In the ever-evolving landscape of cryptocurrency investments, the transparency and security of assets have become paramount concerns for both seasoned and novice investors alike. This pressing need for clarity in the crypto sphere has led 21Shares, one of the world’s most prominent issuers of crypto exchange-traded funds (ETPs), to take a significant step forward. By integrating Chainlink’s Proof of Reserve (PoR) on Ethereum, 21Shares has vaulted their Core Ethereum ETF (CETH) to new heights of transparency, heralding a new era of investor confidence in the firm’s operations.

The seismic shift towards transparent asset management was officially announced by 21Shares US LLC, which has positioned itself at the forefront of securing investor trust through technological innovation. The introduction of the “Chainlink Proof of Reserve” on the Ethereum mainnet serves as a beacon of assurance for investors, guaranteeing that the CETH is securely backed by tangible Ethereum reserves. In an unprecedented move, the detailed compilations of 21Shares’ Ethereum reserves are now accessible via a dedicated Chainlink feed, sourced directly from the secure vaults of Coinbase custody. This technological synergy not only cements the fact that 21Shares’ holdings are robust but also showcases the firm’s unwavering commitment to transparency.

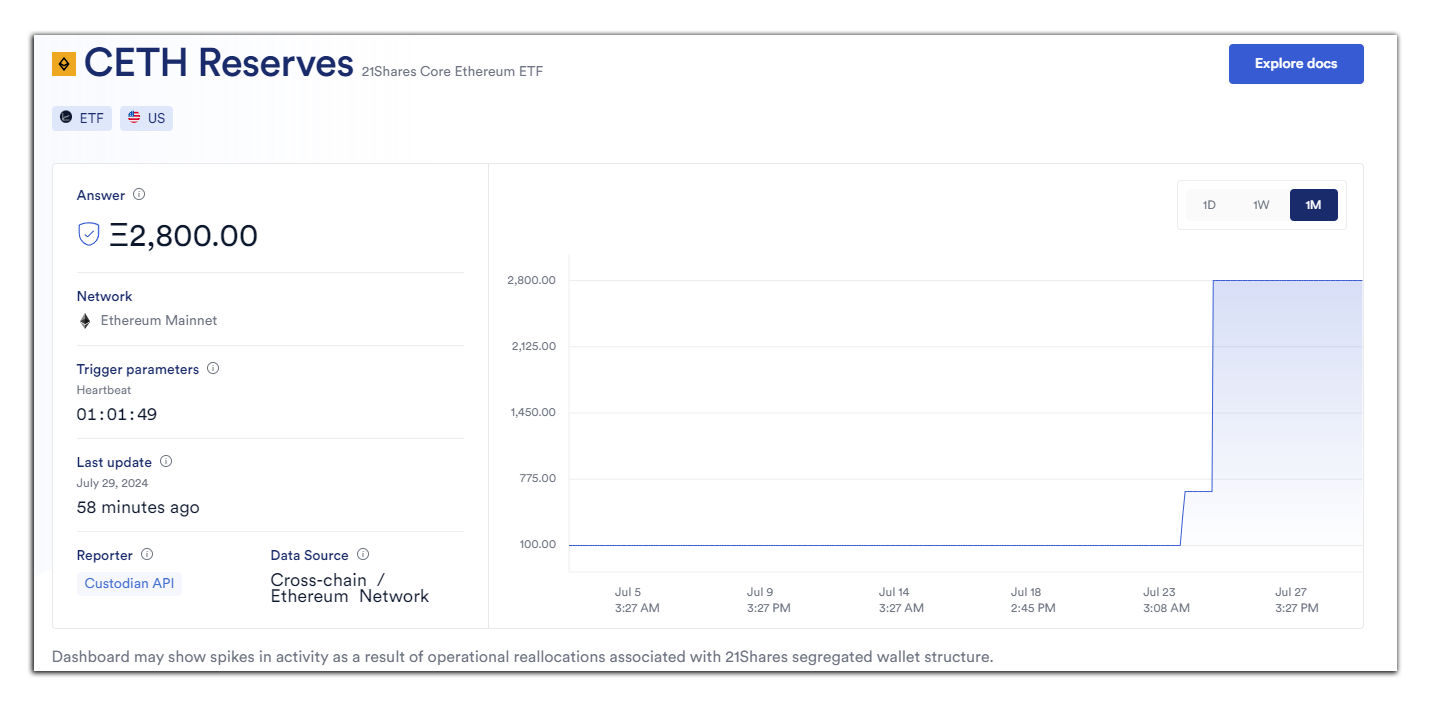

Amidst the bustling digital finance stage, Nate Geraci, President of ETFStore, chimed in with his insights, sharing a screenshot of the CETH reserve. His endorsement not only adds a layer of credibility to the fund’s holdings but also casts a spotlight on the essential need for transparency in backing ETFs with actual Ethereum assets.

Why Chainlink?

The rationale behind 21Shares’ choice of Chainlink for this pivotal integration is no mystery. Chainlink enjoys a stellar reputation as a decentralized oracle network, having facilitated over $12 trillion in total value across on-chain markets. This milestone was achieved through its unwavering dedication to ensuring data integrity, bolstering security, and fostering trust among participants in the cryptocurrency ecosystem. Perhaps the most revolutionary aspect of Chainlink’s Proof of Reserve is its ability to autonomously verify on-chain data in real-time without relying on a central point of failure. This attribute not only exemplifies the very essence of decentralization but also underscores the depth of security and transparency that 21Shares aims to offer its investors. The incorporation of this technology implies that investors can rest easy knowing that the on-chain data regarding their investments is perpetually accurate and up to date.

