rewrite this content using a minimum of 1000 words and keep HTML tags

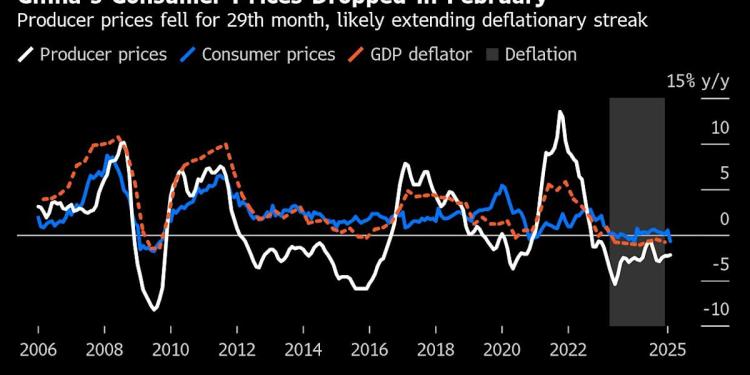

(Bloomberg) — Stocks in Asia were poised for a volatile opening on Monday as markets grappled with Chinese deflation and Federal Reserve Chair Jerome Powell acknowledging uncertainty in the US economic outlook.

Most Read from Bloomberg

Australian stocks were little changed, equity-index futures for Japan advanced while those for Hong Kong edged lower. Contracts for the S&P 500 and the tech-heavy Nasdaq 100 fell while the yen gained. Oil fell on Monday after posting a seventh weekly loss, while Bitcoin extended its drops. Bonds fell and the greenback slipped to cap its worst week since 2022.

A myriad of headlines around the economy, tariffs and geopolitical developments combined for a roller-coaster week for markets. With it has come increased volatility, with the Cboe Volatility Index — which measures expectations for S&P 500 swings over the next month — rising above 26 intraday last week, a level rarely seen since the Covid era of 2020-2022.

While Powell acknowledged a rise in uncertainty for the US economic outlook on Friday, he said officials didn’t need to rush to cut interest rates. Furthermore, he expected the path to 2% inflation to continue, suggesting price hikes from tariffs may be temporary.

Powell “appeared calm on growth, pleased with the progress occurring on inflation and somewhat dismissive of the recent rise in inflation expectations,” Vital Knowledge founder Adam Crisafulli said, noting that the Fed Chair’s words “clearly had a positive effect on markets.”

Treasury yields rose Friday and the dollar lifted off lows after Powell’s comments as the market tamped down expectations the central bank may resume cutting interest rates as soon as May. Bonds have been caught between signs that US economic growth is slowing and sticky inflation in the past month.

US job growth steadied last month while the unemployment rate rose — a mixed snapshot of the labor market. Nonfarm payrolls increased 151,000 in February after a downward revision to the prior month. The unemployment rate climbed to 4.1%.

“Friday’s jobs report was weaker than expected, which is concerning because this report doesn’t account for the recent government job cuts from DOGE,” said Glen Smith, chief investment officer at GDS Wealth Management. He added that the report “suggested that businesses are taking a pause on hiring until there is more certainty about tariff policy and the economic outlook.”

Story Continues

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link