rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Strong Big Tech earnings can’t take away US election nervousness

Last week, Alphabet, Meta, Microsoft, Amazon, and Apple all delivered their earnings reports for the latest quarter. Alphabet and Amazon surprised with stronger-than-expected results, while Microsoft disappointed with a warning of slower growth due to capacity constraints. Combined, the five tech giants generated $450 billion in revenue, which they are set to invest heavily in AI. Amazon CEO Andy Jassy even referred to it as a “once-in-a-lifetime opportunity”.

Big Tech is reportedly seeing customers spend more time on AI-enhanced platforms, leading to more ad impressions and product sales. This trend justifies further increases in capital expenditure budgets, with a combined run rate of $250 billion per year. Microsoft (in partnership with OpenAI), Alphabet, and Meta are investing heavily in their own large language models, while Amazon and Apple choose to build on the efforts of multiple external providers.

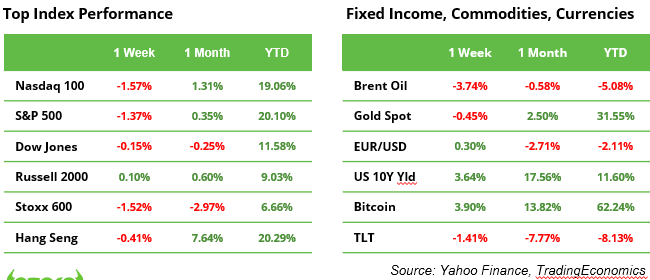

Big Tech earnings couldn’t prevent equity markets from retreating though. Uncertainty surrounding the outcome of the US elections and concerns about ballooning government debt sent the S&P 500 and Nasdaq down by 1.4% and 1.6%, respectively. Bond investors demanding a higher risk premium for holding government debt pushed the US 10-year interest rate up to 4.4%. However, new macroeconomic data on growth, inflation and the jobs market suggest that the Fed’s most likely move this week is to cut the policy rate by 0.25%. In response to an outlook of weaker global growth and a drop in oil prices of nearly 4% over the past week, OPEC+ decided over the weekend to postpone a planned production increase.

The market is awaiting the US election outcome before choosing a direction towards year end.

Fed seen to cut its policy interest rate with another 0.25% on Thursday

The latest US economic data didn’t provide a best-case scenario for Wall Street but remained acceptable for investors, reinforcing expectations for a small Fed rate cut on Thursday. The market has nearly fully priced in a 0.25% reduction to a range of 4.50% to 4.75%. The data pointed to a cooling labour market, slightly slower growth, and stagnant core PCE inflation. While these signals support a “soft landing”, recession risks have increased as a result, which may lead investors to speculate on further rate cuts in the medium term. Fed Chair Powell’s press conference could provide crucial insights into the future course of the rate-cutting cycle.

US presidential election: will it be Trump or Harris?

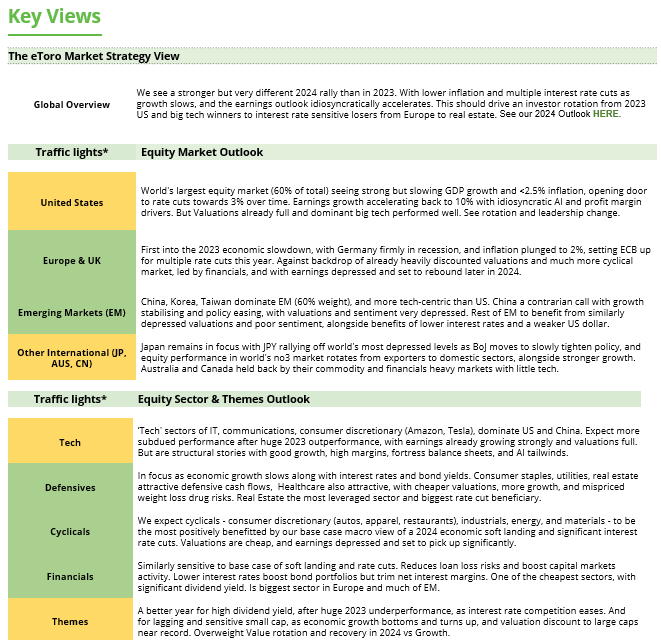

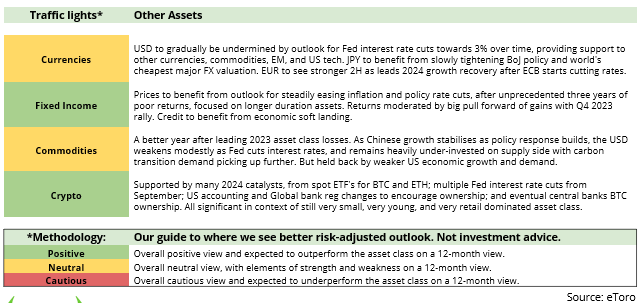

The outcome of the US elections carries significant weight, as the winning candidate will set the tone for the coming years. However, it remains challenging to gauge how much a president can genuinely influence GDP growth or stock market performance. More critical than political leadership is the overall health of the economy, which currently positions the US relatively strongly. The Federal Reserve retains ample flexibility to respond to unexpected developments. While present risks increase vulnerability to shocks, the long-term outlook remains positive. Even so, the economic impact of political decisions should not be underestimated.

At the core of this heated election-year debate lies tax policy, a key issue sharply dividing the candidates. Republicans advocate tax cuts to stimulate economic growth, with Trump proposing a drastic 60% tariff on Chinese imports—a risky move with potential repercussions for US consumers. In contrast, Democrats are calling for tax hikes on the wealthiest to address rising income inequality, a shift that could profoundly impact sectors like luxury goods, telecommunications, and financial services.

Trump’s policies could favour the defence sector, while a Harris victory might bring the healthcare sector into sharper focus. In terms of energy policy, fossil fuels and renewables stand in stark opposition, creating uncertainty for businesses. However, there is bipartisan consensus on the pressing need for investment in US infrastructure and on the importance of maintaining technological leadership over China.

Earnings and events

Interest rate decisions by the Fed and the Bank of England are the main macroeconomic releases the market will focus on this week. Besides, China and Germany will publish new trade balance data. All this activity takes place on Thursday 7 November.

Many companies report earnings this week, including 100 out the S&P 500. A selection:

Earnings releases:

4 Nov. Palantir, Constellation Energy

5 Nov. Ferrari, Deutsche Post, Unicredit

6 Nov. Qualcomm, Arm, Novo Nordisk

7 Nov. Barrick Gold, Cameco, Arista Networks, Rivian, Airbnb, The Trade Desk

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link