rewrite this content using a minimum of 1200 words and keep HTML tags

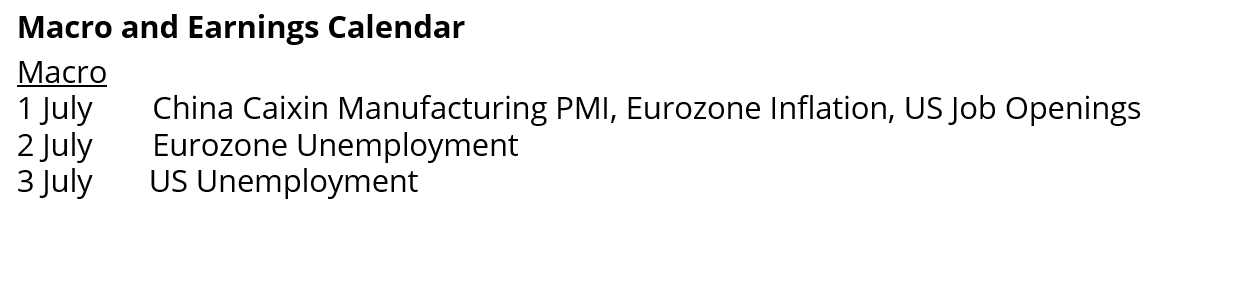

Analyst Weekly, June 30, 2025

Industrial power generation stocks have been on a heater lately, but unlike the AI chip crowd, they might not be over-owned just yet. While some investors see a short-term breather coming, long-term tailwinds are only getting stronger.

AI Ate My Electric Bill: First came EVs, then came AI, and both are hungry for electricity. A single ChatGPT prompt? It can gulp down 10x the energy of your average Google search. Training a model like GPT-3? That’s a year’s worth of power for 130 US homes. As AI adoption spreads from niche tools to enterprise-wide functions (per McKinsey), the demand for data centers, and the juice to run them, is set to surge.

Infrastructure Meets Intelligence: Data centers don’t run on vibes. They need real infrastructure, power grids, turbines, and backup generators. That’s fueling a quiet boom in industrial power generation, and investors are starting to take notice.

Not Just AI, Not Just the West: Emerging markets are adding demand of their own, think air conditioning, basic electrification, and expanding grids. Meanwhile, geopolitical shifts and a potentially energy-friendly White House could slow the anti-fossil-fuel push, creating breathing room for the sector.

Long-Term Voltage: The AI era is just warming up, and the power behind it may still be under-owned. This might be the early innings of a new kind of industrial revolution. Deglobalization and digitization may feel like separate trends, but both plug into the same outlet: demand for more local, more reliable, and more powerful energy.

Source: Census data as of April 30, 2025

Tariff Revenues Are Quietly Balancing the Books

US customs just logged another $20B in tariff revenue for June, pushing total tariff income $60B higher than this time last year. That surge is doing more than protecting trade interest, it’s becoming a critical offset to the cost of tax cuts moving through Congress.

Deficit Shrinks, Thanks to Trade Duties: For three straight months, the US budget deficit has narrowed year-over-year. June’s improvement came despite weak corporate tax receipts mid-month. That’s partly because tariff revenues are acting as a fiscal cushion. Moody’s flagged tax cuts as a risk in its downgrade projections but didn’t factor in the tariff tailwind. A notable omission.

Legal Risk on the Horizon: The tariff program isn’t bulletproof. Legal challenges are in motion, with appeals court hearings set for July 31 and a Supreme Court ruling expected in the fall. But the Administration appears ready with a fallback to keep revenue flowing, signaling that removing tariffs, even under new leadership in 2028, won’t be simple. Any unwind could require higher corporate or personal taxes to fill the gap.

Inflation Impact Still MIA: Fed Chair Powell has warned that tariffs should eventually show up in inflation metrics but so far, CPI remains unbothered. While some prices on tariffed goods have risen, cheaper prices elsewhere (like non-tariffed imports) and pressure from oil and housing are keeping overall inflation grounded.

Profits Taking the Hit? If consumers aren’t absorbing the cost and inflation data isn’t reflecting it, it raises a key possibility: companies may be swallowing the tariffs themselves. That would mean tariffs are quietly pressuring profit margins, making them deflationary, not inflationary.

