In today’s rapidly changing global market, the pulse of Wall Street provides a stark reflection of the broader economic sentiments pervading across continents. With a slight downturn anticipated at the bell, investors and market aficionados are on edge as they await the unveiling of job openings data, a pivotal metric that could steer the course of economic forecasts. Amidst this palpable tension, pre-market trading observed a notable dip in Nvidia Corp., with a decrease of 1.6%, an early indication of the jittery market mood.

The prelude to the trading day has been marked by a slight contraction in futures associated with the S&P 500, registering a decline of 0.4%. This movement suggests a tempering of the prior day’s significant selloff, which scaled to a 2.1% retreat. The contagion of losses wasn’t just confined within the borders of the United States but was also mirrored across Europe and Asia. The unsettling acceleration and magnitude of this retreat sent ripples of concern, pushing the Cboe Volatility Index beyond the threshold of 22, signaling a heightened sense of market anxiety. Concurrently, a semblance of relief was palpable as the dollar index saw a retreat after a bullish sprint extending over five days.

The anticipation surrounding the U.S. job openings report, scheduled for release on Wednesday, is reaching a fever pitch. Market participants are poised for data that could either confirm or dissipate the current cloud of uncertainty. Following a series of data indicating a contraction in manufacturing activity over five successive months, the focus is gradually shifting. The spotlight is transitioning from inflationary pressures to overarching concerns about economic vitality. This transition underscores a growing sensitivity within the stock market and other risk assets towards negative macroeconomic indicators.

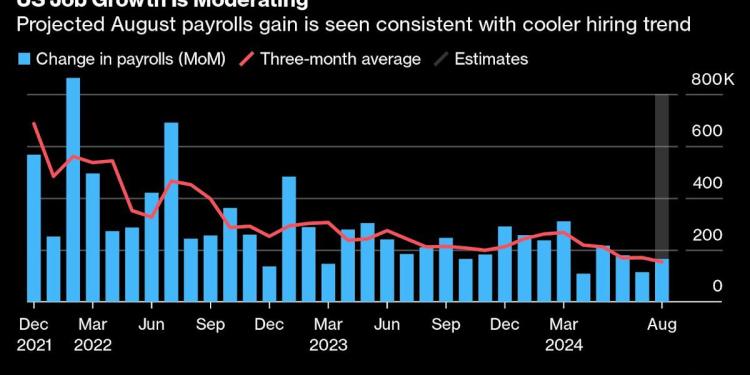

The Federal Reserve’s upcoming policy decisions are enveloped in speculation, with expectations tilting towards a relaxation in September and a prospective reduction in rates that could surpass two full percentage points over the ensuing year. This anticipated policy pivot is unparalleled outside the contexts of economic downturns since the 1980s, underscoring the gravity of the current situation. The forthcoming payrolls data, expected on Friday, stands as a critical determinant that could calibrate the magnitude and velocity of the Fed’s initial rate adjustments.

Investment strategists, including Neil Birrell of Premier Miton Investors, express caution amidst this uncertainty. The apprehension is palpable, with a consensus veering away from making bold moves until the clearer economic indicators emerge post the data release on Friday.

The Treasury market has mirrored this cautious optimism, with yields on two-year notes dwindling to 3.83%, suggestive of an increasing bet amongst traders for a significant rate cut by the Federal Reserve. This speculation has bolstered the probability of a half-point reduction in the near term, witnessing a jump in market sentiment.

The commodities market, on the other hand, displayed a mix of volatility and resilience. Oil prices experienced a modicum of recovery after a precipitous drop to a nine-month nadir, spurred by discussions within OPEC+ about postponing their supply augmentation plans. Brent futures edged above $74 a barrel, recovering from a nearly 5% slide, while West Texas Intermediate crude registered a slight increase.

A backdrop of corporate news adds another layer of intrigue and complexity to the market narrative. With the U.S. Justice Department intensifying its scrutiny with subpoenas to major players like Nvidia Corp., under the lens for potential antitrust violations, the corporate landscape remains a critical variable in the broader market equation.

As we pivot towards the remainder of the week, a slew of economic data points and central bank decisions across the globe—from Eurozone retail sales to Canada’s rate decision and a crucial report on U.S. job openings—will define the trajectory of market sentiment and economic outlook.

In this maelstrom of economic indicators, market movements, and corporate developments, the essence of strategic investment and market analysis becomes ever more crucial.

For those seeking deeper dives into the currents shaping the financial landscapes, DeFi Daily News stands as a beacon of insights, offering trending news pieces that contour the face of decentralized finance and beyond.

Conclusion:

In an entertaining twist to the week’s financial narrative, imagine market trends as a grand orchestra, each section (stocks, bonds, commodities) tuning up for a symphony led by the conductors at the Federal Reserve and global economic indicators. As investors and traders, we’re seated in the auditorium, programs in hand, trying to decipher the evening’s performance. Will it be a harmonious masterpiece or a cacophony of surprises? Only time will tell. But one thing’s for sure – the market’s score is complex, with each day adding notes to an ongoing financial opera. Grab your popcorn (or portfolio), because this show is anything but predictable!

–With assistance from industry aficionados and market strategists, we bring you this piece, leveraging insights and animations to navigate the financial tempest.

:max_bytes(150000):strip_icc()/health-GettyImages-1693327949-e40a901b96944f42b23fac6ec6bff673.jpg?w=75&resize=75,75&ssl=1)