rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Most markets rose steadily in anticipation of Donald Trump’s presidency

Last week offered something for every type of investor. Bond and small-cap investors found some relief in softer-than-expected inflation data, which caused the US 10-year yield to fall from 4.76% to 4.62%. Value investors were pleased with solid US bank earnings, all of which exceeded expectations. Growth and AI investors welcomed TSMC’s announcement of a planned increase in capital expenditures for 2025 to approximately $40 billion, sparking speculation about which portion will fund a new state-of-the-art factory in the US.

Meanwhile, cryptocurrency enthusiasts were astonished by the launch of a Trump memecoin, which skyrocketed to billions in market value. This surge also lifted Bitcoin by 11% (to a new alltime high of $108,900), although it caused a decline in many altcoins. China’s GDP growth in the fourth quarter of 2024 rose to 5.4%, arguably driven by front-loaded exports seeking to avoid higher tariffs under Trump’s presidency.

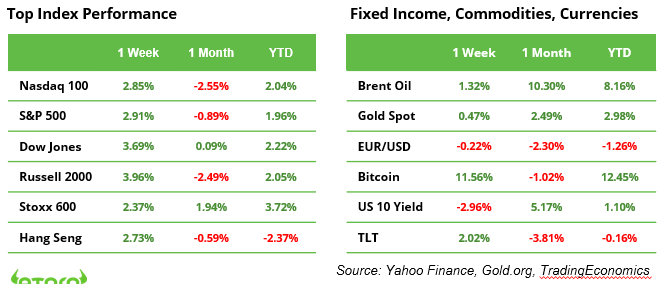

Major equity indices closed the week in positive territory. The S&P 500 and Nasdaq 100 were up by 3%, while the Dow Jones and Russell 2000 gained 3.7% and 4.0%, respectively. The European STOXX 600 and the China-focused Hang Seng also posted gains of 2.4% and 2.7%, respectively. The UK FTSE 100 Index reached a new all-time high above 8,500 points on Friday (see chart).

Macro Outlook for the week

This week in macro, investors will focus on the UK’s unemployment and wage growth data, following last week’s lower-than-expected inflation, retail sales, and GDP figures. Markets are factoring in significant rate cuts by the Bank of England in 2025, aiming to facilitate a soft landing for the economy.

Attention will also turn to Germany’s economic sentiment index, as investors seek signs of improving sentiment, particularly in light of recent GDP data showing the economy contracted for a second consecutive year. Notably, Germany remains the only major industrialized nation where GDP per capita is projected to stay below 2019 levels through 2025.

FTSE 100 Index reached a new all-time high above 8,500 points on Friday

Who decides the fate of the yen, the Bank of Japan or Donald Trump?

The yen and the euro have been losing ground against the dollar for months, with the greenback buoyed by a strong US economy and the “Trump Trade,” driven by proposed tax cuts and looming tariffs.

Last week brought some relief: EUR/USD climbed above 1.027, while USD/JPY fell 1% to 156.2. Yen traders responded to Bank of Japan (BoJ) Governor Kazuo Ueda’s hints of a potential rate hike this Friday, following key inflation data due earlier that day.

However, Japan’s options remain limited. Years of sluggish growth and high public debt keep the economy reliant on low interest rates. While the BoJ might stabilise the yen, a major rally seems unlikely. A weaker US dollar could prove more impactful than any BoJ policy shift.

The yen’s fate may ultimately rest with Trump. His inauguration on Monday could shape markets, with a strong dollar still the baseline under his “America First” agenda. However, softer tariffs or fiscal policies could weaken the dollar and give the yen some respite.

Earnings season: big names reporting

The earnings season is entering its crucial second week, with seven of the world’s top 100 largest companies reporting their 2024 Q4 earnings (see below). Investors should recognise that some stock prices may have been influenced by the upcoming presidential transition. In his final days, Joe Biden allocated $26 billion to clean energy projects. Meanwhile, Donald Trump has repeatedly stated his intention to impose a 20% tariff on all goods sold to the US, and a 60% tariff specifically on goods from China. Execution orders, signed by Trump in his first week, could change federal policies from the start and cause unexpected market movements.

Macro and earnings data releases

Macro

UK unemployment, Germany ZEW (22/1), Japan CPI, BoJ rate decision, Global PMI (24/1)

Earnings

21 Jan. Netflix, Charles Schwab, 3M, United Airlines

22 Jan. Procter & Gamble, Johnson & Johnson, GE Vernova, Amphenol

23 Jan. GE Aerospace, Texas Instruments, American Airlines

24 Jan. American Express, Verizon, NextEra Energy

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link