Chainlink for Bitcoin ETF

The narrative of success surrounding Chainlink’s integration does not stop with Ethereum. In a move reflective of their pioneering spirit, 21Shares previously integrated Chainlink’s Proof of Reserve for their ARK Bitcoin ETF (ARKB) in February 2024. The ARKB, a flagship Bitcoin spot exchange-traded product, boasts holdings worth $3.2 billion, underscoring the thrust of investors’ confidence in the offering. This preceding integration serves as a testament to the practicality and effectiveness of Chainlink’s Proof of Reserve in ensuring the legitimacy and transparency of crypto assets in exchange-traded products.

High Volatility Risks

In a comprehensive discussion on the inherent risks associated with cryptocurrency investments, 21Shares US took to Twitter to elaborate on the high volatility surrounding crypto funds. Its discourse paints a clear picture that, despite the allure of high returns, the crypto market remains susceptible to intense price fluctuations, often leaving investors at risk of substantial losses. This candid acknowledgment by 21Shares serves to remind potential and current investors of the critical importance of due diligence and risk assessment when navigating the crypto investment landscape.

Adding an extra layer of commitment to transparency, the firm also made available a comprehensive 139-page ETH ETF Prospectus for the 21Shares CETF, providing deep dives into the fund’s structure, operational dynamics, and investment strategies.

The confluence of innovative technologies with the world of finance continues to fascinatingly unfold, as evidenced by 21Shares’ pioneering steps. The integration of Chainlink’s Proof of Reserve into its Ethereum ETF offering not only marks a significant stride towards unparalleled transparency and security in crypto investments but also arguably sets a new benchmark for the industry at large.

In concluding this mesmerizing journey into the heart of crypto-financial innovation, it becomes evident that the fusion of blockchain technology with strategic financial instruments like ETFs ignites a beacon of hope and trust for investors navigating the tumultuous waters of the cryptocurrency market. The initiatives of 21Shares and their embrace of Chainlink’s groundbreaking technology pave the way for a future where investment in digital assets is as solid and transparent as the traditional financial system, if not more so.

For those yearning to stay updated on these thrilling developments within the DeFi and crypto space, make sure to bookmark DeFi Daily News for more trending news articles.