rewrite this content using a minimum of 1000 words and keep HTML tags

Binance staking is a way to earn rewards by locking your crypto on the Binance platform. It supports over 100 Proof of Stake (PoS) coins and gives you passive income in return. The benefits of staking on Binance include a beginner-friendly and straightforward setup, a wide range of supported coins to choose from, and the flexibility to select between locked or flexible staking options based on your needs.

To stake on Binance, you must log in to your account, go to the “Simple Earn” section, select a supported coin, choose between locked or flexible terms, enter the amount, and confirm the staking process.

In this Binance staking review, we will explain what it is, how it works, and its pros and cons. We will also provide you with a step-by-step guide on how to stake and unstake your crypto on Binance.

Binance Staking Review: What Is It?

Crypto staking on Binance involves locking digital assets to support a blockchain network’s security and earn rewards. This system is called Proof-of-Stake (PoS), and when you stake your crypto, you are mainly helping to verify and add new transactions to the blockchain.

Unlike mining, staking requires no hardware or energy. No hardware or energy is required. You just need to hold your coins on the platform, and Binance manages technical processes. You only need to choose the coin and the staking period.

Binance offers both types of staking: Locked Staking and Flexible Staking. Locked means your funds stay locked for a few days or weeks, and flexible means you can unstake your funds anytime. Locked staking typically yields higher rewards.

Binance vs. Binance.US Staking: What Are the Differences?

Binance and Binance.US both offer crypto staking services to their users, but have some differences. Global Binance supports more than 100 coins for staking, so you can stake coins like BNB, ADA, DOT, SOL, and many others. Binance.US gives fewer choices, and to be exact, it supports around 20 coins only.

Global Binance distributes staking rewards daily or weekly, depending on the coin. On Binance.US, most rewards are paid weekly. Additionally, APR varies between platforms. Binance generally offers high APRs due to its support for more niche coins, which you won’t find on the Binance.US platform.

Binance charges a lower staking fee compared to Binance.US. On global Binance, the fee can go up to 10% of your rewards, which is quite reasonable. But on Binance.US, the fee is much higher; it can range between 9.95% and even go up to 39.95%, depending on the coin you stake.

FeatureBinanceBinance.USSupported PoS coins100+ different coins20+ coins (e.g., ETH, ADA, BNB, SOL, MATIC)Staking typeLocked & Flexible stakingFlexible stakingReward distributionDaily or weekly, depending on the coinWeeklyStaking FeesUp to 10% of staking rewards9.95 – 39.95%Ease of useFull interface, more optionsClean, simple staking interfaceAPR rangesHigh APRLow APR (compared to global Binance)Technical requirementsNo node needed; Binance runs validatorsNo node neededEligibilityGlobal usersUS users only

What Are the Benefits of Staking on Binance?

The benefits of staking on Binance are earning passive income, easy usage, supporting the network, having many crypto options, and not needing to run a validator node.

Earn Passive Income: One main benefit is that you can earn more cryptocurrency without doing much work. Your crypto earns rewards just by staying in your Binance account, and this can be seen as an effective method to grow your cryptocurrency holdings.Easy to Use: Binance makes staking very simple. You do not need to have special computer skills or equipment. You just have to choose the crypto you want to stake on the platform and confirm it with a few clicks.Support the Network: You actively strengthen blockchain network security by staking your cryptocurrency. Your staked assets are used to verify transactions and keep the network safe.Many Crypto Options: Binance offers staking for a lot of different cryptocurrencies, over 100 coins. You can choose which coin you want to stake based on what you have and the rewards offered. They also have different staking periods, like flexible or locked.No Need to Run a Node: You do not need to set up any validator or system. Binance handles everything for you, and you only need to hold coins in your account.

What Are the Limitations of Binance Staking?

The limitations of Binance staking include lock-up periods, market changes, limited new coin support, slow unstaking, and changing reward rates.

