In an unexpected turn of events that left the cryptocurrency world buzzing with excitement and optimism, Bitcoin (BTC) saw a dramatic surge, propelling over 6% in a single day. This remarkable spike was primarily attributed to a significant announcement by Federal Reserve Chairman Jerome Powell, who indicated a shift in monetary policy, leaning towards a more dovish stance. The revelation of a potential 25 basis points rate cut in the upcoming meeting scheduled for September 18 sent shockwaves through the financial markets. This pivotal moment has notably injected a fresh dose of volatility into the cryptocurrency sector, particularly affecting Bitcoin, which had previously experienced price fluctuations characterized by unpredictable swings in recent weeks.

Related Reading

Adding to the intrigue and potential optimism amongst cryptocurrency enthusiasts and investors is a set of crucial on-chain data unveiled by CryptoQuant. This data paints a promising picture for Bitcoin’s price trajectory, suggesting that traders are increasingly positioning themselves in anticipation of further price appreciations. This sentiment reflects a broader market reaction as participants digest the Federal Reserve’s adjusted policy stance, placing Bitcoin under the spotlight as a key asset to watch for potentially entering a new bullish phase.

Bitcoin Data Showing Market Optimism

Currently, Bitcoin is not just hovering but actively trading above the $63,000 mark, demonstrating strong momentum with sights set on breaching the crucial $65,000 threshold. CryptoQuant’s on-chain analysis further bolsters sentiment, highlighting a distinctive market trend that could propel prices even higher. A particularly noteworthy observation is the significant depletion of Bitcoin exchange reserves across centralized platforms, plunging to an unprecedented all-time low.

From the tail end of July, there’s been a noticeable reduction in the supply of BTC on exchanges, dwindling from over 2.75 million to slightly around 2.67 million, marking an approximate 3% decrease within a span of just 30 days.

This decline underscores a significant reduction in the amount of BTC available for trading on these platforms, potentially setting the stage for a supply shock scenario. A supply shock often arises when demand significantly exceeds supply, potentially leading to a sharp price increase. As the availability of Bitcoin on exchanges dwindles, the probability of a marked price uptick becomes increasingly plausible.

With Bitcoin starting to demonstrate tangible strength, the market is keenly observing this trend, which could very well thrust Bitcoin into previously unchartered bullish territories.

BTC Price Action: $65,000 Next?

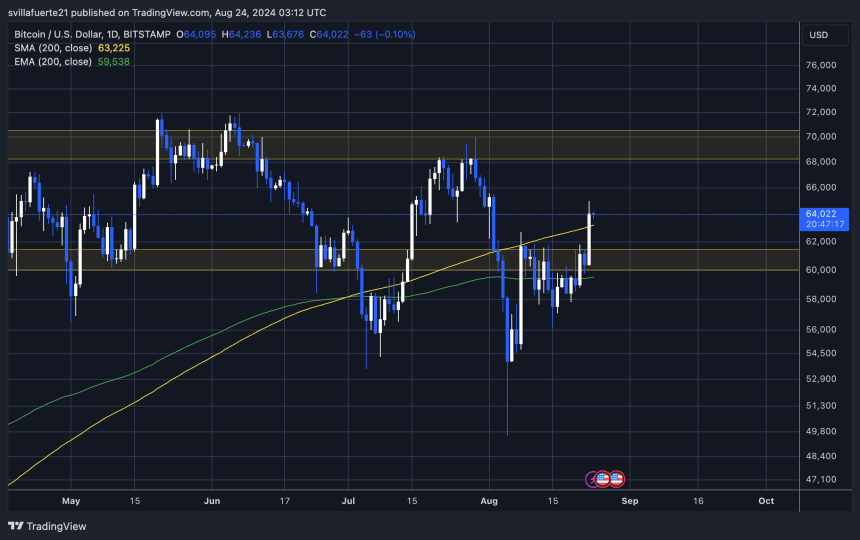

Following a fortnight marked by volatility and a phase of consolidation, Bitcoin is currently priced at $64,100 at the moment of writing. It’s managing to sustain its position above the crucial daily 200 Moving Average (MA), indicating a potentially bullish outlook.

For Bitcoin to convincingly clear the $65,000 mark, it’s imperative for it to affirm its bullish setup by maintaining a position above the $57,500 level. Ideally, remaining above the daily 200 Exponential Moving Average (EMA), which is currently at $59,538, would provide a more persuasive argument for sustained upward movement.

These levels are pivotal in fostering a continued upward trajectory. Securing positions above them would signal a significant market strength and invigorate confidence among traders and investing communities. Coupling the positive trends of declining Bitcoin exchange reserves with the optimistic beat from central bank policies, there’s a growing expectation of a Bitcoin rally in the ensuing months, energized by these bullish indicators.

Cover image from Dall-E, chart from TradingView.

Conclusion: A New Dawn for Bitcoin?

The recent upturn in Bitcoin’s fortunes, catalyzed by a confluence of encouraging data and strategic monetary policy adjustments, has sent ripples of excitement across the crypto sphere. While the short-term outlook brims with optimism, the true testament to Bitcoin’s resilience and potential will unfold in the weeks leading to and following the Federal Reserve’s highly anticipated September meeting.

As investors and traders align their strategies with the evolving economic indicators, the narrative of a bullish Bitcoin gaining momentum could very well become the theme of the next quarter. Amid these developments, engaging platforms and resources remain indispensable for those looking to navigate the complexities of the cryptocurrency markets.

For more trending news and insightful analysis on the dynamic world of decentralized finance and cryptocurrencies, head over to DeFi Daily News. Stay updated, stay ahead.