rewrite this content using a minimum of 1200 words and keep HTML tags

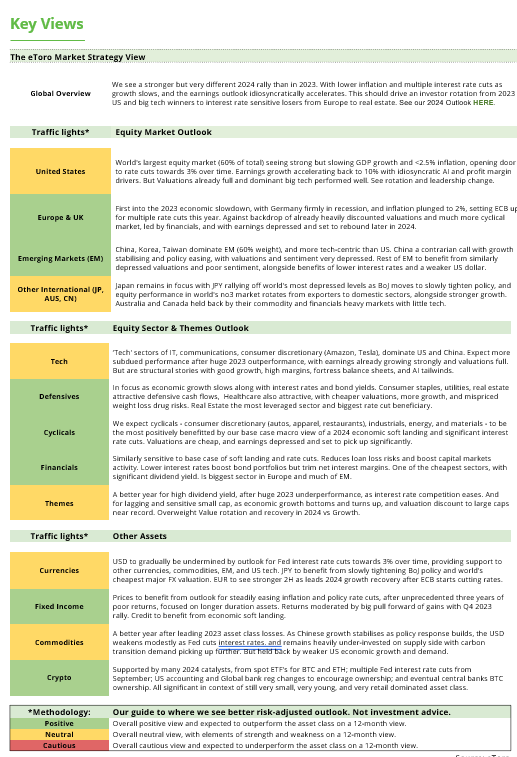

We continue our analysis of Trump 2.0. Typically, a single policy dominates each year following a new administration’s election (e.g., tax reform in 2017, the trade war in 2018, COVID-19 in 2020, and industrial policy/CHIPS Act/IRA in 2021). However, Trump 2.0 is addressing multiple policies simultaneously. The noise-to-signal ratio is exceptionally high—focus on what matters and what we know, as outlined below. Much of the tariff debate falls into the category of “known unknowns,” with both scope and sequencing still uncertain.

What we know:

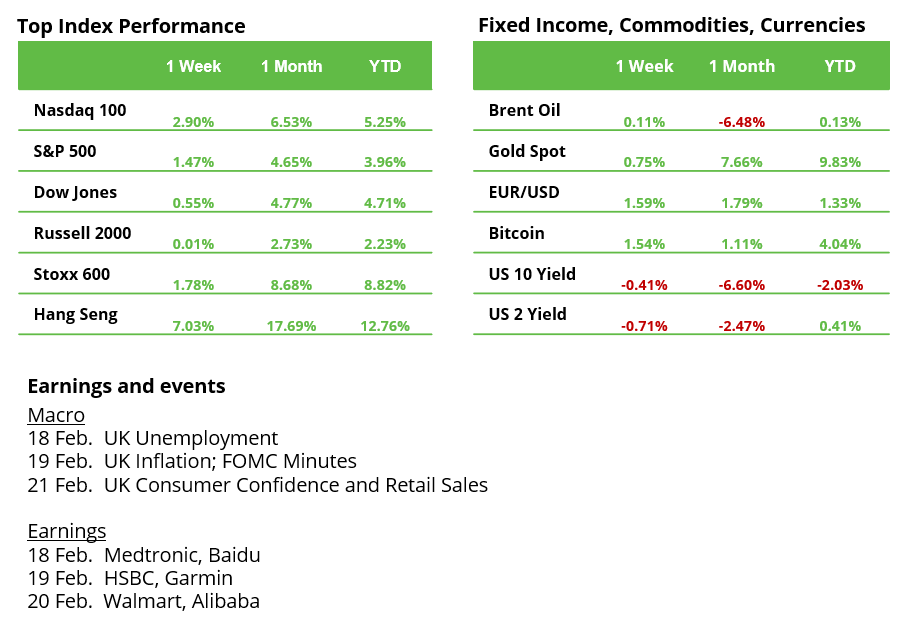

Tariffs: FX markets are where trade policy shows up the most, and currently markets are pricing in a scenario resembling a global tariff. Trump wants countries to negotiate with him directly. He threatens with reciprocal tariffs to get countries to talk to him (case in point, Modi). If reciprocal tariffs take effect, EM countries will be hit worst (India, Argentina, Mexico, Brazil, Vietnam, Taiwan, Indonesia).

a) From an investments point of view, we think that services sectors will outperform goods sectors. Companies that are pro-border-adjustable tax (winners): Boeing (BA), General Electric (GE), Caterpillar (CAT), financials such as Bank of America (BAC), JP Morgan (JPM), Mastercard (MA), Prudential (PRU.L). Companies which are anti-border-adjustable tax (losers): Walmart (WMT), Nike (NKE), Gap (GAP)., Toyota (TM).

b) Finally, we think China is treated differently than other countries. Trump does not want any US company to operate in China, period. US companies levered to China will continue come under pressure.