Lock-up Periods: Sometimes, when you stake your crypto, it gets locked for a certain time. During this period, you cannot move or sell your staked coins. Thus, this can be an issue if you need your funds quickly. For some coins, Binance allows you to unstake before maturity, but in this case, you have to return your earned staking rewards. Market Volatility: The value of your staked cryptocurrency can go up or down very fast. Even if you earn rewards, if the price of the coin drops a lot, the value of your total investment might still be lower. The market can be very uncertain.Limited Availability for Some Coins: While Binance offers many options, not every single cryptocurrency can be staked. Additionally, staking spots for popular coins may become unavailable quickly, and this means you might not always find a spot for the specific coin you want to stake.Unstaking Time: When you decide to stop staking and get your coins back, there can be a waiting period. This is called the unstaking period. During this time, your coins are not available for use, and you do not earn any new rewards. The unstaking period varies by the coin you staked.Reward Rates Change: The APR is not fixed. It can go up or down at any time. This makes it hard to guess how much you will earn.

What Are Binance Staking Rewards and Rates?

Binance staking rewards are the profits you earn for locking your crypto on the Binance platform. The reward is usually displayed as Annual Percentage Rate (APR), an estimated annual return. So, some coins give 10% APR, and some give 15% or more. But this rate can change at any time. Here are Binance staking rates for some popular coins (at the time of writing):

CoinsStaking APR (Simple Earn)USD Coin (USDC)11.61%Tether (USDT)12.2%Ethereum (ETH)1.24%Solana (SOL)5.1%Polkadot (DOT)5.8%Cardano (ADA)2.1%

How Does Binance Staking Rewards Work?

Binance staking rewards work by giving you earnings for holding certain coins on the platform. When you stake a cryptocurrency, Binance secures it for you. They then use your locked coin to secure the blockchain network. You don’t need to do any difficult technical stuff yourself; Binance handles all that for you. Because your coins help this network stay safe and run smoothly, you get rewards back.

These rewards are actually distributed through the blockchain network itself, not directly from Binance. Binance just helps to collect these rewards and then sends them to your account.

The amount of reward depends on the coin, the network rules, and how much you stake. Some coins pay higher, and some pay lower. Binance also shows you an Annual Percentage Rate (APR), which is like an estimated yearly return, before you start. But remember, this APR can change and is not a fixed number. Some rewards are paid daily, and some are weekly.

Binance has two main ways to stake. One is called flexible staking, and the other is locked staking. Your coins are held for a set amount of time with locked staking, like 30 or 90 days, and you usually get bigger rewards for this. Flexible staking lets you withdraw your coins almost any time you want, but the rewards are often smaller.

Binance also takes a small fee from the rewards you earn, which is generally around 10%. Once staking ends, your coins and rewards are returned to your Binance wallet.

What Are the Types of Staking on Binance?

The types of staking on Binance are locked staking, DeFi staking, ETH 2.0 staking, and flexible staking.

Locked Staking

Locked Staking on Binance is a method of receiving higher rewards for your crypto holdings. When you opt for locked staking (also called fixed-term staking), you mainly commit to leaving your crypto locked in a Binance account for an agreed duration. This duration can be, for instance, 30 days, 60 days, or 90 days.

You are not allowed to transfer or sell your coins during the locked duration. Since your coins are being locked for a predetermined time, the rewards earned by you are generally higher. This is reflected in the form of a higher Annual Percentage Rate (APR). It implies that more comes back to you compared to flexible staking.

This style of staking is great if you are going to keep your coins for the long term in any case. It lets you get more value from your crypto while it’s sitting idle. The terms of each locked staking product will indicate to you the actual lock-up period and the APR you can receive. At the end of the selected period, your initial staked quantity and the rewards you earned are transferred back to your spot wallet.

DeFi Staking

DeFi Staking on Binance enables you to participate in decentralized finance (DeFi) projects. You can participate via Binance, avoiding complex technical processes. DeFi projects are based on blockchain and can provide services such as lending or borrowing cryptocurrency, all without involving banks. Using Binance’s DeFi staking, Binance links your cryptocurrency to these third-party DeFi protocols.

Binance manages complex tasks, selecting reliable DeFi projects. You just need to place your cryptocurrency in Binance’s DeFi staking program, and Binance becomes the intermediary to these decentralized services.

