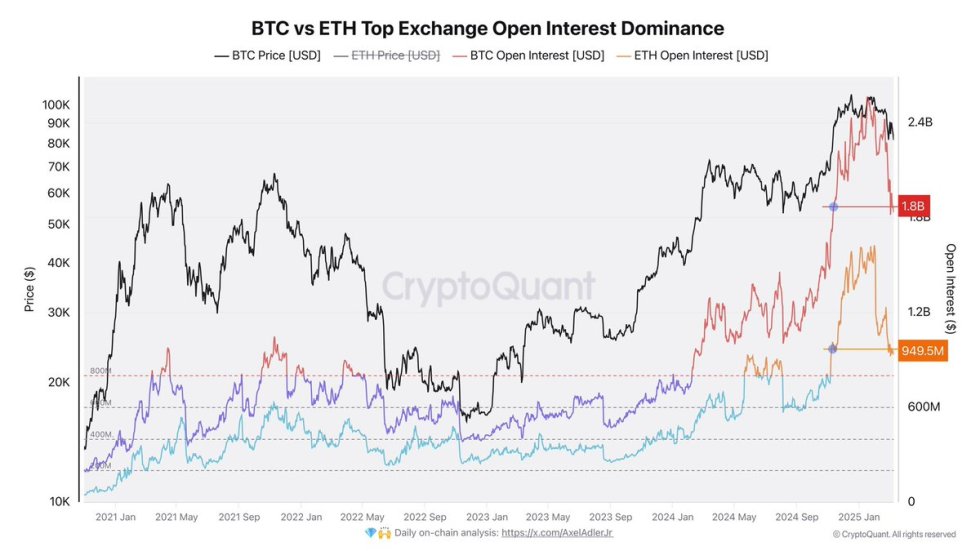

Key on-chain metrics from CryptoQuant reveal that open interest in Bitcoin and Ethereum futures has dropped significantly, reflecting a clear shift in investor sentiment and speculative activity. The decline in open positions suggests that traders are exiting the market due to liquidations or risk aversion, adding to the uncertainty surrounding Bitcoin’s and Ethereum’s price action.

With markets under pressure, the coming days will be crucial in determining whether BTC and ETH can recover or if further downside is ahead.

Bitcoin Drops 19% As Fear Grows

Bitcoin has fallen over 19% since the start of March, with fear and uncertainty dominating market sentiment. Many investors now believe the bull cycle is over as BTC struggles to reclaim key levels and bearish sentiment sets new downside targets. With selling pressure increasing, traders are closely watching whether Bitcoin can stabilize or if further losses are ahead.

Since the U.S. elections in November 2024, macroeconomic volatility and uncertainty have driven the market. Rising trade war fears, unpredictable policy changes, and global economic instability have all contributed to continued weakness across risk assets, including both crypto and U.S. stocks. With these conditions expected to persist, Bitcoin remains vulnerable to more price swings.

Top analyst Axel Adler shared insights on X, revealing the significant drop in open interest in Bitcoin and Ethereum futures indicates a major shift in investor sentiment and speculative activity. Traders exit their positions amid heightened uncertainty. According to Adler, open interest in BTC futures has dropped by $668 million, while ETH futures have seen a decline of $700 million. In total, positions worth $1.368 billion have been closed across both instruments.

Adler notes that this liquidation wave represents a partial market reset, as leveraged traders exit the market. While this could signal reduced speculative pressure, Bitcoin still needs to reclaim key levels before a recovery can take place.

BTC Struggles Below Key Moving Averages

Bitcoin is currently trading at $81,500, having lost the 200-day Moving Average (MA) and Exponential Moving Average (EMA) around the $85,000–$82,000 range. This breakdown has placed BTC in a weaker position, increasing the risk of further declines unless bulls can reclaim key resistance levels.

For a recovery to gain momentum, bulls must hold firm above the $80,000 support level and push back above $85,000. A strong move past this zone could signal the start of a rebound, but market conditions remain uncertain, making the pace of any recovery highly unpredictable. Without a decisive push higher, BTC could remain trapped in a consolidation phase, struggling to find direction.

However, losing the $80,000–$78,000 range would put Bitcoin at risk of further downside, with the next key support levels sitting at $75,000 and potentially even $69,000. If bears maintain control, BTC could experience another wave of selling pressure, delaying any hopes of a recovery. The coming days will be critical in determining whether Bitcoin can stabilize or if further declines are on the horizon.

Featured image from Dall-E, chart from TradingView

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link