rewrite this content using a minimum of 1200 words and keep HTML tags

Just when investors thought they had clarity, they got chaos. President Trump slapped 25% tariffs on imports from Canada and Mexico, sending markets into a tailspin. By March 6, the White House threw in a last-minute exemption for USMCA-compliant goods, bringing brief relief, but wait, there’s more! A 30-day delay on auto tariffs added another layer of confusion.

Why does this matter? Markets hate uncertainty. When tariffs flip-flop, businesses pause investments, retailers warn of price hikes, and sectors like tech and autos get hammered. Best Buy ($BBY) and other consumer giants are already flagging higher costs and stagflation fears.

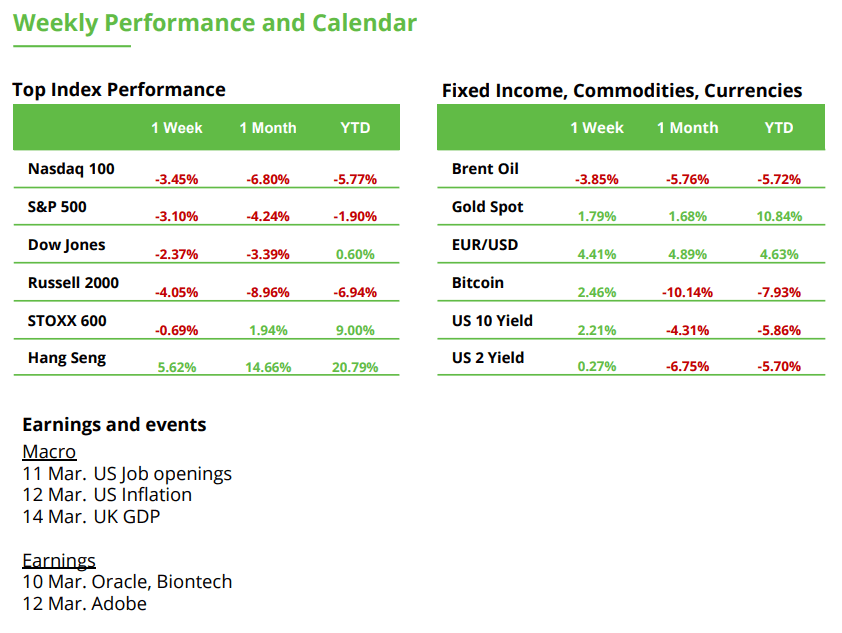

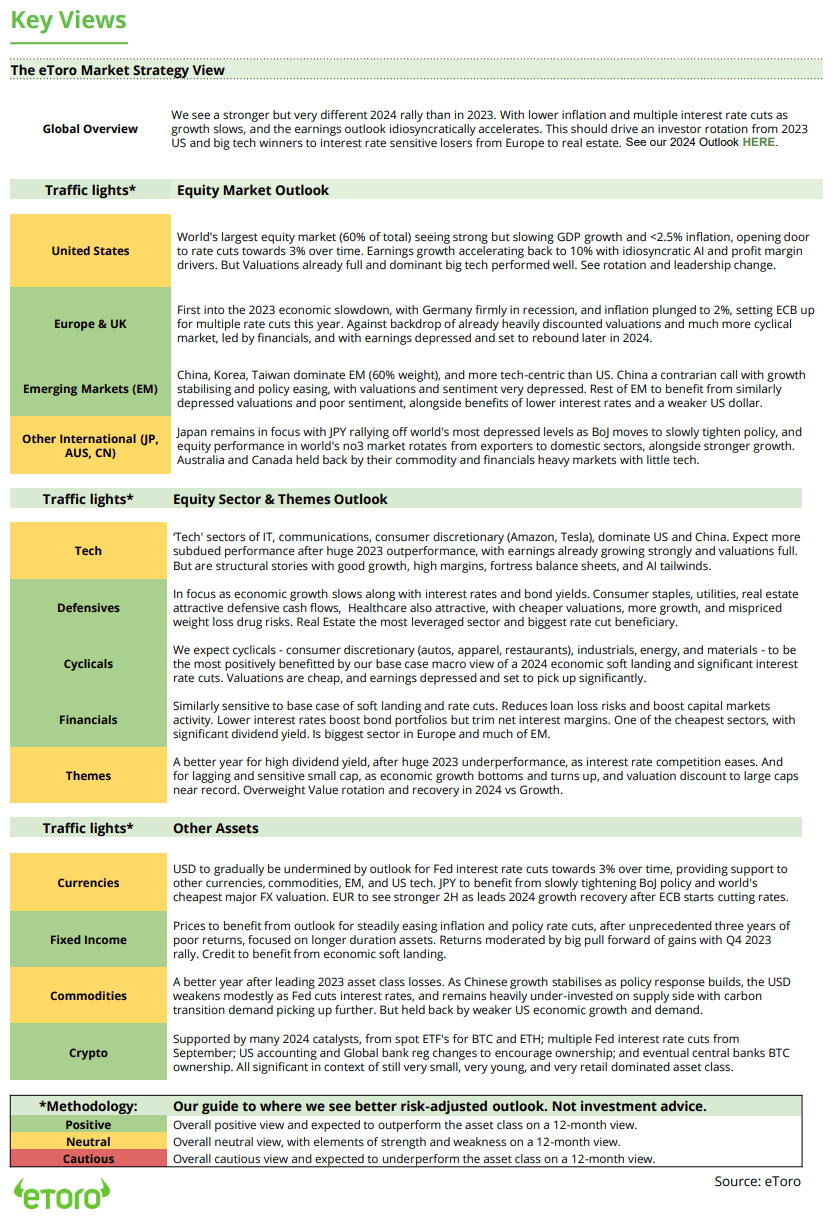

The Fed: “WE’RE IN NO RUSH” Fed Chair Powell didn’t sugarcoat it- rate cuts aren’t coming anytime soon. With inflation still hovering above 2%, the Fed is in wait-and-see mode. The US economy added 151K jobs in February (better than last month, but still meh), giving Powell enough reason to pump the brakes on easing. Meanwhile, across the pond… The ECB cut rates, but Lagarde cautioned that rising energy prices from geopolitical tensions could shift policy. Investor takeaway: Rate cuts aren’t a given. Growth stocks (especially tech) might see more volatility, while financials and dividend-paying plays could hold steady.

How Investors Are Playing 2025: With markets swinging like a pendulum, investors are tweaking their playbook: diversifying, hedging, and hunting for stability.

Core strategies: Investors are hedging single-stock risk with broad market exposure through diversified ETFs.

International Equities ($VEU): With global markets showing pockets of resilience, investors are dipping into European and Asian stocks for diversification.

Quality over Hype: Investors focus on high-quality ($QUAL) companies with solid fundamentals instead of chasing meme stocks.

Sector Themes: Who’s Winning & Losing?

Defensive Sectors on the Rise: Healthcare ($XLV), utilities ($XLU), and consumer staples ($XLP) are attracting inflows as investors seek stability.

Financials Find Their Footing: More Than Just a Bounce? Financial stocks ($XLF, $VFH) have shown notable resilience amid recent market turmoil. Banks ($KBE) and value stocks outperformed, supported by rising net interest margins and improving loan growth.

Thematic Investing: Money is moving toward long-term growth themes like: 1. Defense stocks, global military spending is skyrocketing, led by Europe. 2. Clean energy ($ICLN), government subsidies keeping momentum alive.

Hedging: How smart money is protecting itself

Gold ($GLD) & Commodities ETFs: A classic inflation hedge as rate cut expectations remain murky.

Bond ETFs ($TLT) for Income: With the US 10-year yield at ~4.3%, some investors are locking in yields before central banks pivot. They also generate regular income and help stabilize returns during stock market turbulence.