You will then receive rewards from these DeFi protocols in return. Hence, this makes it easier and safer for normal users to get involved in DeFi. Binance selects reliable DeFi protocols, though risks such as smart contract vulnerabilities remain.

ETH 2.0 Staking

ETH 2.0 Staking, which is now referred to as Ethereum’s Beacon Chain staking, is mainly a way to support the upgrade of the Ethereum network. Binance provides an easy means of getting involved in it. When you stake your Ethereum (ETH) into ETH 2.0 via Binance, your ETH is locked up for an extremely long period of time. It will remain locked until the entire Ethereum network upgrade is complete, something that could take a couple of years.

Because of this extended lock-up, Binance provides a unique BETH token. If you stake ETH for ETH 2.0, you receive BETH at a 1:1 ratio in return. BETH is a token that represents your staked ETH along with whatever rewards you accumulate. Binance takes care of all the technical requirements of ETH 2.0 staking so that users can easily join.

Flexible Staking

Flexible Staking on Binance is an extremely simple method of getting some rewards from your cryptocurrency. Unlike locked staking, flexible staking allows withdrawals without a fixed duration. This implies that you can put your crypto in for staking and withdraw it almost at any time you desire. There is no significant lock-up period. This is ideal for accessing coins for trading or other uses.

The key advantage is the ease of withdrawing your money. But since you can withdraw your coins at will, the rewards you get are typically lower compared to locked staking. The Annual Percentage Yield (APY) of flexible staking tends to be lower. This is suitable for users who wish to receive some extra from their unused crypto but would like to keep their money readily available.

How to Stake and Unstake on Binance?

To stake on Binance, you need to log in and find the staking section, then choose your staking type and the specific coin, input the amount to stake and confirm the details, and finally, monitor your staking activity and rewards.

To unstake on Binance, you need to go to your staking page and initiate the redemption, then wait for the required unstaking period (which is up to 24 hours for some coins), and finally, receive your crypto back in your wallet.

Step-by-Step Guide to Staking on Binance

Step 1: Log In and Find Staking Section

First, you need to open your web browser and go to the official Binance website. If you are not already logged in, enter your email or phone number and your password to sign in to your Binance account. Also, if you are new, learn everything about the exchange in our honest and detailed Binance review, and register using our Binance referral code to get a $100 welcome bonus.

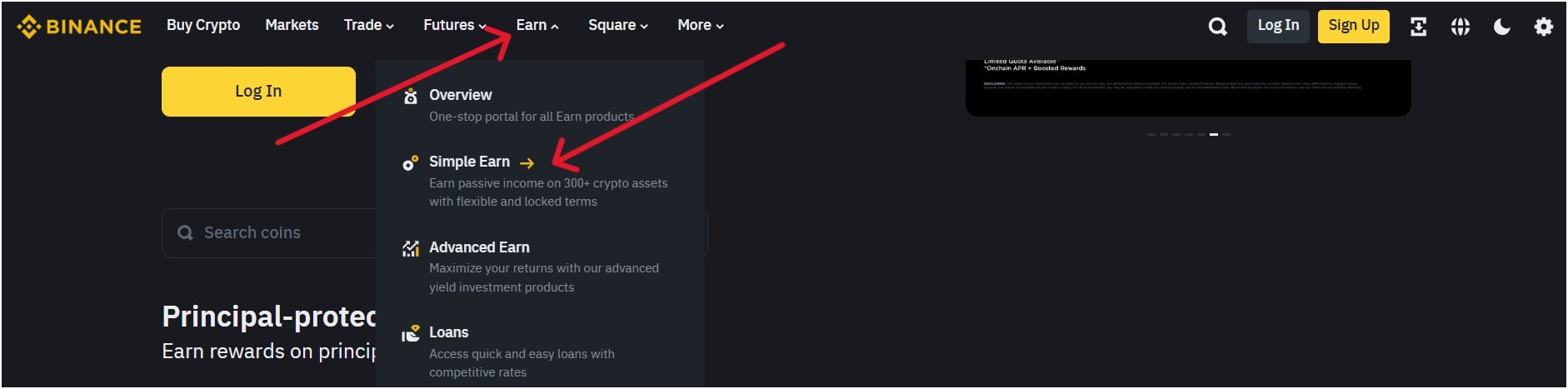

Once logged in, navigate to the top menu bar to find options like ‘Trade,’ ‘Earn,’ and more. Move your mouse over the “Earn” button. A drop-down menu will appear. In this menu, look for an option that says “Simple Earn”. Click on this. This will take you to the main staking page.