Historically, stocks do well in the 1st year of a new president unless there is a recession. The last four cycle of 1st years of a president have produced +20% returns. It’s the second year when stocks come under pressure when policies filter through the economy.

Since 1973, financials have outperformed the S&P 500 during every 1st year of a new president (except for one year, 2009 financial crisis). Healthcare stocks have outperformed the S&P 500 in the 1st year of every Republican administration since Reagan, 1981.

Which financial markets indicators matter the most to the new administration (per Treasury Secretary Scott Bessent’s recent interview with Larry Kudlow): 1. 10-year yield, 2. Price of oil. 3. Price of gold – we monitor these to gauge the direction of policy.

If Congress wanted to do an-unpaid-for-tax cuts, the bond market would deliver a punishment. Hence, focus on decreasing spending to historical levels first (DOGE). Sectors that come under pressure due to decreased spending: consumer staples, energy, education, transportation. Positive for defense stocks.

For H1 2025, we think that the US market is well supported by liquidity supplied by the US Treasury. On January 21st, the US hit the debt ceiling (US cannot issue net new debt). Instead, Treasury is now paying its bills, a liquidity tailwind (400-500 USD bil.) for markets (keep yields low), financial conditions loosen. In effect, similar to QE. This will stay until Congress raises the debt ceiling (can issue new debt), and until then help keep yields/USD in check. Counter forces (higher yields) are: 1. Sticky CPI, 2. Tariffs, 3. Budget deficit

Bottomline: Trump 2.0’s policy approach, particularly around tariffs, is creating a high level of uncertainty in the markets. Key sectors likely to outperform include financials, services, and border-adjustable tax companies, while those exposed to China or reliant on global trade may face pressure. Liquidity from the US Treasury and a weakening USD could support the market in H1 2025, but risks remain, including tariffs and sticky inflation.

In Focus: German Elections; DAX on Record Run Despite Recession

Expectations for the Upcoming Election: Polls show the CDU/CSU leading comfortably, followed by the AfD in second place. The SPD and Greens are in a tight race for third, while the FDP, Die Linke, and BSW struggle with the five-percent threshold. Key questions remain: how strong will the CDU/CSU perform, which coalition partner will they choose, and will a single partner suffice? With CDU leader Friedrich Merz ruling out cooperation with the AfD, the 2029 election could become significantly more interesting, especially if the AfD’s support continues to grow. Short-term market reactions are possible in case of an unexpected result or difficult coalition talks, but long-term factors like interest rates, inflation, and the global economy remain more crucial.

DAX Analysis: One week before the German federal election (Sunday, 23 February), the DAX continued its record-breaking rally, while the German economy remains in recession. This apparent discrepancy is easily explained: DAX companies generate most of their revenues abroad. In key export markets like the US, China, and France, conditions are not perfect but remain better than in Germany. Global giants like SAP, Siemens, and Infineon benefit from megatrends such as digitalization, automation, and renewable energy.

These German Stocks Belong on Your Watchlist: Key challenges include infrastructure expansion (ThyssenKrupp, Hochtief, Bilfinger), bureaucracy reduction and digitalization (SAP, Software AG, Bechtle), energy transition (Siemens Energy, Nordex, Encavis), housing (Vonovia, LEG Immobilien), future technologies (Infineon, Carl Zeiss Meditec), and reforms in pensions and healthcare (Fresenius, Siemens Healthineers, Medios).

Germany Sticks to Its Debt Brake: With a debt-to-GDP ratio of 63 percent, Germany remains solid by international standards. Japan is four times more indebted at 250 percent, while Italy (135 percent) and the US (123 percent) have roughly double the debt levels. To reach a debt ratio of 101 percent like the UK, Germany would need to take on around €1.59 trillion in additional debt. Even a fraction of this could finance much-needed investments without jeopardizing long-term fiscal stability. Notably, Germany is the only country in our comparison (see chart) with a declining debt ratio over the past 20 years.

Debt Alone Won’t Solve Germany’s Structural Issues: Its low debt levels provide significant fiscal leeway for growth and crisis management – an opportunity that remains largely untapped.

Bottomline: The upcoming German election is unlikely to disrupt markets unless coalition negotiations prove unexpectedly difficult. Investors should focus on structural themes, digitalization, automation, and energy transition, while monitoring potential fiscal shifts post-election, particularly regarding infrastructure and industrial policy.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link