Onchain Highlights

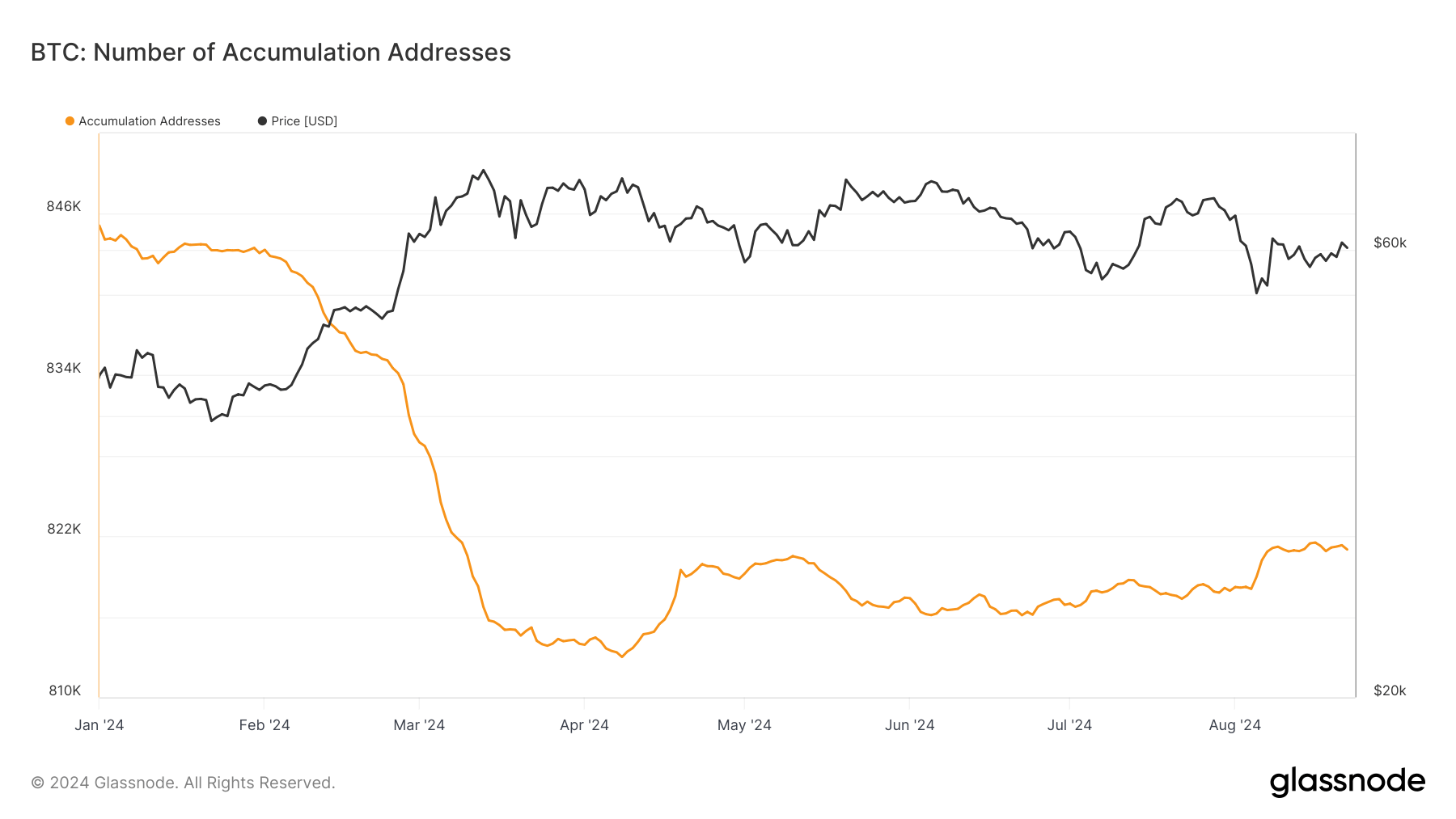

DEFINITION: A critical onchain metric to monitor is the count of unique accumulation addresses. These special addresses are characterized by having received at least two incoming non-dust transfers and have never initiated any fund disbursement. It’s important to note that exchange addresses and those acquiring assets through coinbase transactions, commonly known as miner addresses, are excluded from this tally. Furthermore, to eliminate the possibility of accounting for lost coins, addresses that have remained inactive for a duration exceeding 7 years are also disregarded.

The landscape of Bitcoin’s accumulation addresses underwent a significant contraction in 2024. This marks a pivotal turn from the past trend, where these addresses saw a consistent rise, mirroring the growing confidence among long-term Bitcoin holders in response to the cryptocurrency’s appreciating value over the preceding decade.

Approaching the year 2022, the total of accumulation addresses neared the 800,000 mark, evidencing further growth in the following year. This growth trajectory reached a zenith of approximately 846,000 at the commencement of 2024.

In the aftermath of the halving event in April, a precipitous decline in the number of accumulation addresses was observed, dipping below 815,000 by March. The timing of this downturn paralleled a retracement in Bitcoin prices from their peak levels achieved in March, hinting at a potential liquidation or downscaling of positions by some holders as the market recalibrated to the altered supply dynamics.

A modest resurgence in the tally of these addresses was recorded starting May, with the figures attaining a level of stability around 822,000 by August. The prevailing trend underscores a prudent stance adopted by long-term investors in the face of the volatile market conditions ensuing the halving event.

Conclusion: Navigating the Digital Currency Seas

The shifting sands of Bitcoin’s accumulation addresses in 2024 unfolds a tale of cautious optimism amongst the cryptocurrency’s stalwart believers. While the tempest of market volatility post-halving tossed many a ship, the captains of these digital vessels held their course, albeit with a trimmer sail. This ongoing saga, charted meticulously through the lens of onchain data, offers not merely a snapshot of current affairs but a beacon towards understanding the cryptic currents of cryptocurrency markets.

The dialogue between Bitcoin’s price motions and the swells and ebbs of accumulation addresses bespeaks the intricate dance between supply and demand, investor sentiment, and the unrelenting advance of blockchain technology. As the horizon of digital currency extends into the future, these narratives, captured within datasets and graphs, serve as both compass and cartography for navigating the open digital seas.

In the grand tapestry of cryptocurrency’s odyssey, every data point is a stitch in the story of human endeavor across the digital expanse. May those who partake in this journey find their port of call not just in financial gain, but in the broader discovery of what lies beyond the blockchain’s boundless horizons.