rewrite this content using a minimum of 1200 words and keep HTML tags

Please see this week’s market overview from eToro’s global analyst team, which includes the latest market data and the house investment view.

Focus on November’s jobs report and Powell’s speech

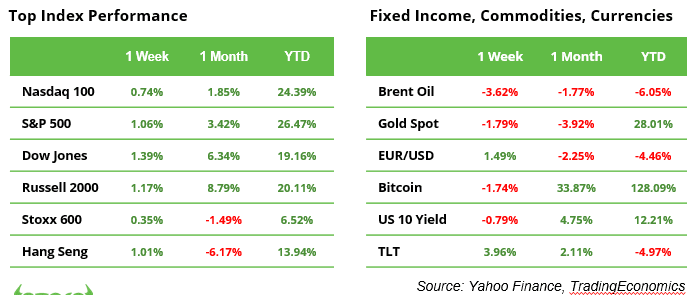

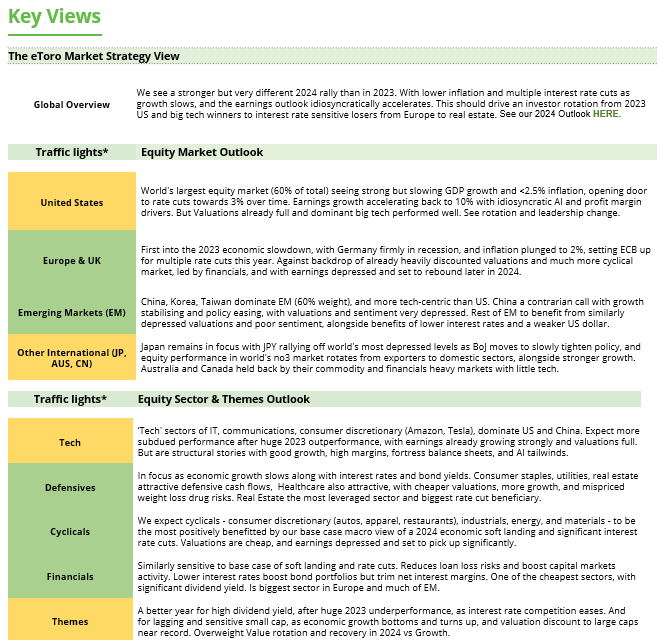

In a shortened trading week due to Thanksgiving, the S&P 500 Index closed at a record high of 6,032 points. With a gain of 5.7% (see chart), November has been the best month of 2024 so far for the benchmark. Year-to-date, the index is up 27.5%. This stellar performance has pushed its valuation to 22x forward earnings, significantly above the 10-year historical average of 18x.

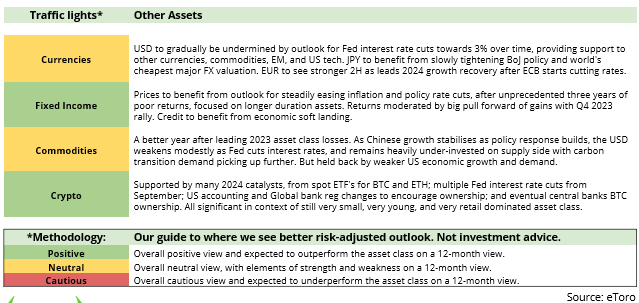

Investors are closely monitoring U.S. government policy expectations as Donald Trump prepares to enter the White House on January 20, 2025. Despite his comments about imposing tariffs as high as 25% on Mexico and Canada, and an additional 10% on China, the announcement of nominees with more moderate profiles has led many to believe that Trump may govern more softly than initially anticipated. Last week, the U.S. dollar softened slightly, while the 10-year Treasury yield fell by 23 basis points, from 4.41% to 4.18%.

This week, market attention will turn to November’s jobs report on Friday and Federal Reserve Chair Jerome Powell’s speech on Wednesday. These events will offer key data and guidance ahead of the Fed’s meeting on December 17-18. Currently, markets are pricing in a 67% probability of another 25-basis-point interest rate cut. An unemployment rate of 4.2%, slightly higher than October’s 4.1%, is expected to support this outlook.

A critical look at Trump’s economic agenda

Donald Trump is planning significant tax cuts to stimulate economic growth and boost corporate profits. However, this strategy comes at a significant cost: reduced tax revenues are likely to widen the budget deficit and further increase the national debt of $36 trillion. To address the resulting financing gap, Trump seems to be relying on higher import tariffs. However, trade wars present substantial risks: 1) They are notoriously difficult, if not impossible, to “win.“ 2) U.S. consumers ultimately shoulder the burden of rising prices, and3) Economic weakness limits the effectiveness of protectionist policies.

Tariffs could also drive up inflation, constraining the Federal Reserve’s ability to lower interest rates further. Combined with rising debt, reduced fiscal flexibility, and increased market risks, these factors pose significant threats to economic stability. The nomination of Scott Bessent as U.S. Treasury Secretary offers hope for stability. The hedge fund manager, known for his pragmatic approach, is expected to focus on safeguarding the economy rather than unconditionally advancing Trump’s political agenda.

Big macro week ahead: will fresh data lead to a year-end rally?

A wave of economic data this week could shape market sentiment as investors seek confirmation of the economy’s resilience. The ISM reports on Monday and Wednesday take center stage. Manufacturing PMI, currently at 46.5 (its lowest since July 2023), may show early signs of recovery if it edges closer to 50. Meanwhile, Services PMI, at 56 (its highest since August 2022), could spark recession fears if it weakens significantly.

ISM employment data will also set the stage for Friday’s jobs report, with key questions on the table: Will job growth remain subdued, and could the unemployment rate tick higher?

Last week, the S&P 500 rebounded near record highs, reflecting market optimism. Strong macro data could trigger a breakout, while weaker figures may prompt short-term profit-taking without derailing the broader uptrend. Additionally, softer data could fuel rate-cut speculation, providing a safety net against significant sell-offs.

OPEC+ meets on 5 December to discuss its oil production strategy

The OPEC+ alliance, managing multiple production cuts totaling over 3.9 million barrels per day (bpd), faces pressure from volatile oil prices and uncertain demand. Discussions may include extending a 2.2 million bpd voluntary cut, amid geopolitical tensions and shifting market conditions. Adding to the complexity is the return of president-elect Trump, whose policies may influence U.S. production and enforcement of sanctions on Iran.

Data releases and earnings reports

Macro data:

2 Dec. U.S. Manufacturing PMI, China Manufacturing PMI

3 Dec. JOLTS job openings

4 Dec. U.S. Services PMI, China Services PMI

5 Dec. U.S. Trade Balance

6 Dec. Non-Farm Payrolls, US Unemployment rate

Corporate earnings:

3 Dec. Salesforce

4 Dec. Synopsys

5 Dec. UiPath, Lululemon, Ulta Beauty

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

and include conclusion section that’s entertaining to read. do not include the title. Add a hyperlink to this website http://defi-daily.com and label it “DeFi Daily News” for more trending news articles like this

Source link