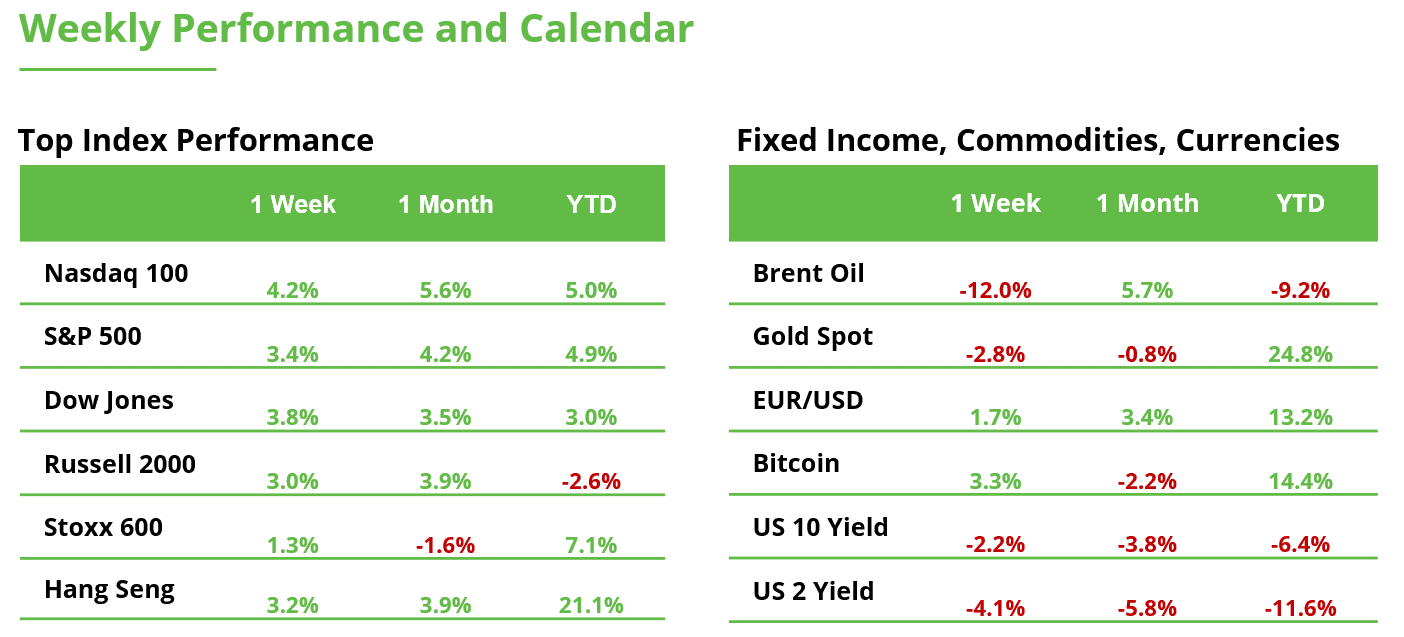

Tech is back – but different: These are the top-performing stocks of 2025

The Nasdaq 100 became the first U.S. stock index to reach a new all-time high last week. Tech is back – but in a new form. Beneath the surface, a shift in market dynamics is becoming apparent. Only one stock among the ten most valuable companies is currently a top performer in 2025, and that’s the streaming provider Netflix.

Nasdaq 100 in the daily chart: The index has been rising for six consecutive trading days. From a technical perspective, a continuation of the long-term uptrend appears most likely. In the event of pullbacks, the two fair value gaps created during the recent rally could serve as key price zones: 22,326 to 22,379 points and 21,874 to 22,163 points. The former all-time high is marked with the blue line.

Source: eToro

Selective Stock Picking: Breadth within the tech sector is increasing. Investors are no longer focused solely on the major mega-caps. Over the past two years, Nvidia, Microsoft, and Apple were the key drivers of Nasdaq 100 performance due to their heavy index weighting. Recent developments indicate a structurally healthier rally. Selective stock picking is gaining importance, a positive signal for active investors and active management.

