rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

In focus: key macroeconomic data releases and the Q4 earnings season

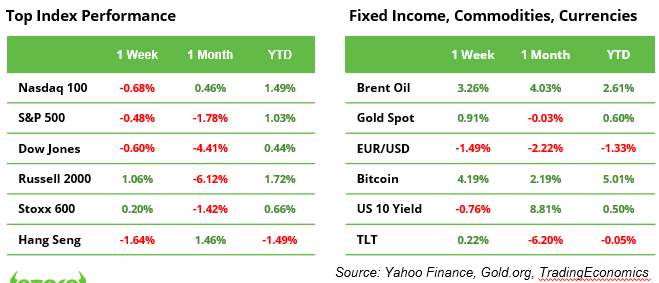

After a December marked by declining stock market averages due to profit-taking and growth concerns, major equity indices advanced in the first two trading days of 2025. The Nasdaq 100 rose by 1.5%, the S&P 500 by 1.0%, the Dow Jones by 0.4%, and the small-cap Russell 2000 gained 1.7%. Meanwhile, Bitcoin surged 5.0%, Brent crude oil increased by 2.6%, and gold gained 0.6%.

This week, investors will focus on two key themes to assess whether asset growth can continue in January: a series of macroeconomic data releases and guidance for the Q4 earnings season. The US will release labour market statistics, including job openings, non-farm payroll additions, and unemployment figures, as well as fresh data on PMI, durable goods orders, and the Fed minutes of the meeting held in December. Delta Airlines will be in the spotlight as one of the first companies to report earnings. Meanwhile, eurozone countries are set to publish inflation figures, potentially shedding light on the pace of future ECB interest rate cuts.

A key event this week is the annual Consumer Electronics Show (CES) in Las Vegas, running from 6 to 10 January, starting with a keynote speech by NVIDIA CEO Jensen Huang on Monday evening. On Thursday 9 January, US stock markets will remain closed in honour of former President Jimmy Carter, who passed away at the age of 100.

Unchecked US dollar rally: how long will it last?

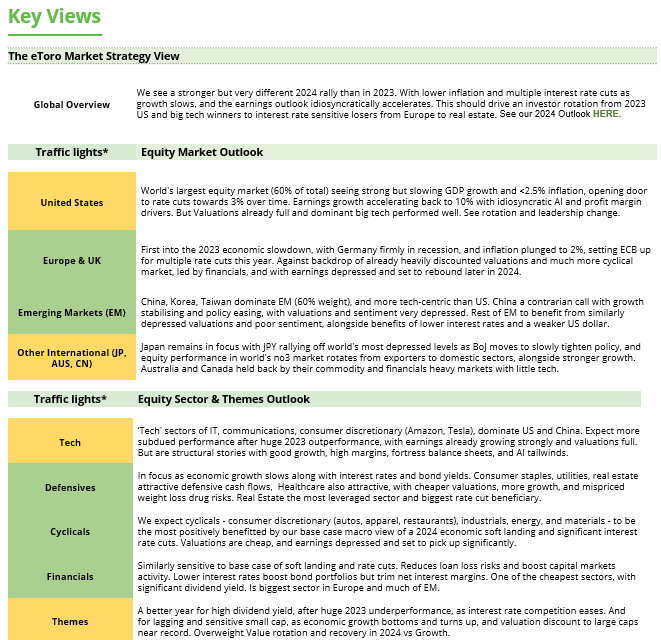

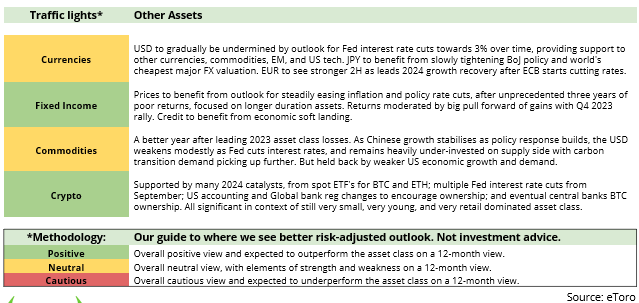

The US dollar remains in high demand. The EUR/USD pair fell below 1.03 last week, with many analysts now predicting parity. This trend is driven by a strong US economy and the so-called “Trump Trade.” An 8% rise in the US Dollar Index made 2024 the strongest year since 2015.

Historically, during Trump’s first term, the dollar depreciated in three of four years, with its steepest decline in 2017 (see chart below). Could history repeat itself? Much depends on whether Trump takes a softer stance or continues his tough “America First” trade policies. Trump’s aggressive approach relies on a robust economy. If growth falters, he may have to pivot. A more conciliatory trade policy with Europe and China could lower inflation expectations, reduce bond yields, prompt faster Fed rate cuts, and weaken the dollar.

Note: In the coming two weeks, politics may overshadow economic fundamentals in shaping the dollar’s path. With the January 20 inauguration looming, markets remain in a holding pattern.

Source: TradingView

A week full of potential turning points for the markets

The US NFP report and unemployment rate on Friday are the key highlights of the week. Non-farm payrolls are expected to show a 150K increase, with unemployment forecast at 4.2%. Since Q2 2024, there have been signs of a cooling labour market, and investors are keen to see if this trend persisted in December. On Tuesday, the ISM Services PMI data will be released . The ISM index recently fell to 52.1. Further weakness could dampen stock market rallies while increasing the likelihood of rate cuts. Markets currently anticipate one to two rate cuts in 2025. Minutes of the latest FOMC meeting will be released on Wednesday. On Friday afternoon, focus will shift to consumer confidence, which has risen for five consecutive months. Can this trend continue? In Europe, inflation data for the Eurozone will be released on Tuesday morning. The CPI has climbed from 1.7% to 2.2% over two months. For traders, a sharper rise in inflation could reignite concerns and shift attention back to ECB policy adjustments.

Don’t believe the focus on AI will diminish this year!

Although the year is just two trading days old, key AI stocks have already delivered impressive returns. NVIDIA has gained 8%, chip designer Arm is up 14%, and foundry TSMC has risen 6%. South Korean semiconductor company SK Hynix increased its total return for the year to 16% this morning. A major catalyst for this surge was a blog post by Microsoft President Brad Smith, revealing the company expects to invest $80 billion in AI data centres during fiscal year 2025. This unprecedented spending highlights the immense opportunities in the AI sector. “Picks and shovels” plays, such as the companies mentioned, stand to benefit significantly from the ongoing AI race. However, the ultimate leader in the consumer segment remains uncertain.

Earnings and events

Macro

7 Jan. Eurozone Inflation and Unemployment; US PMI, JOLTS job openings

8 Jan. FOMC minutes

9 Jan. Germany Balance of Trade

10 Jan. Non-farm payrolls, Unemployment

11 Jan. China Inflation, Balance of Trade

Earnings

8 Jan. Albertsons

10 Jan. Walgreens Boots Alliance, Delta Airlines, Constellation Brands

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link