Step 2: Choose Your Staking Type and Coin

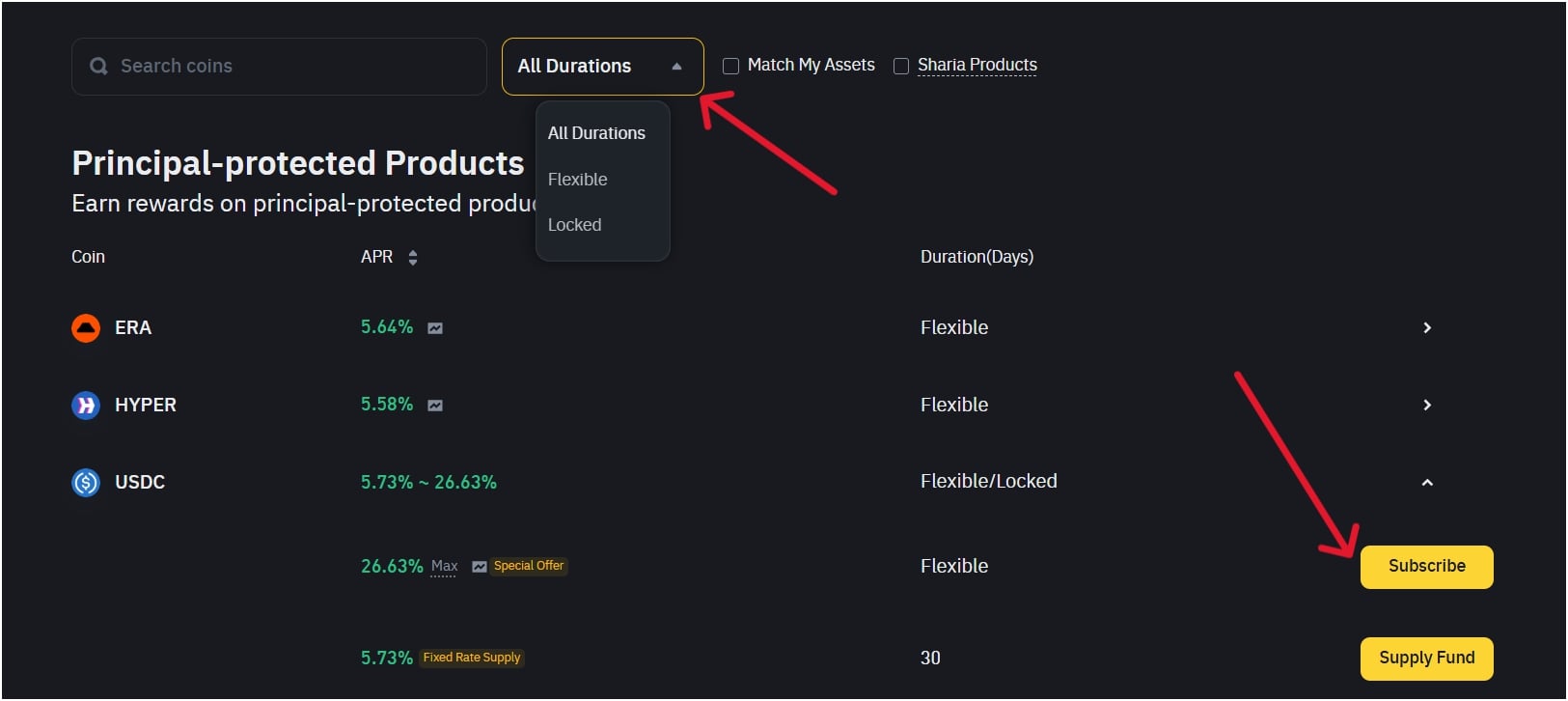

Now, here on the Binance Staking page, you will see different types of staking available. As discussed above, the most common ones are “Locked Staking” and “Flexible Staking”.Then you can select your preferred staking type from the available options.