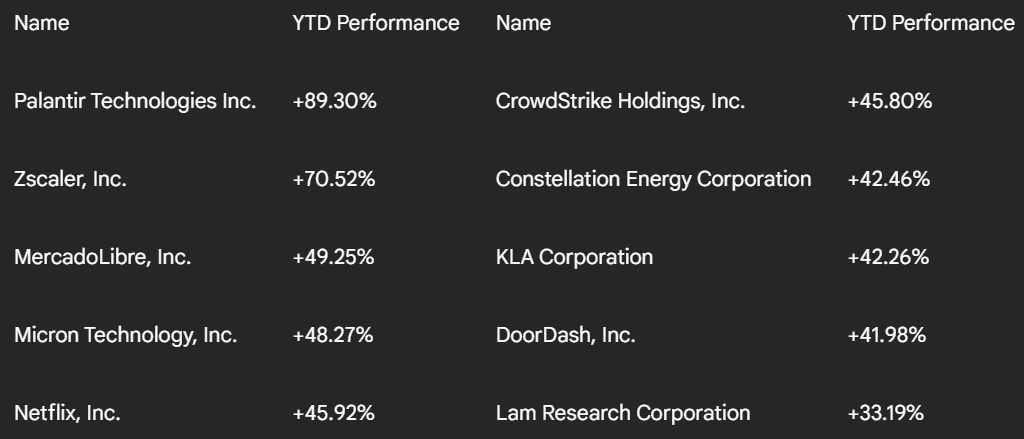

These Are the Outperformers: The list of the top 10 best-performing stocks year-to-date can be grouped into broader categories:

Palantir Technologies, Zscaler, and CrowdStrike represent investor interest in software, artificial intelligence, and big data.

The semiconductor and semiconductor equipment segment is also in focus, with Micron Technology, KLA, and Lam Research among the most sought-after names.

In e-commerce and internet services, MercadoLibre, DoorDash, and Netflix are seeing strong demand.

Constellation Energy is the only energy stock in the top 10.

Top 10 performers in the Nasdaq 100 year-to-date. Source: TradingView, Gemini

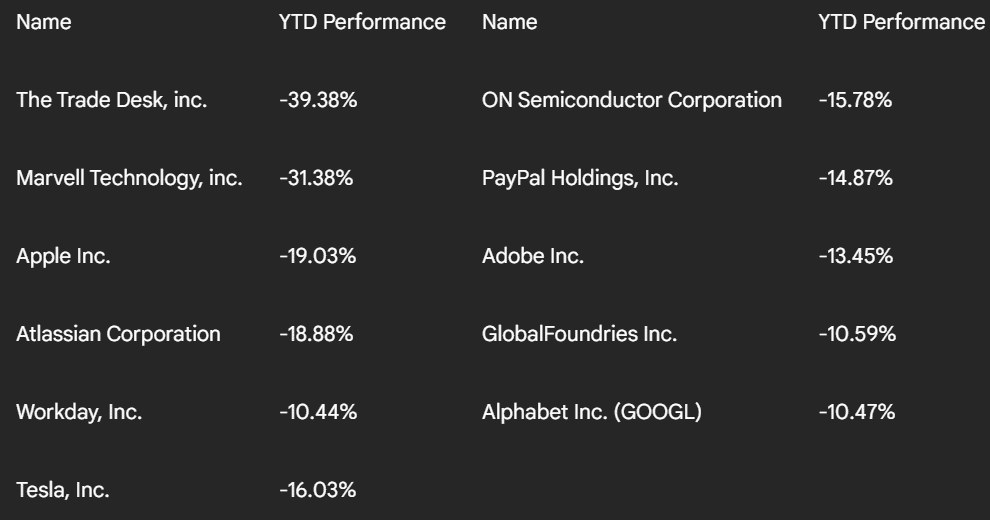

These Are the Underperformers: 11 of the 20 worst-performing stocks year-to-date come from the technology sector. Despite the broader tech rally, there are significant weaknesses within the sector. Even heavyweights are among the laggards. Apple, Alphabet, and Tesla are all among the ten most valuable companies worldwide, yet currently rank among the biggest decliners. Market capitalization alone is no longer a sufficient investment criterion.

11 tech laggards in the Nasdaq 100 year-to-date. Source: TradingView, Gemini

These weak tech stocks can be divided into five key sub-sectors. Their weakness is not random, but concentrated in segments particularly affected by tariff risks and structural headwinds:

Sub-sector 1: Software, Cloud and Ad-Tech – The Trade Desk, Atlassian Corporation, Adobe, Workday

Sub-sector 2: Semiconductors and Semiconductor Equipment – Marvell Technology, ON Semiconductor Corporation, GlobalFoundries

Sub-sector 3: Internet Services and Platforms – Alphabet, PayPal

Sub-sector 4: Hardware and Consumer Electronics – Apple

Sub-sector 5: Automotive and E-Mobility – Tesla

Bottomline: Investors should take a differentiated approach to their tech exposure. Digital business models tend to offer protection from tariff risks, while globalized hardware and manufacturing companies are more vulnerable. Sharp price moves are especially likely in response to tariff-related news, in both directions. A comeback starts with trust, and building trust is a process that takes time.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link