An intriguing analysis has recently unfurled insights suggesting Bitcoin might unfold a spectacular climb to potentially end the year 2024 hitting a range between $108,000 and $155,000. This bold projection, instigated by analyst James Van Straten, hinges on the cyclical patterns observed in Bitcoin’s historical performance – a method of gauging future trajectories based on past trends.

Historical Echoes in Bitcoin’s Cycle

Within a freshly minted discourse on X, Straten delves into an analysis of Bitcoin’s pilgrimage from its cycle low points. The crux of this exploration is a chart that delineates the trajectory between each notable low across Bitcoin’s lifecycle. Of particular interest is the period following the notorious collapse of cryptocurrency exchange FTX in late 2022, marking the inception of the latest cycle in the analysis.

Below, the chart crafted by Straten provides a visual representation juxtaposing this most recent cycle against its predecessors:

The graphical exposition reveals an uncanny resemblance between Bitcoin’s recent movements and those from its past, suggesting a rhythmic consistency in its cyclical behavior. “Out of all the graphs, TA etc, Bitcoin from the cycle low continues to be the most valid,” Straten asserts. This striking parallelism teases the possibility of Bitcoin’s journey ahead mirroring its historical ascents.

Straten underscores that the culmination of previous cycles saw a significant uptick starting September, setting the stage for monumental bull runs. Drawing from this pattern, one might speculate a forthcoming surge for Bitcoin, should it continue to shadow its ancestors’ paths. “If BTC were to align with historical midpoints by year’s end, figures between 108k and 155k seem plausible,” Straten explains, charting a trajectory of possible future valuations.

In converting these speculations to percentages, soaring to the lower spectrum at $108,000 signifies a jump of approximately 70%, whereas a sprint to the $155,000 marker denotes an ascension surpassing 144%.

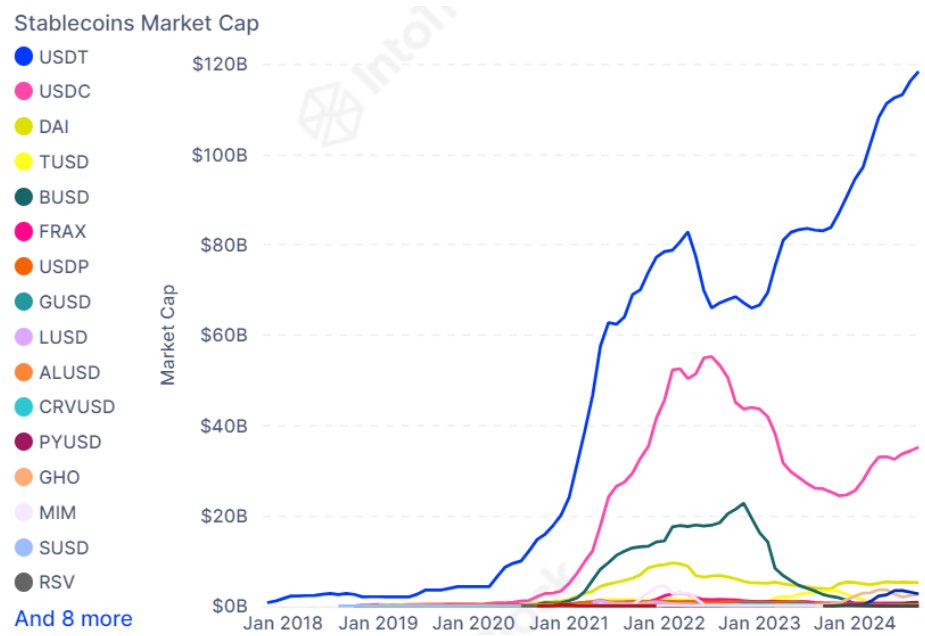

However, it’s quintessential to remember that history, while instructive, does not promise future outcomes. Straten cautiously adds, “if we sidestep a recession, these heights are within reach.” In concurrent discussions, the market intelligence beacon IntoTheBlock, through a post on X, highlighted USDT’s (Tether) market capitalization burgeoning to new zeniths, hinting at the crypto sphere’s vibrancy.

The elevation in USDT’s market cap not only underscores its dominance among stablecoins but also suggests a buoyant reservoir of potential liquidity for Bitcoin investments. Surges in USDT supply could signal increased investor readiness to pivot towards Bitcoin, further fueling its ascent.

The Current Stance of Bitcoin

Despite recent hiccups in its recovery path, Bitcoin’s price has plateaued around the $63,600 benchmark, indicating a phase of consolidation. Yet, within this lull lies the simmering potential of historical patterns reprising their influence, guiding Bitcoin’s next climactic leap.

Featured imagery and analytical tools curate a narrative that Bitcoin, the pioneer of the cryptocurrency realm, might be on the verge of another historic rally, should it adhere to its cyclical propensities. Leveraging insights from platforms like Dall-E, IntoTheBlock.com, Glassnode.com, and TradingView.com enriches our comprehension of Bitcoin’s potential trajectories.

Epilogue: The Unfolding Journey of Bitcoin

As we stand at the cusp of potentially witnessing another monumental chapter in Bitcoin’s journey, the blend of historical analysis and contemporary market dynamics provides a compelling vista of what might lie ahead. The echoes from the past, coupled with the fervor of present investments, weave a tale of anticipation and speculation.

In a digital age where the narrative of finance is continually being rewritten, Bitcoin’s trajectory serves not only as a testament to its resilience but also as a beacon for speculative investment and the fascinating dynamics of market cycles. For enthusiasts, analysts, and investors alike, the unfolding story of Bitcoin is a riveting saga, punctuated by moments of suspense, elation, and profound insights.

To delve deeper into the evolving narrative of digital finance and explore more trending news stories like this, visit DeFi Daily News.

:max_bytes(150000):strip_icc()/Health-GettyImages-1441694626-482091a7e2c14bc4924c59bd7df4f030.jpg?w=120&resize=120,86&ssl=1)