Review the list of cryptocurrencies available for staking, each displaying the Annual Percentage Rate (APR), which is the estimated yearly reward, and also the available periods for locked staking. You should choose the cryptocurrency you want to stake and the staking type that fits your needs, and then click on the coin you want to stake.

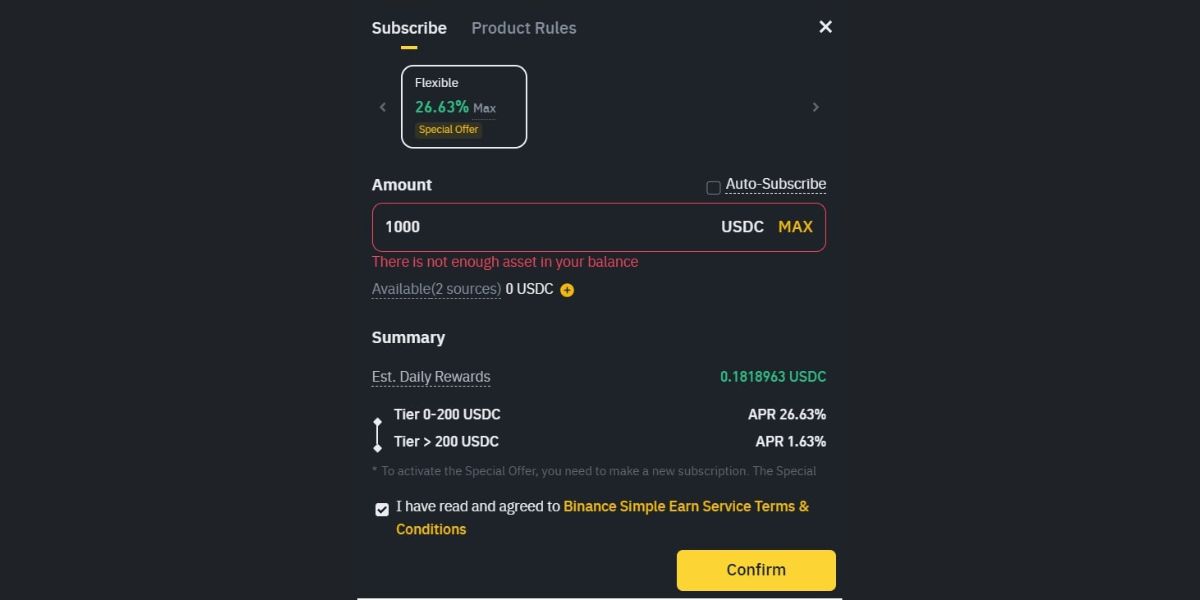

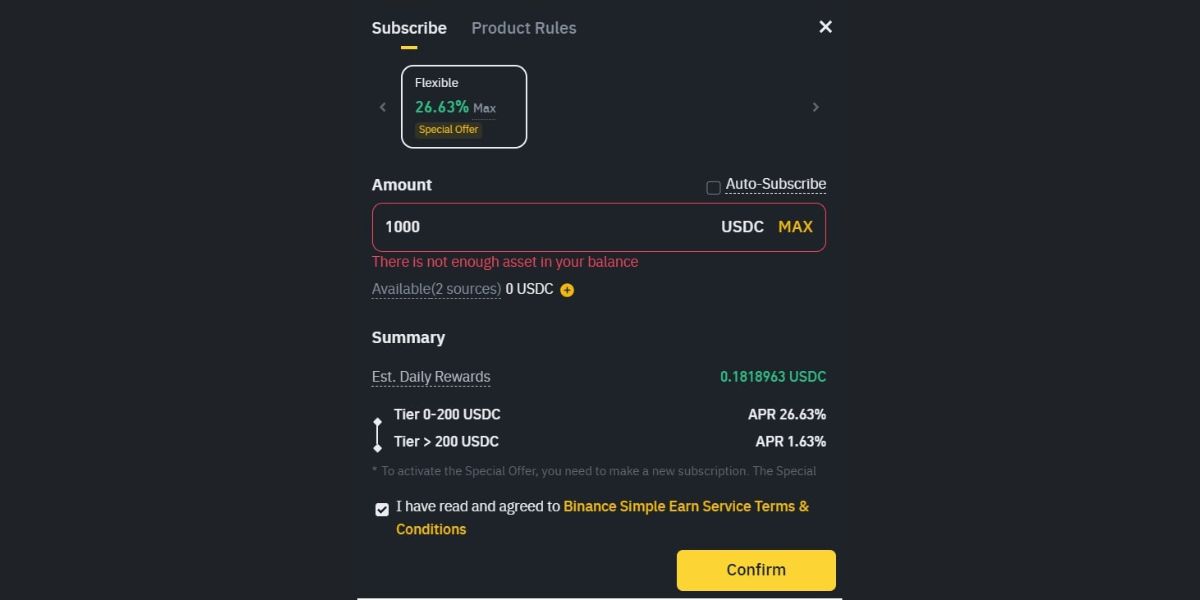

Step 3: Input Staking Amount and Confirm

After you choose your coin, a new window or page will open, and here, you need to enter the amount of cryptocurrency you want to stake. There will be a box where you can type in the number of coins. Also, you must review the minimum and maximum staking amounts for your chosen coin before staking.

You will also see details about the staking period (if it’s locked staking), the estimated APR, and when your rewards will be paid. And, make sure to read the staking rules and agreements carefully. These rules explain things like unstaking times or any special conditions. After you have checked all the details and are happy with them, click the “Confirm” button. This will start your staking.