Crypto Allocation: In volatile times, it’s wise to stick with the crypto blue-chips. Bitcoin ($BTC) and Ethereum ($ETH) remain the go-to holdings for many investors. Why? They have the biggest networks, the most adoption, and serious institutional backing.

Bottomline: For years, tech was the undisputed king. But 2025 might be different- instead of just AI stocks carrying the market, we’re seeing a more balanced performance across multiple sectors. Investors are adjusting accordingly: favoring quality & stability over speculation.

Europe’s New Investment Strategy Boosts the Euro

The Market Is Repricing the Euro: EUR/USD ($EURUSD) surged last week, rising from below 1.04 to over 1.08, a 4.4% gain and the strongest weekly increase in years. The euro reached its highest level since November, signaling a potential fundamental shift. Europe is now focusing more on a new investment strategy to stimulate growth, providing additional support for the euro. Not long ago, there were fears that the pair would drop back to parity due to the “Trump Trade”. Those concerns now seem to have faded.

Fiscal Policy Shift: EU Commission President von der Leyen plans to mobilize up to €800 billion to strengthen Europe’s defense capabilities and maintain support for Ukraine. At the same time, the CDU and SPD, currently in coalition negotiations for the new German government, have agreed on a €500 billion special fund for infrastructure modernization. Additionally, the debt brake is set to be relaxed for targeted defense spending.

Bond Market Turmoil: The 10-year German bond yield (see chart) surged from 2.39% to 2.85% last week – the sharpest increase in years. Investors are demanding higher yields as a risk premium for rising government debt. However, higher yields also mean increased borrowing costs, as long-term market interest rates are closely tied to 10-year bonds.

A Lot of Optimism Is Already Priced In: The stocks of European defense companies such as Rheinmetall, BAE Systems, Safran, Thales, Dassault Aviation, Kongsberg, and Saab AB share one common trait: according to the RSI indicator, they are short-term overbought – some more than others. This market overheating reflects high expectations for increased defense spending. While valuations appear stretched in the short term, the overall growth trend remains intact, making tactical timing increasingly important.

Bottomline: At this point, we remain cautiously optimistic about the defense sector, supported by massive investments in the coming years. The key question will be how funds are allocated and which companies are best positioned to benefit. While Europe aims for greater military independence from the US, a portion of the funds will still flow to American defense companies. Raytheon Technologies, Honeywell, and Lockheed Martin should therefore also be on the watchlist.

10-year German bond yield

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link