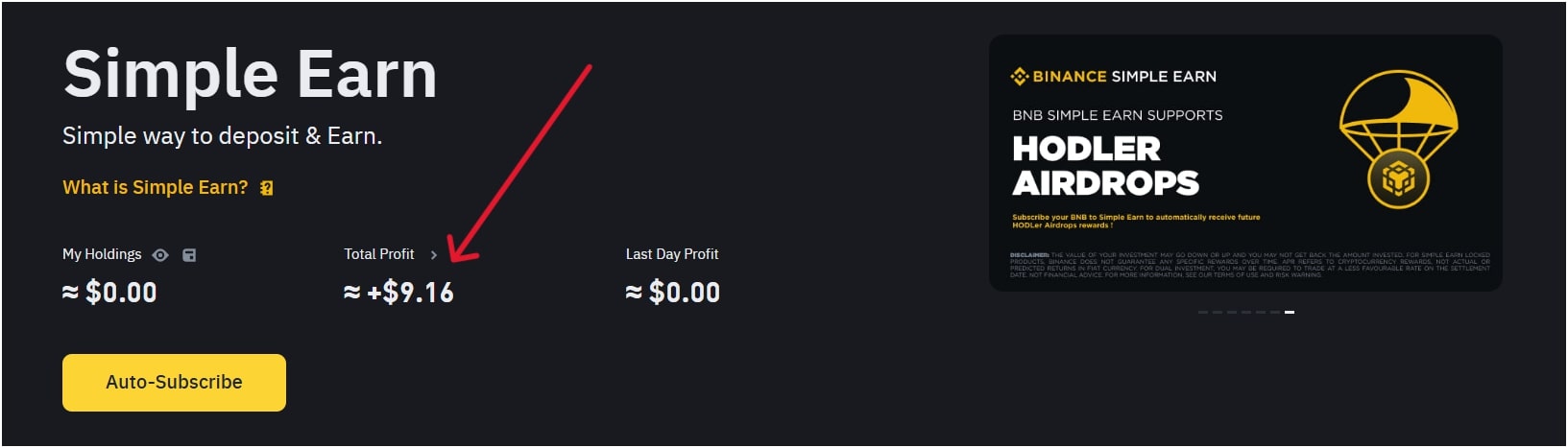

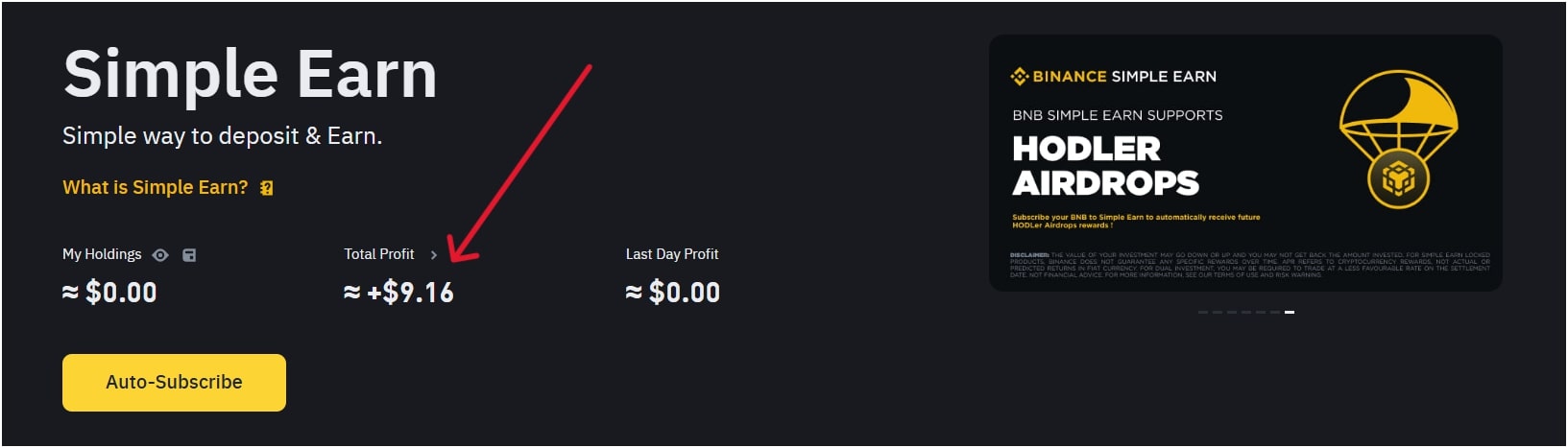

Step 4: Monitor Your Staking and Rewards

Once you have started staking, you can easily check its status. Go back to your Binance account dashboard, and then, look for sections like “Simple Earn”. This page will show you all your active staking products.

Here, you can see how much crypto you have staked, the rewards you have earned so far, and the time remaining if it is locked staking. Rewards are automatically sent to your Spot Wallet daily or weekly. You can monitor your rewards’ growth.

How to Unstake and Redeem on Binance?

To unstake or redeem your staked coins on Binance, you need to visit the “Simple Earn” page again. For flexible staking or early locked staking redemption (where permitted), visit the Simple Earn page. Find the active staking product and look for an “Unstake” button.

Now, click it and follow the steps to confirm, and also remember, there might be a short unstaking period before the coins are fully returned to your Spot Wallet. Unstaking period is generally around 24 hours for some coins. Also, for a full locked staking period, your principal amount and earned rewards are often returned to your Spot Wallet automatically after the period ends. After earning profits, you can explore our guide on how to withdraw your funds from Binance to a bank account.

Is Staking Safe on Binance?

Yes, staking on Binance is generally considered safe, as Binance is a large and well-known cryptocurrency exchange with over 250 million users. They use strong security methods to protect user funds, like two-factor authentication and keeping most funds in “cold storage” (offline wallets), and Binance also has a Secure Asset Fund for Users (SAFU), which can help cover losses in case of a security breach. However, staking involves risks beyond Binance’s control, such as market volatility. The value of the crypto you stake can go down due to market changes.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website [http://defi-daily.com] and label it “DeFi Daily News” for more trending news articles like this

Source link